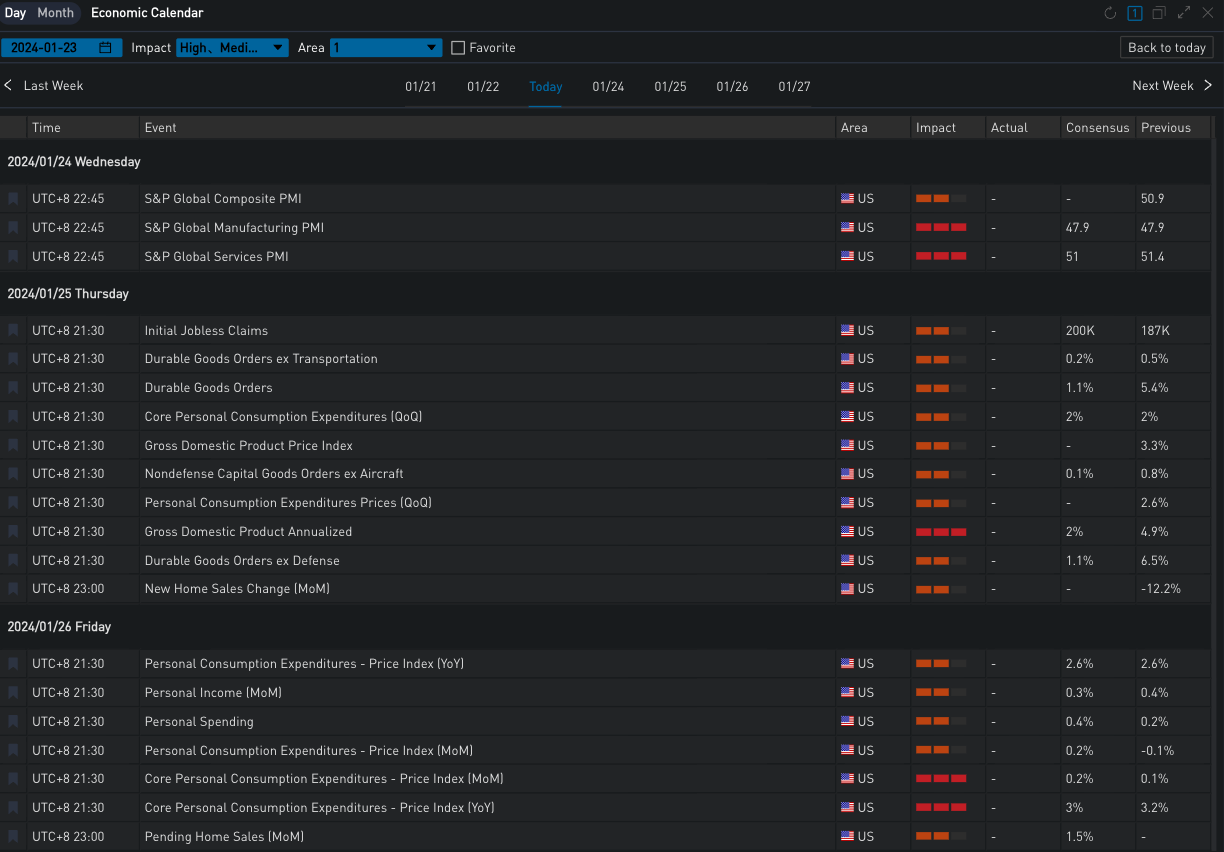

Yesterday (January 23rd), the Bank of Japan maintained its generally expected loose monetary policy, while lowering the core inflation forecast for this fiscal year from 2.8% to 2.4%. Governor Ueda mentioned that if the inflation target is likely to be reached, and at the same time unions demand higher wage increases, the central bank will consider ending the negative interest rate policy, clearly indicating that a rate hike will be considered in April, which led to a rise in Japanese government bond yields again. In Europe and the US, European bond issuance reached a new high with a good response; the market demand for the US’s record 2-year Treasury auction was also good, with an issuance price of 4.365% matching screen prices, unaffected by the recent rebound in oil prices posing an upward risk to inflation. US Treasury yields overall moved lower, with current two-year/ten-year yields at 4.318% /4.102% respectively. The three major US stock indices had mixed results, with the Dow closing down 0.25%, while the S&P and Nasdaq rose by 0.29% /0.43% respectively.

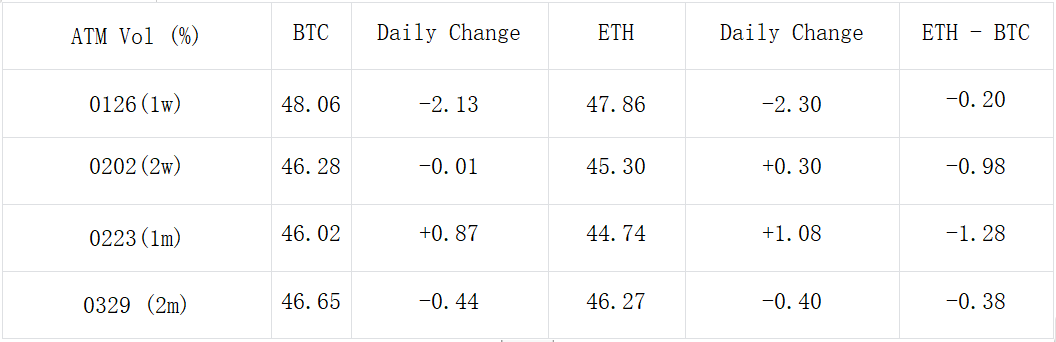

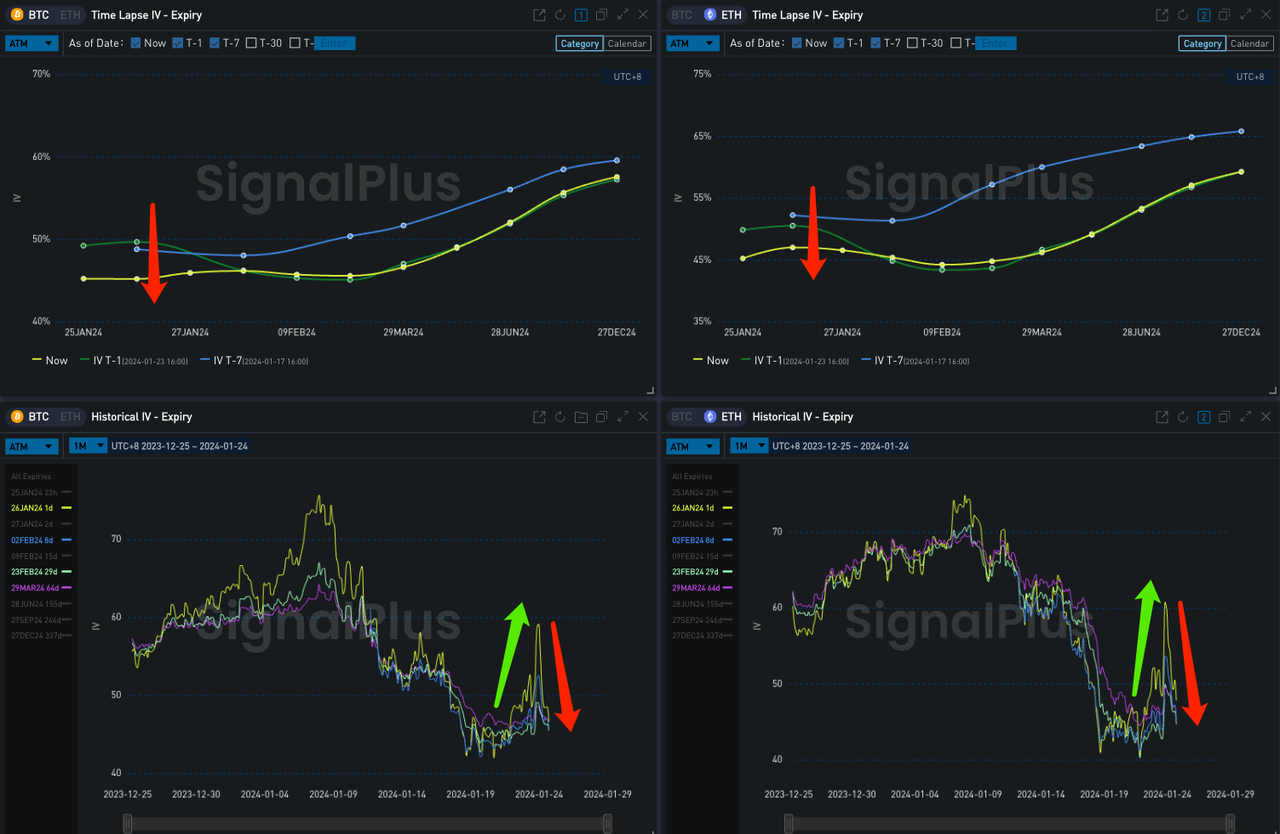

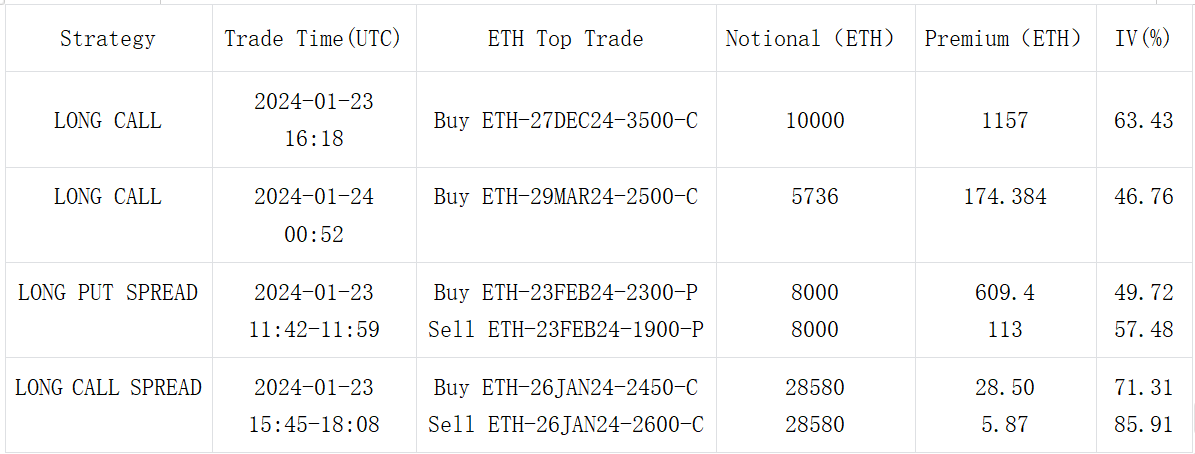

In digital currencies, yesterday BTC experienced a bit of panic as it broke below the 40k mark under pressure, causing a significant flattening and upward movement in the short-term implied volatility surface. However, as prices rebounded back to around the 40k mark, the IV gave back all of its previous gains. In terms of trading, the market clearly showed a pessimistic attitude towards a price increase before the end of February. This is exemplified by triangular price spreads such as BTC Short 23 FEB-40000-C vs Long 29 Mar 24–43000-C, and Long Put Spreads like BTC 23 FEB 41000-P vs 36000-P, ETH 23 FEB 2300-P vs 1900-P. However, there were exceptions, such as the short-term bullish ETH 26 JAN 2450 vs 2600 Long Call Spread, which saw trades of about (per leg) 18000 ETH when ETH was trading around the local low of 2200 yesterday. Additionally, there was a rare large-scale bullish transaction for 27 DEC 24–3500-C (Size: 10000 ETH).

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Options Toolkits: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Comments