Yesterday (January 30th), the U.S. December JOLTS job openings data was recorded at 9.026 million, exceeding the expected 8.75 million and marking a new high for the past three months. Following the release of the data, U.S. Treasury yields briefly spiked, with the ten-year breaking above 4.10% before continuously falling to refresh the day’s lows, currently reported at 4.019%. The two-year trend was similar, barely closing higher, currently reported at 4.316%. The three major U.S. stock indices had mixed performances, with the Dow Jones increasing by 0.35%, the Nasdaq falling by -0.76%, and the S&P 500 staying flat (-0.06%).

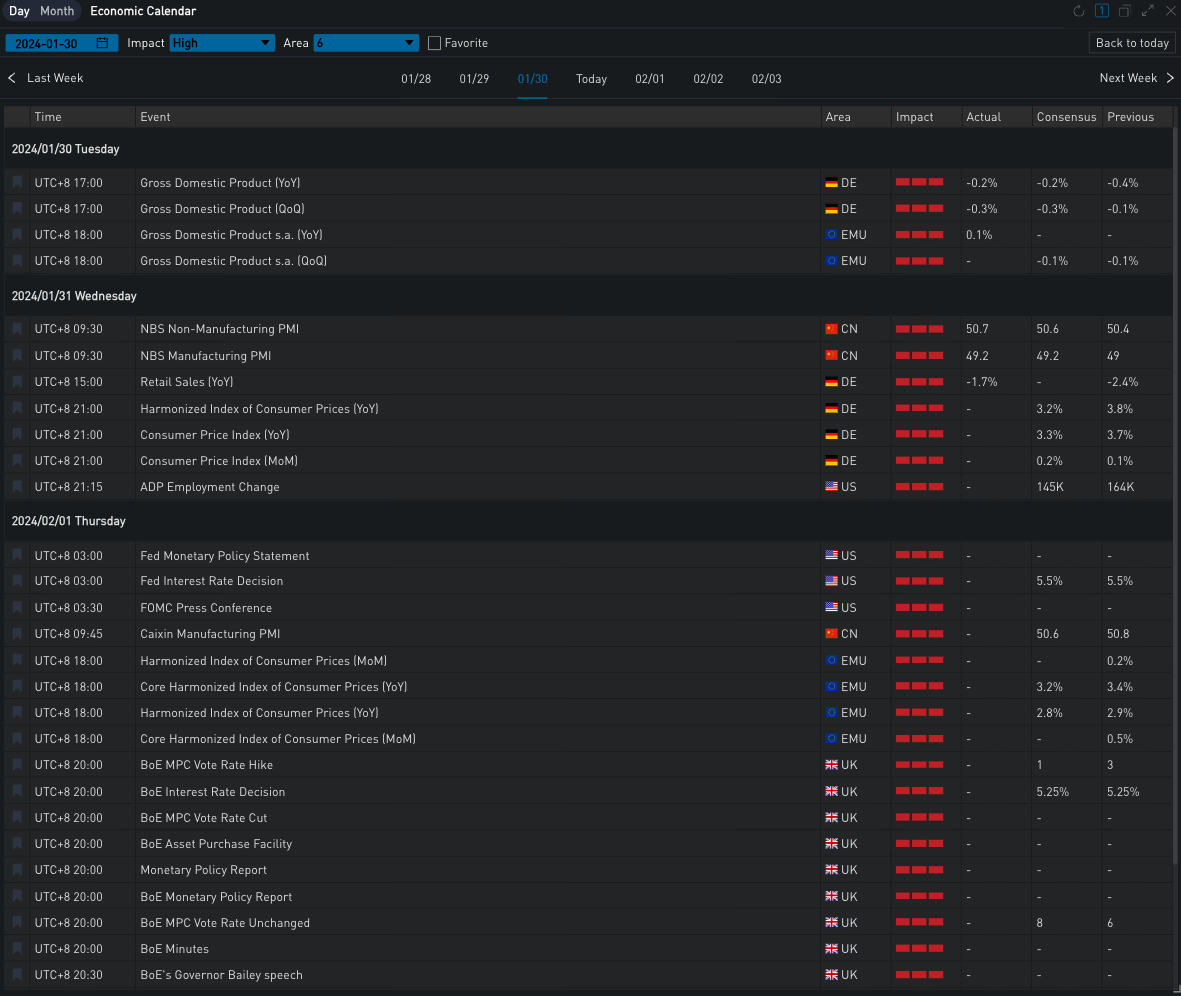

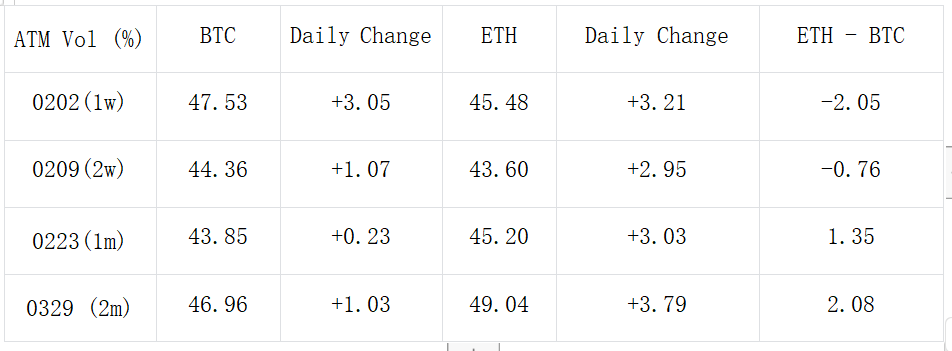

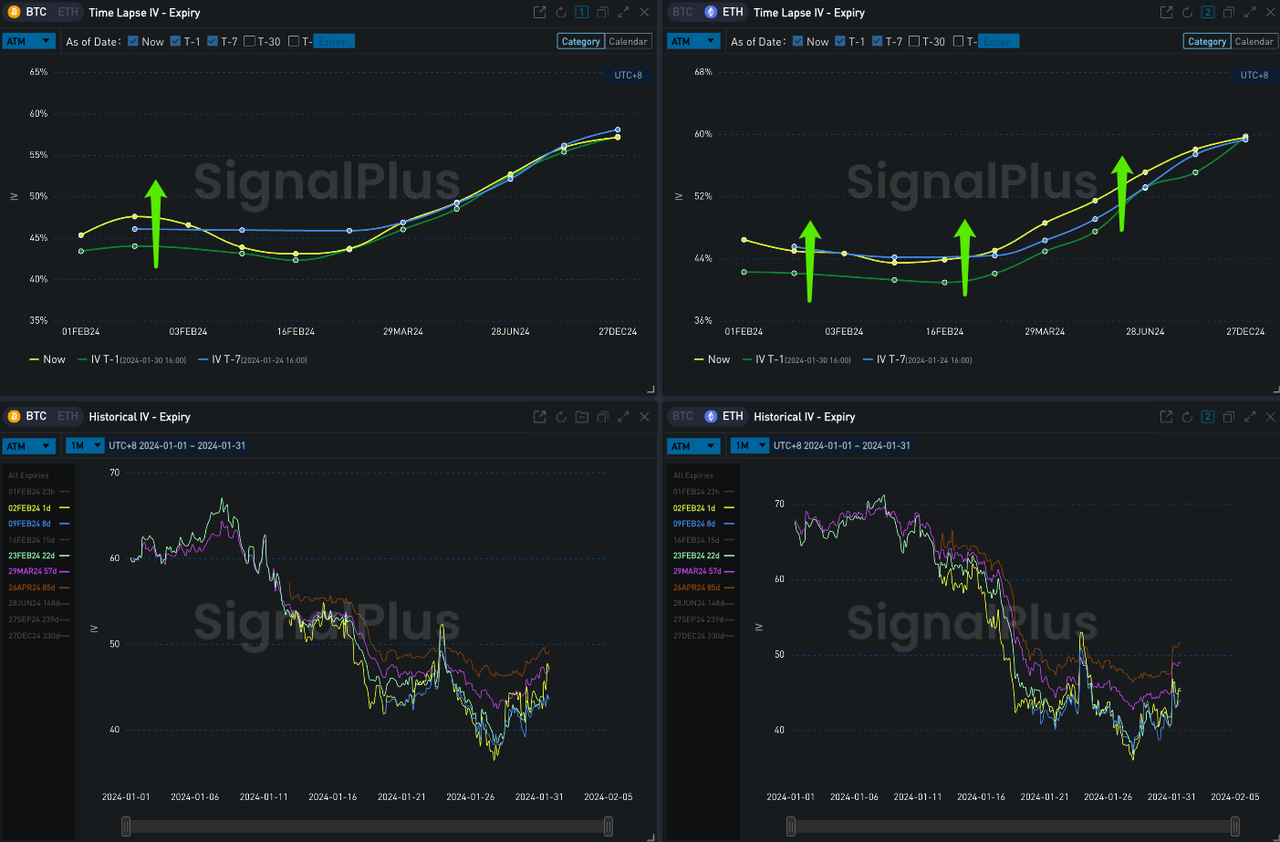

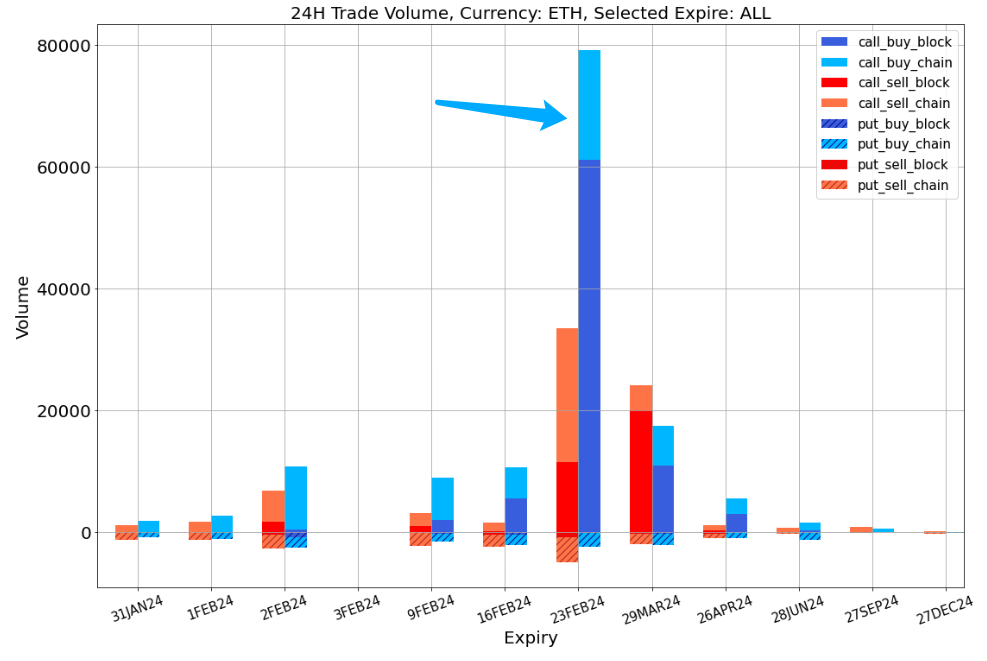

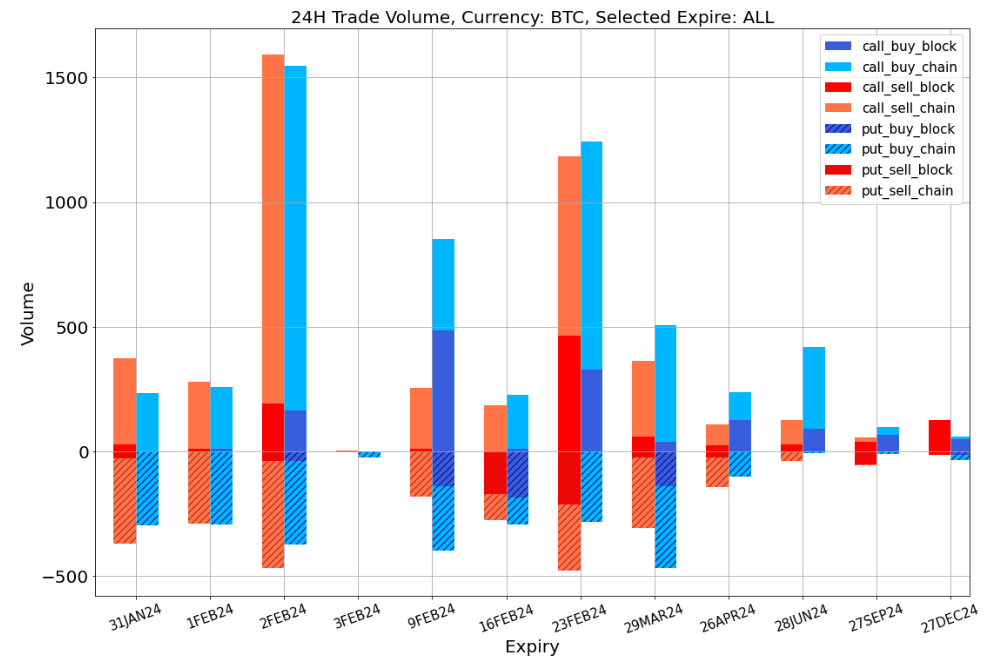

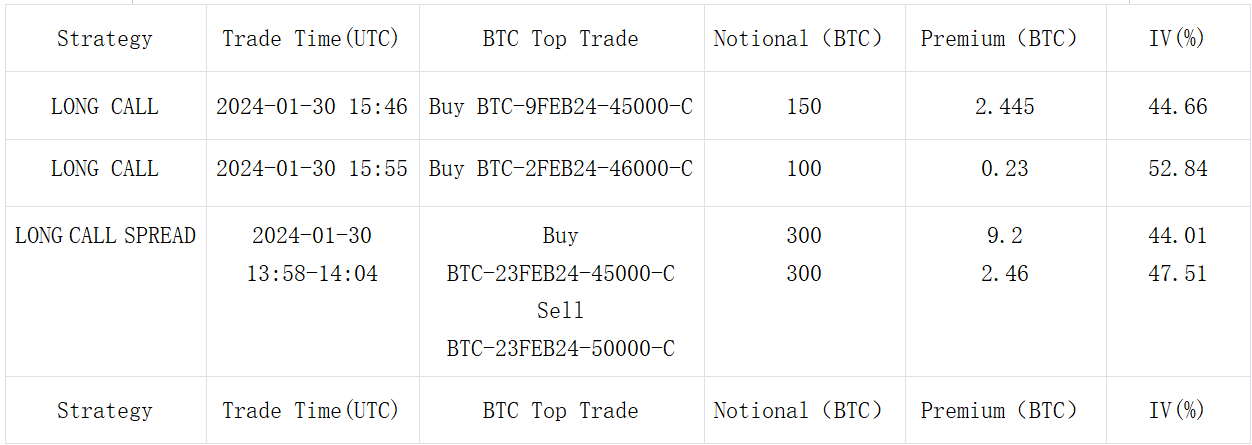

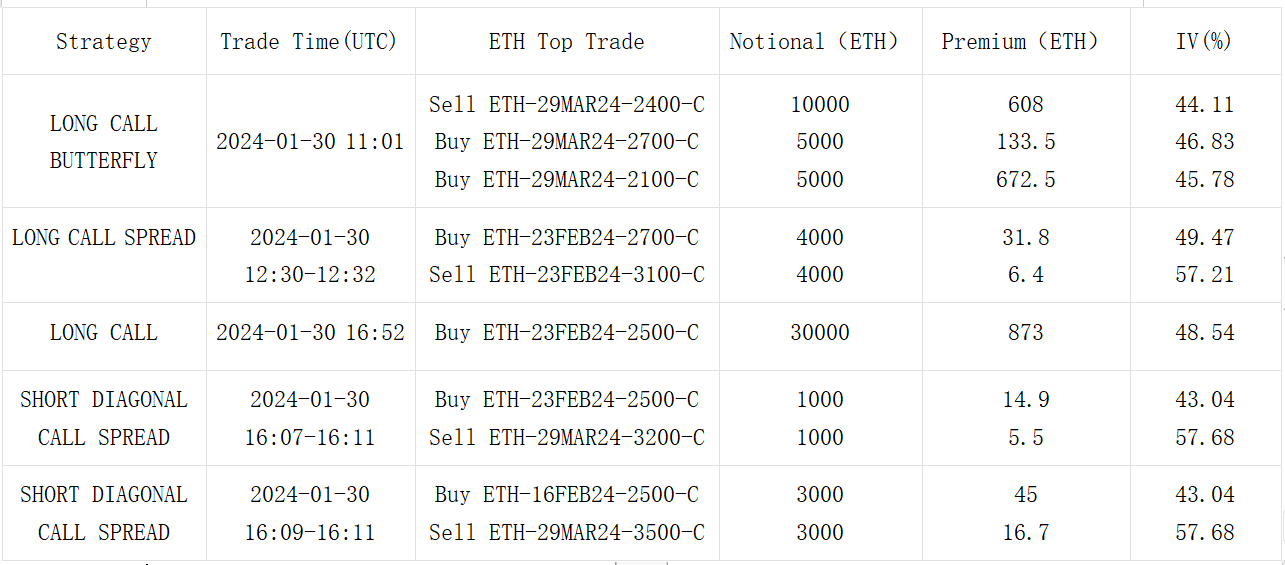

In digital currencies, BTC and ETH prices saw weakened upward momentum after breaking through the $43,000 and $2,300 levels respectively, primarily experiencing minor fluctuations throughout the day. However, the options implied volatility levels did not decrease in response to the actual volatility. Looking at the front end, the IV for both major cryptocurrencies on February 2nd rose by more than 3% Vol, intensifying the inversion of the curve. This includes the uncertainty brought about by the early Thursday FOMC meeting. Despite the market having fully priced in the expectation of no interest rate hike for this meeting, there is still significant interest in the Federal Reserve’s statements regarding future policy directions during the interview segment. Furthermore, ETH’s IV for other maturities also saw an almost parallel increase of about 3% Vol, with mid to long-term Vol Skew further elevated. Active Long Call trading was observed, especially concentrated towards the end of February. A notable focus in the market was the purchase of 23 FEB 24–2500-C with a volume close to 70,000 ETH, primarily consisting of large outright Call buys (one of which had a size of 30,000 ETH), and strategies like buying 23 FEB and selling 29 MAR to form a cross-term bullish butterfly spread. In comparison, BTC’s transaction distribution was more uniform, mostly involving Long Call or Call Spread bullish strategies.

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Options Toolkits: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Comments