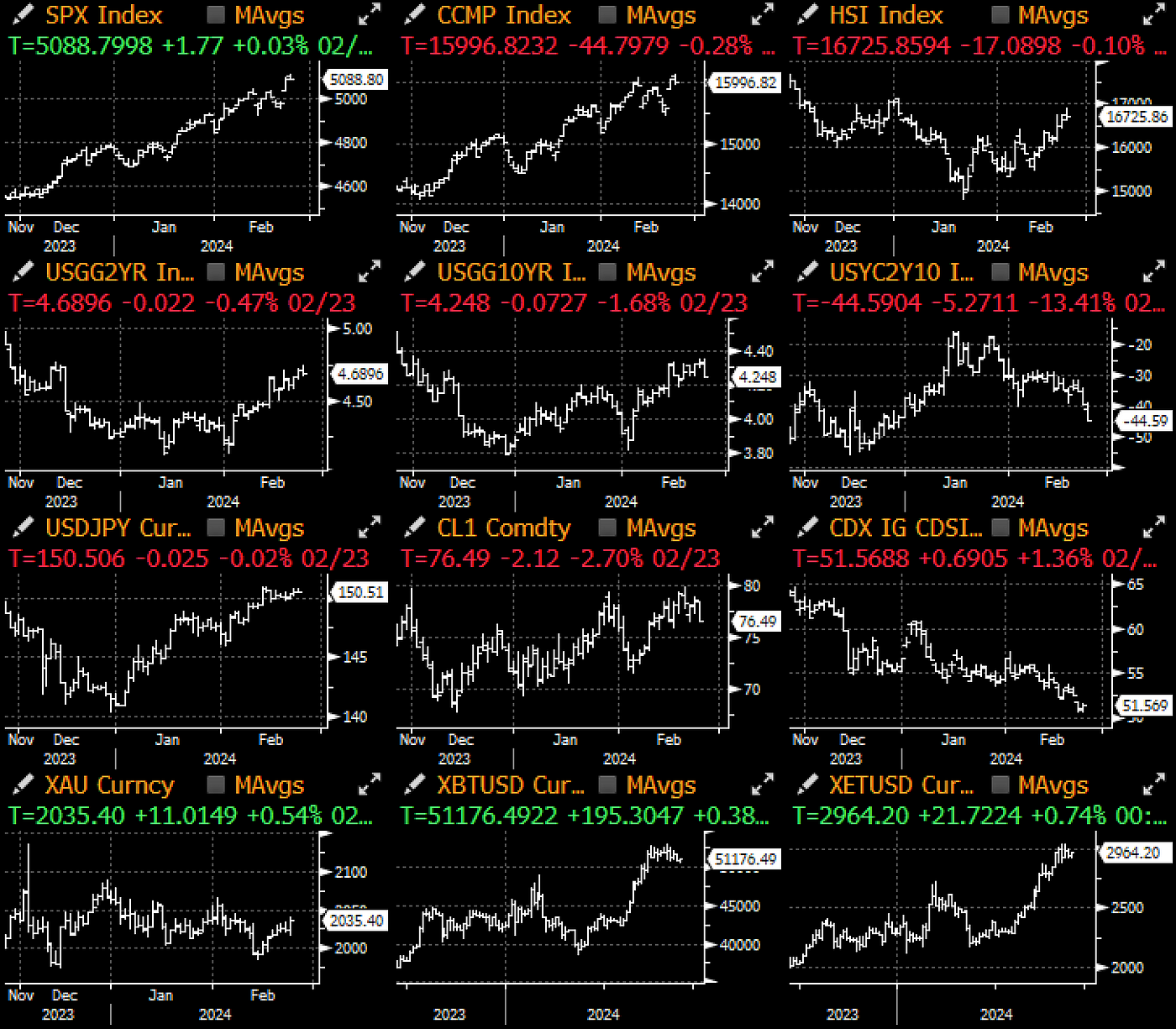

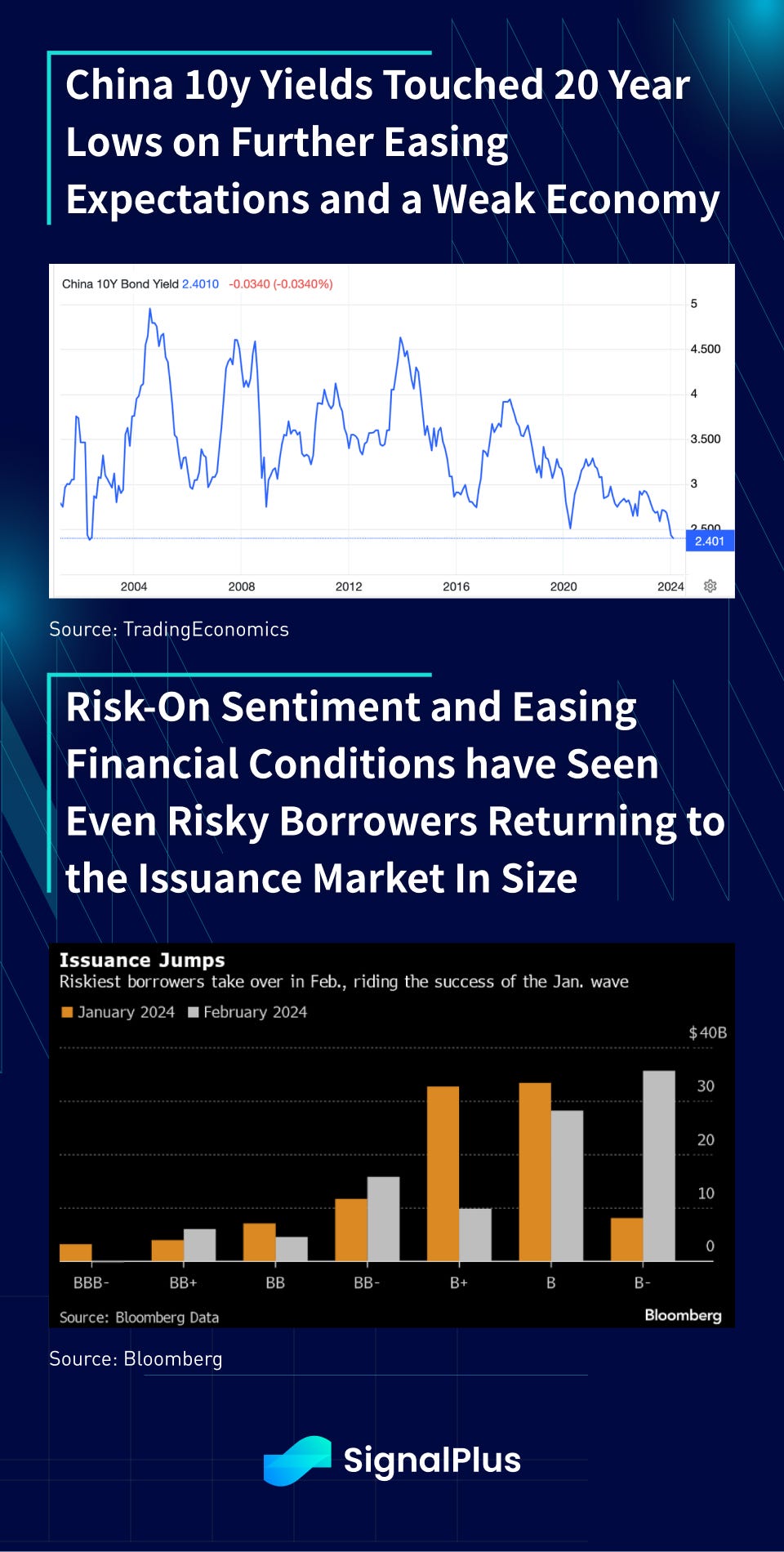

Markets continued in its risk-on ways on Friday, with China 10y yields touching 20 year lows, European fixed income rallying on the back of dovish ECB speak, and new bond supply seeing healthy investor demand despite substantial supply.

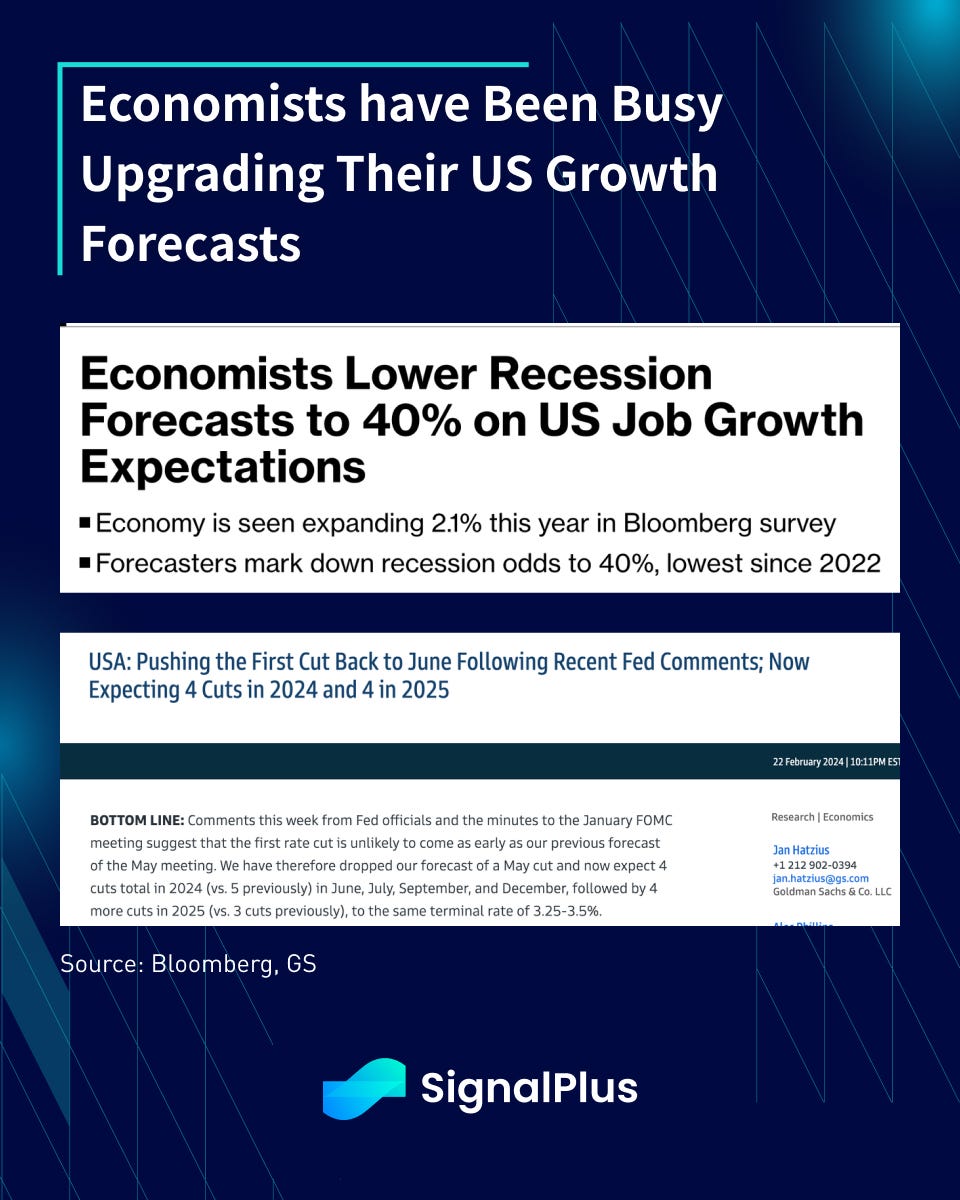

Furthermore, sell side economists have been busy revising up US growth forecasts, with consensus recession calls dropping to less than 40% probability, and the median economist calling for 2.1% growth in 2024. Furthermore, GS has also officially pushed back their official call for a 1st Fed cut back to June thanks to strong data, though they are still expecting terminal rates to trough around the 3.25–3.5% level.

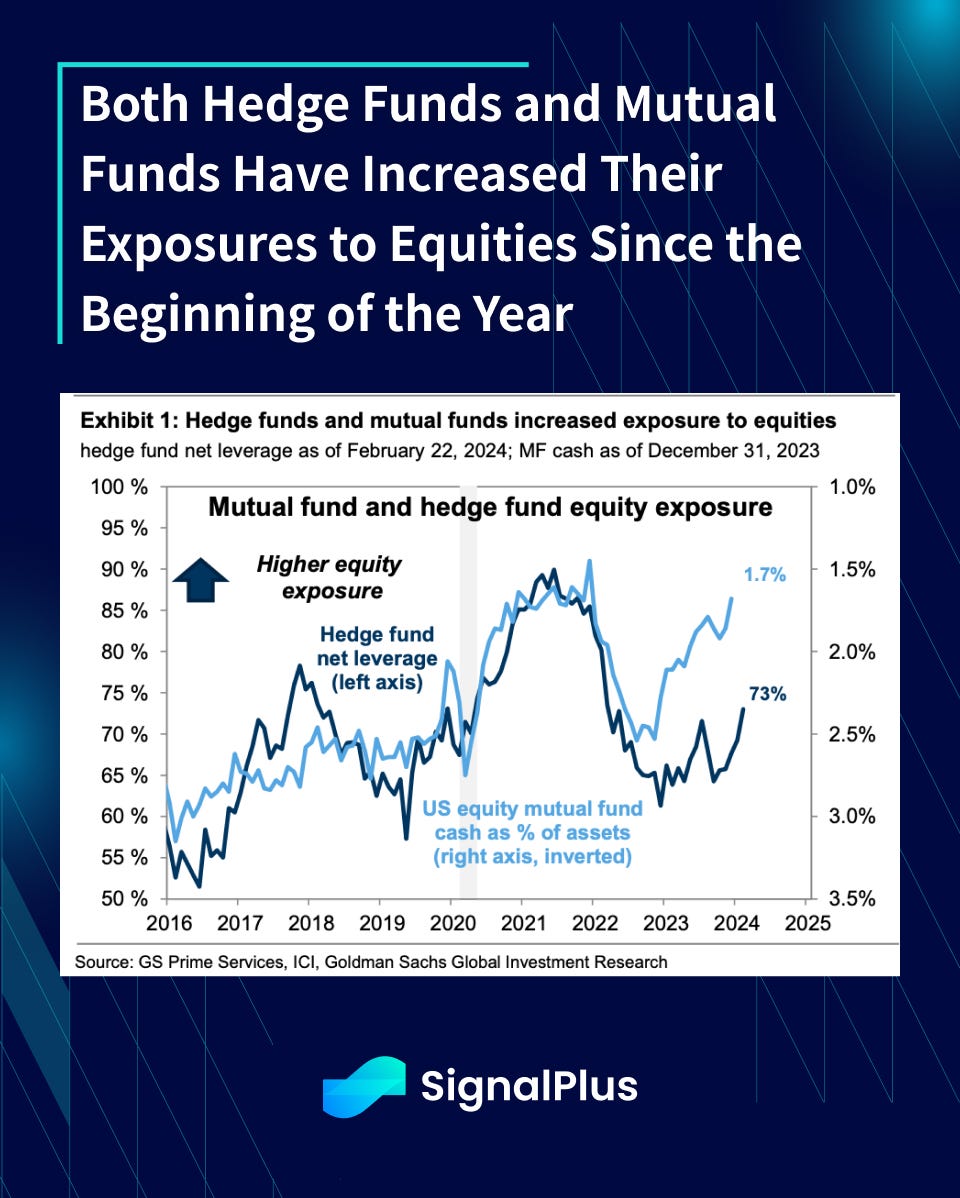

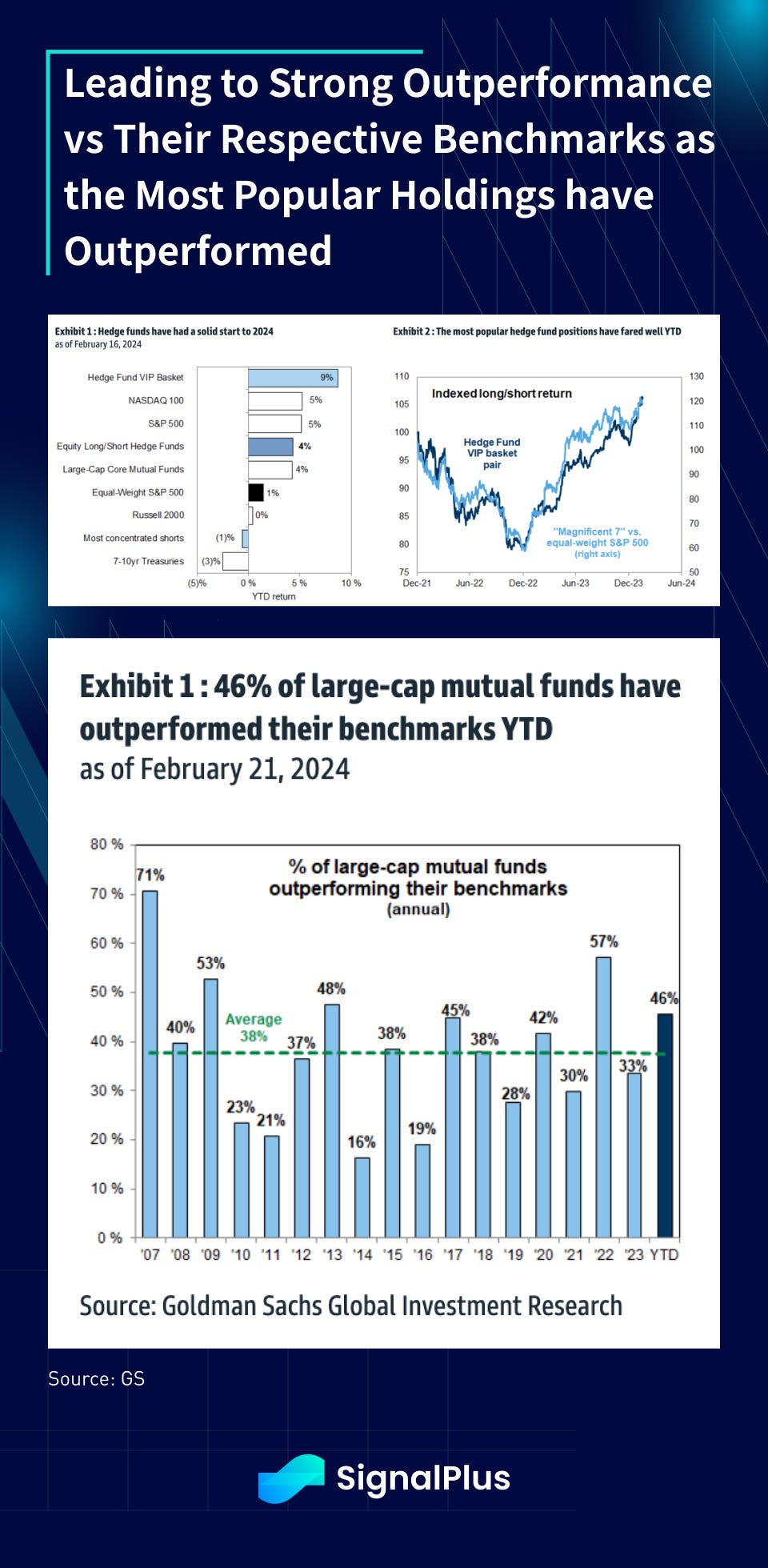

Not surprisingly, equities stayed buoyant around their ATHs, though the tech sector did lag a little on the session on profit-taking after a spectacular run. Both active and passive managers have started the year on the right foot with both hedge funds and mutual funds being heavily exposed to equities since the beginning of the year, with both parties also outperforming their benchmarks on a YTD basis.

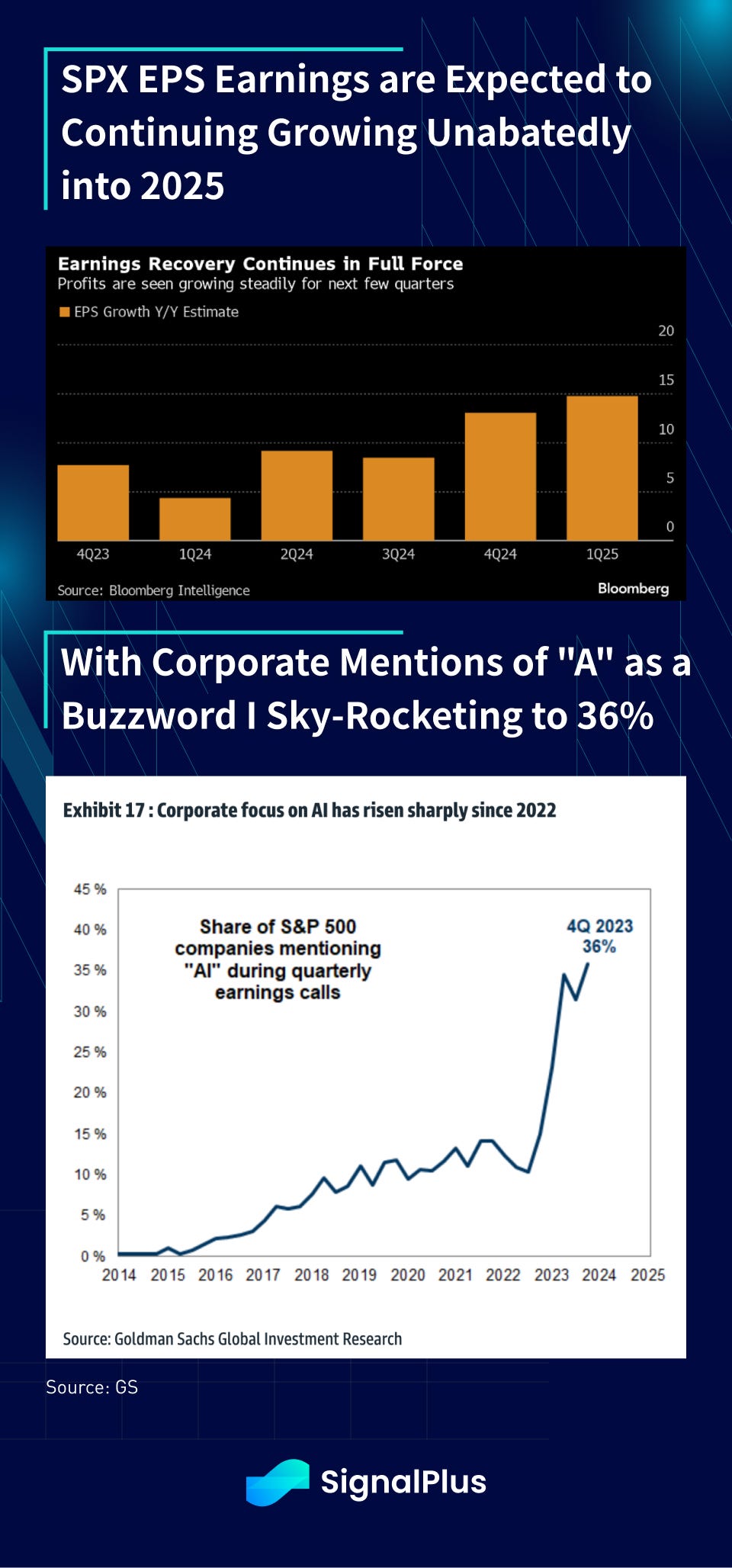

Equity earnings have continued to recover with YoY projections on the up-and-up heading into 2025, with 36% of S&P companies mentioning “AI” in their quarterly earnings call as the subject remains a boon for profits and sentiment without pause.

Over in crypto, prices have similarly flatlined a touch after its recent inspired rally, though the overall mainstream narrative continues to improve. Reddit recently announced in their S-1 (IPO) filing that they have invested some of their excess cash reserves in BTC and ETH, and expect to continue using them to pay for certain virtual goods going forward.

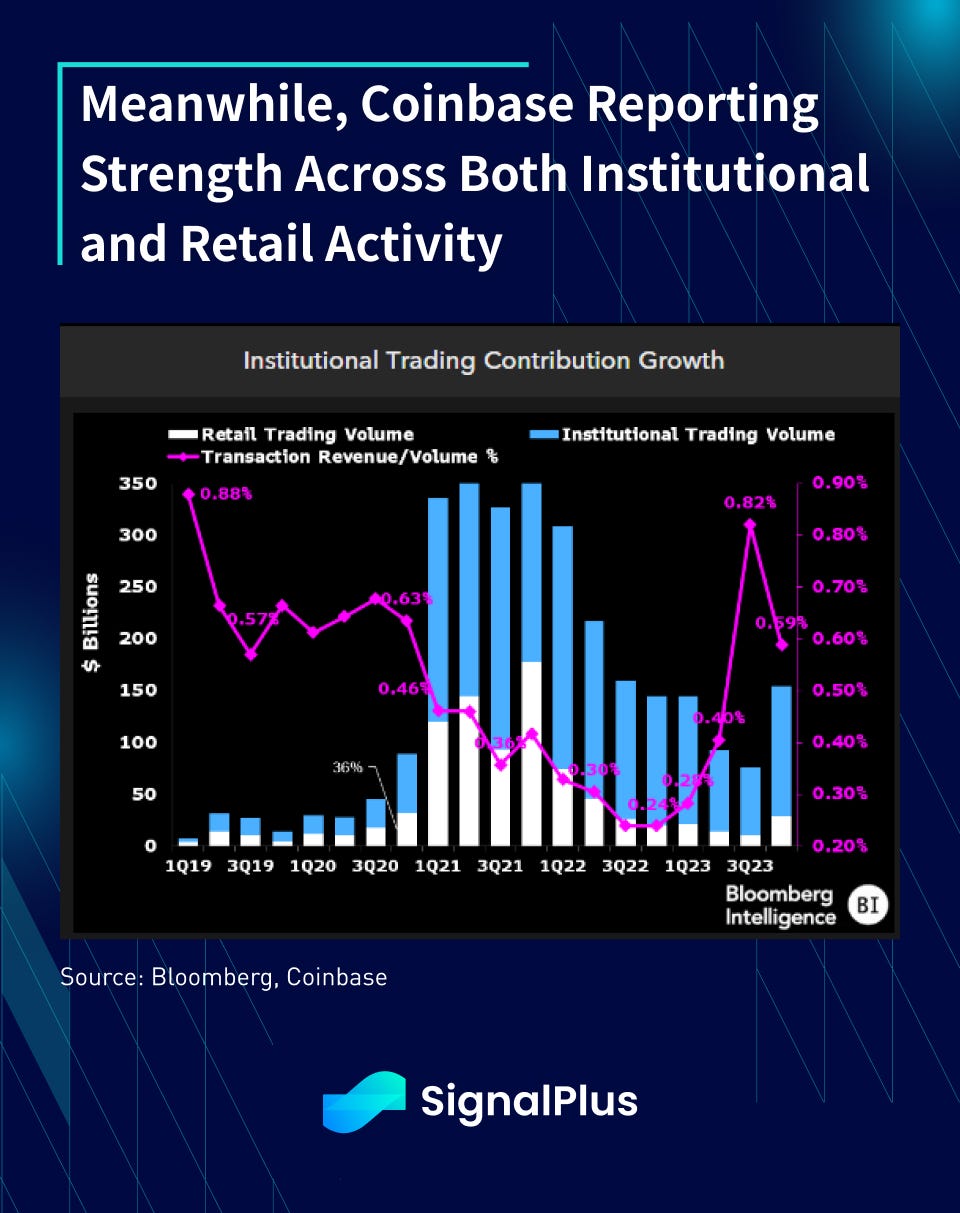

Meanwhile, retail participation continues to show improvements, with JPM reporting that smaller wallets (ie. retail) have been seeing larger (ETF adjusted) inflows vs larger institutional wallets. Net Bitcoin purchases have also seen a rebound across popular retail platforms such as Block, PayPal, and Robinhood in 2023, while Coinbase reported encouraging improvements across both institutional and retail activity in the 4Q23 earnings.

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Options Toolkits: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Trading Ideas: https://t.me/SignalPlus_Playground

Comments