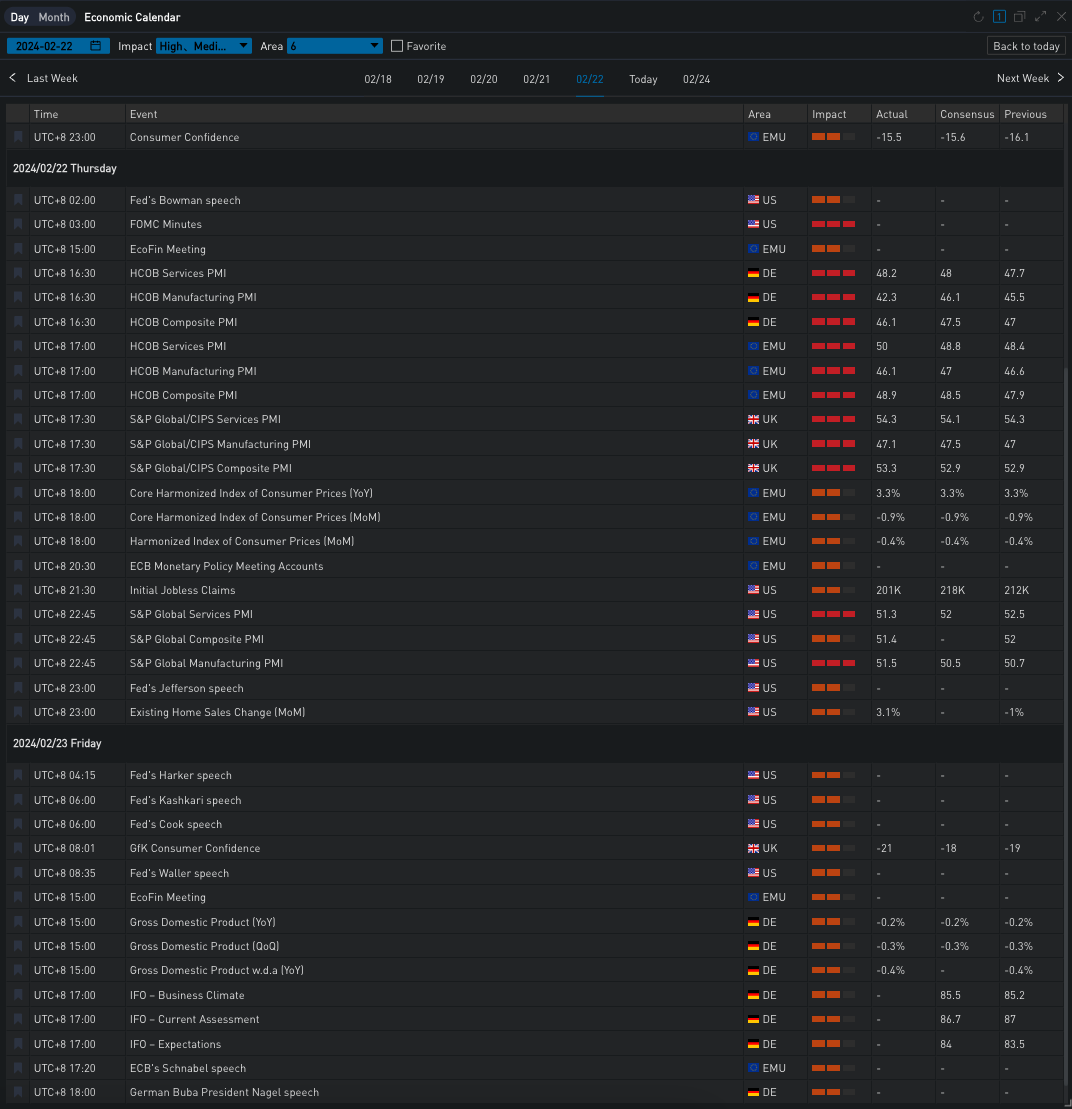

Yesterday (22FEB), the U.S. economic data showed strong performance, and Federal Reserve officials continued to pour cold water on expectations for rate cuts in the near term: the number of initial jobless claims for the week was recorded at 201,000, lower than the expected 218,000, and the Markit Manufacturing PMI unexpectedly climbed to 51.5, higher than the expected 50.5. Philadelphia Fed President Harker issued a warning: the biggest risk is cutting rates too soon, with no urgent need to cut rates; Fed’s Jefferson also expressed concerns that an overly loose policy might lead to inflation reversing or stalling, considering a rate cut later this year might be appropriate. Consequently, U.S. Treasury yields gradually rose, with the two-year/ten-year now at 4.739%/4.343% respectively. The three major U.S. stock indices were boosted by Nvidia’s better-than-expected earnings report, with the Dow Jones/S&P 500/Nasdaq closing up 1.18%/2.11%/2.96%, respectively.

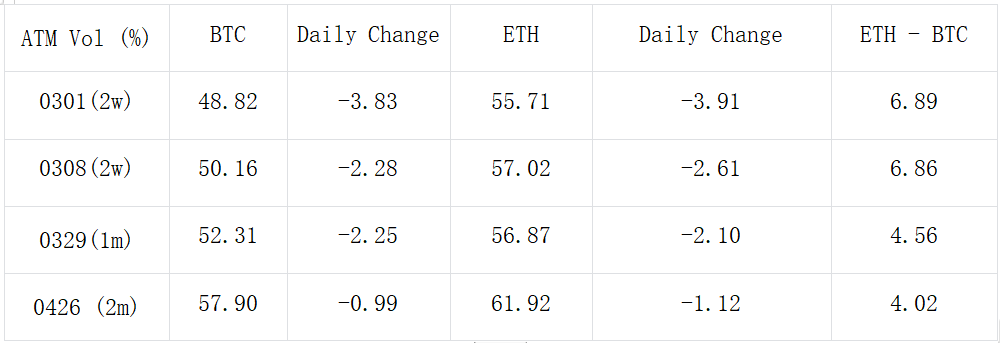

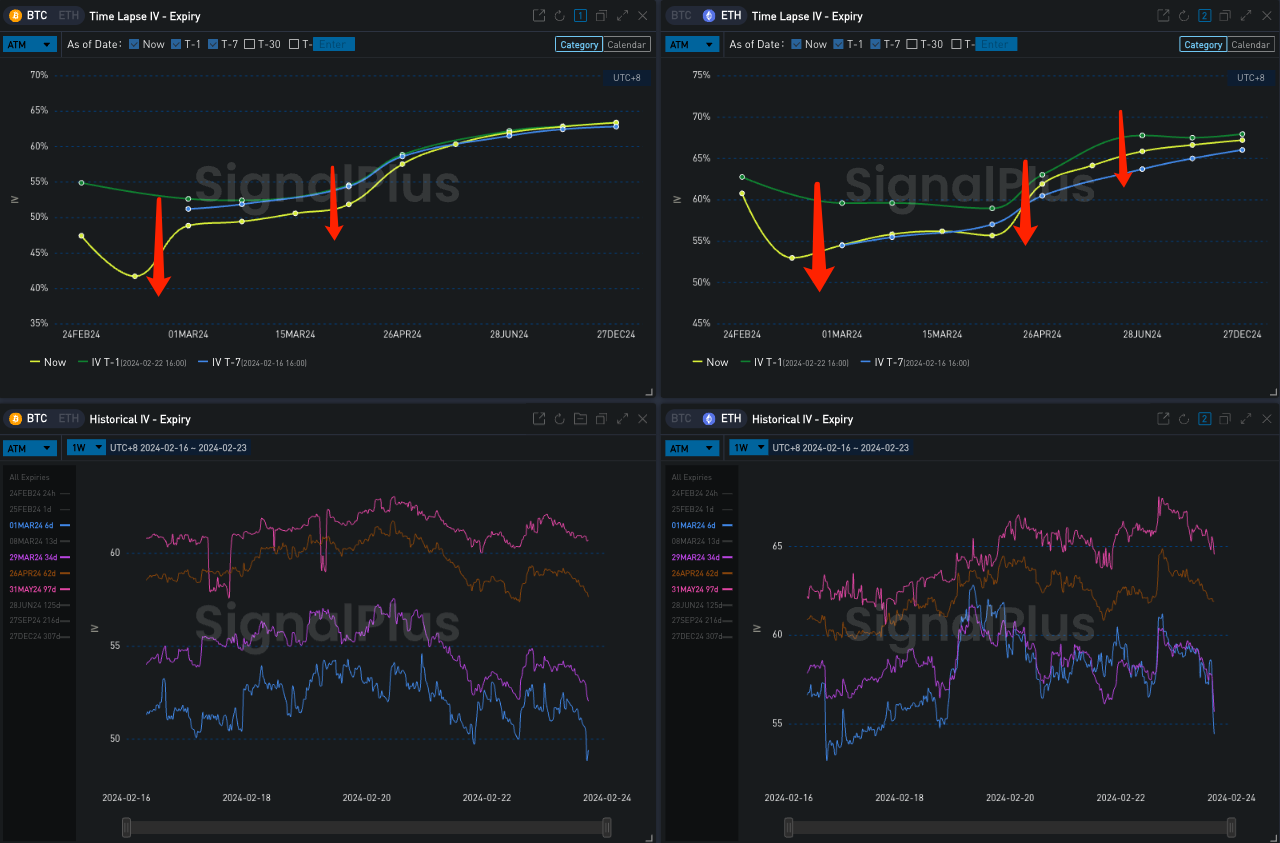

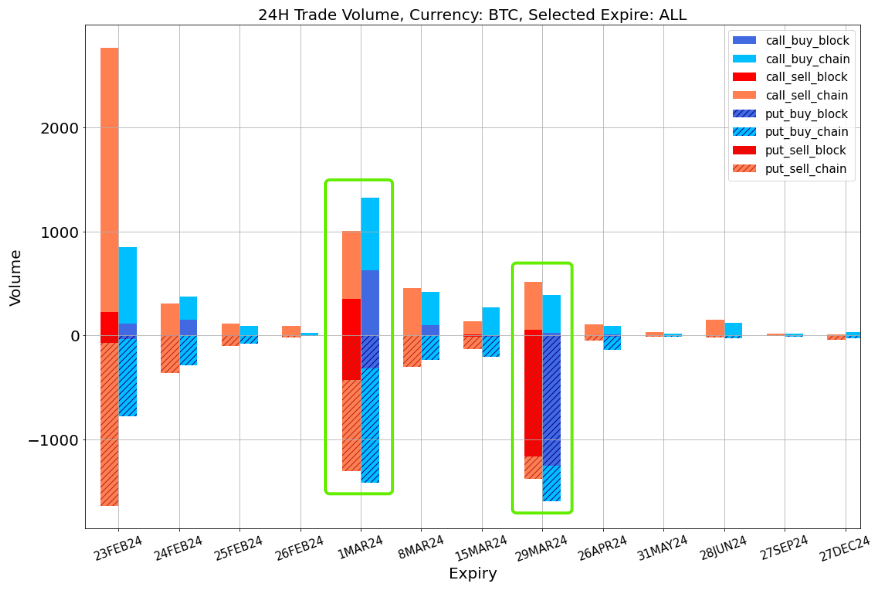

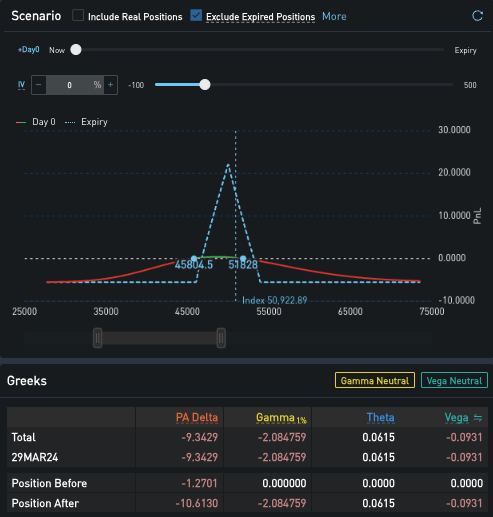

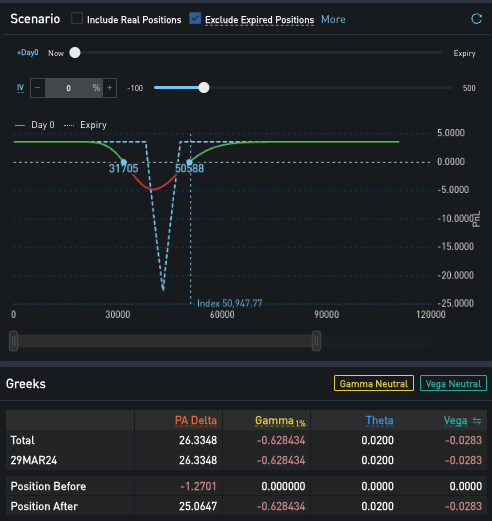

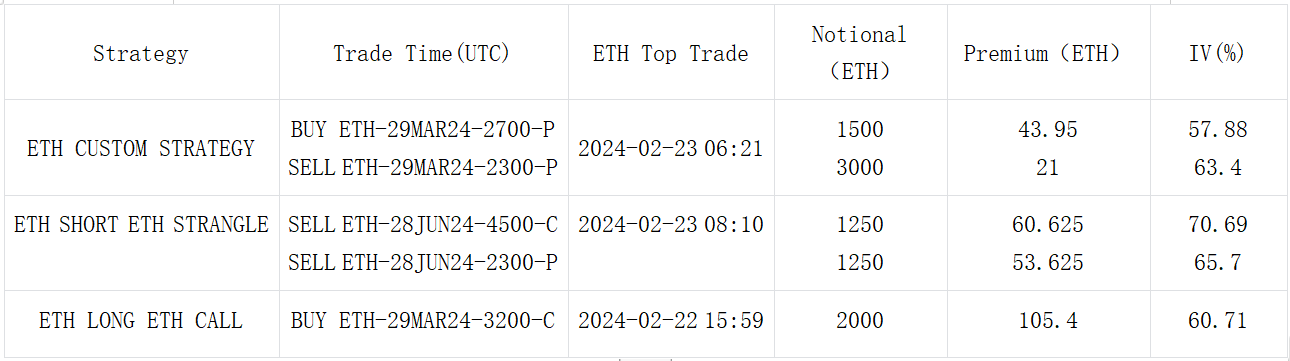

In cryptocurrencies, today marks the delivery day for options/futures at the end of February, unlocking a significant amount of margin that was tied up in the recent uptrend. Prices of BTC/ETH experienced a slight pullback, closing at 51000 (-1.6%) and 2933 (-1.8%), respectively. Regarding options, the implied volatility curve took a steep downturn, with ETH’s Vol Premium relative to BTC remaining unchanged. From a trading perspective, BTC transactions were concentrated on 1MAR/29MAR, with a significant increase in the proportion of put option transactions, primarily consisting of 1MAR 50000/49000 Long Put Spread and two sets of bearish put spread strategies for 29MAR, with accompanying charts illustrating the profit and loss changes for these strategies. Most ETH transactions were also concentrated in March, with the most notable net inflows being 3100/3200 call buying and 3000 put buying.

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Options Toolkits: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Trading Ideas: https://t.me/SignalPlus_Playground

Comments