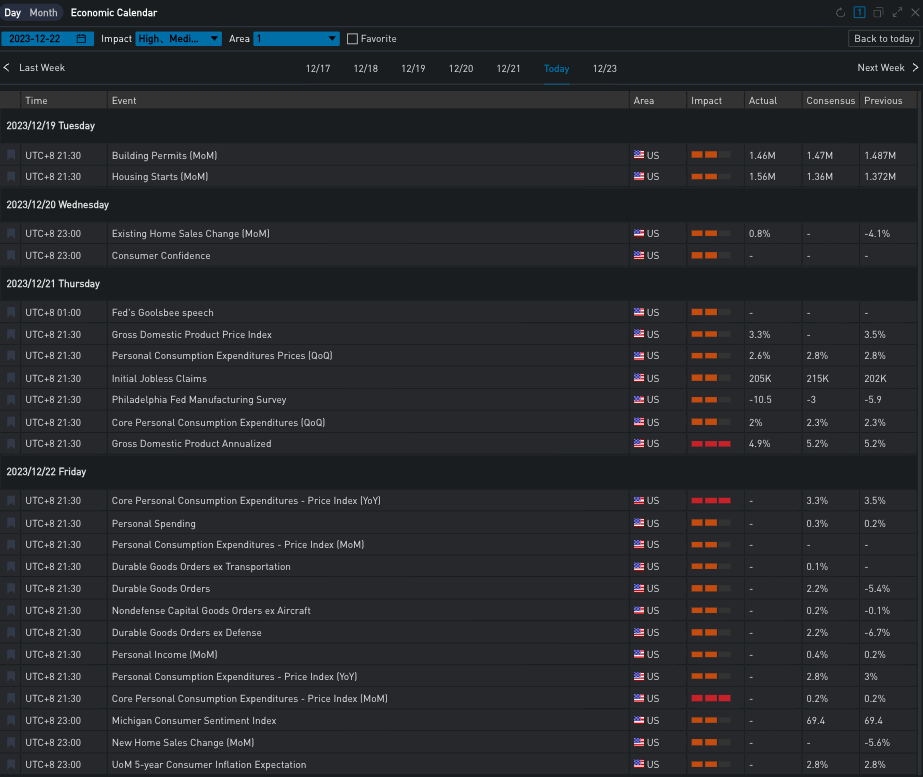

Yesterday evening (21 Dec) at 11:30 PM (UTC), the U.S. Department of Commerce reported that the annualized quarter-over-quarter value of the U.S. GDP for the third quarter was unexpectedly revised down to 4.9%, indicating that the growth for the quarter was not as strong as anticipated. This prompted a short-term decline in Treasury yields. However, at the same time, the number of initial jobless claims for the week was reported at 205,000, lower than the expected 215,000 and remaining near historical lows, showing the resilience of the labor market. After digesting this round of data, Treasury yields quickly recovered, with the two-year and ten-year yields currently at 4.346% and 3.891%, respectively. The three major U.S. stock indices opened high and closed higher, with the Dow Jones, S&P, and NASDAQ rising by 0.87%, 1.03%, and 1.26%, respectively.

In the oil sector, according to reports from Angola’s news agency, Angola has expressed its intention to leave OPEC due to dissatisfaction with the production arrangement. This move further ignited market concerns about an increase in supply, causing international crude oil futures prices to fall during the night and then fluctuate and recover. WTI and Brent crude ultimately closed up by 0.22% and 0.3%, respectively.

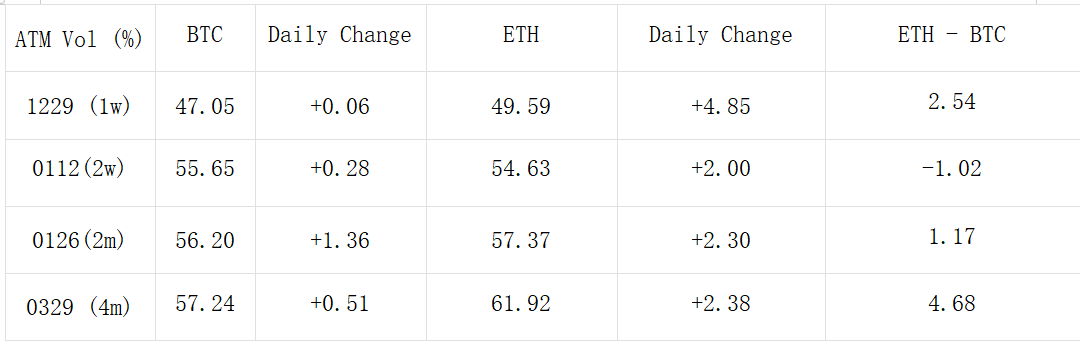

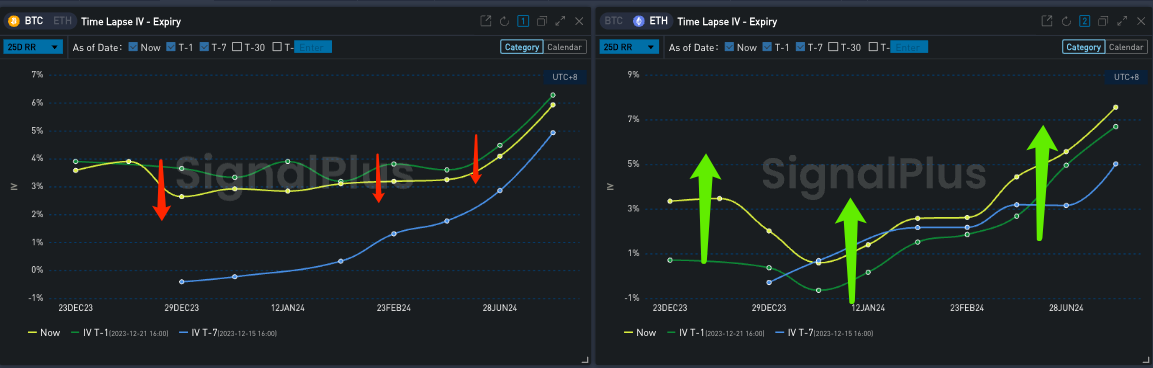

In the cryptocurrency sector, BTC continues its upward trend, repeatedly challenging the $44,000 mark. In terms of options, partly influenced by several macroeconomic data releases tonight, the IV for short-term options has strongly increased, with BTC and ETH currently reaching levels of 50% and 60% respectively. On the other hand, rumors about the launch of an ETH ETF next year are becoming more widespread, possibly contributing to today’s increase in distant IV by 2% Vol and a noticeable rise in Vol Skew.

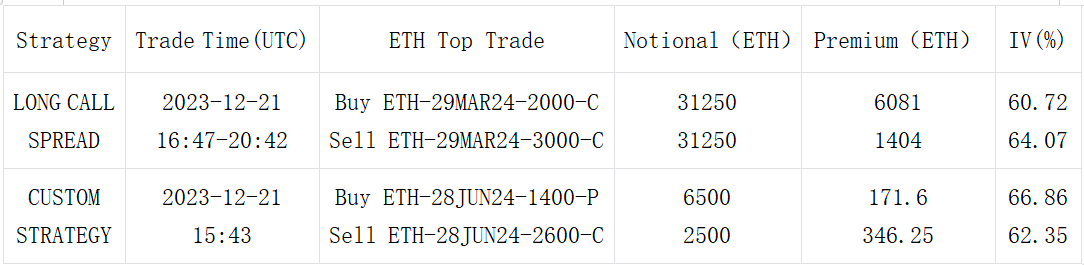

In the area of large transactions, the volatility trend in January remains a hot topic of market discussion. On the Deribit trading platform, a set of 500 BTC per leg ‘Buy 12 Jan Straddle vs Sell 26 Jan Straddle’ cross-period volatility spread strategies emerged, continuing to bet on the early-year dynamics of the SEC. At the same time, at the end of January, there is a 1000:2000 BTC ‘Sell 40000-P vs Buy 37000-P’ bearish spread, costing about 0.001 BTC per set. In terms of ETH, the ’29 Mar 24 2000 vs 3000 Long Call Spread’ leads the trading volume charts, with a total of 31,250 ETH traded per leg and an OI increase of approximately 22,030/29,400 ETH respectively.

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Options Toolkits: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Comments