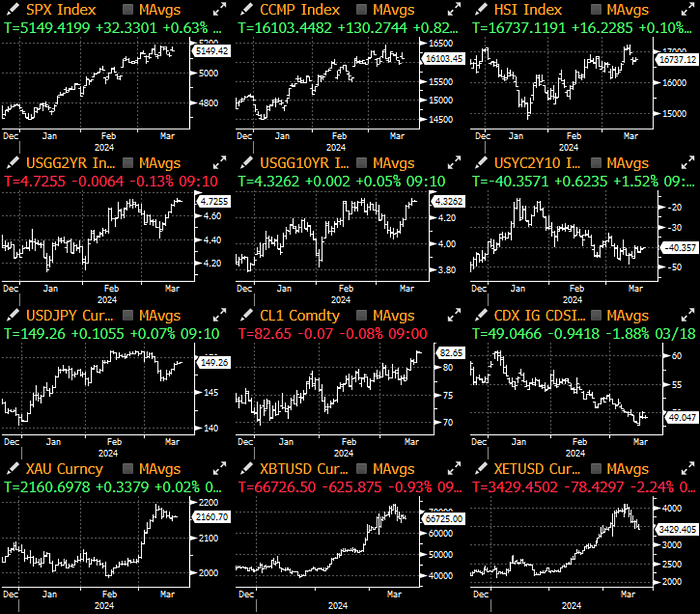

Quiet day yesterday in markets as we await today’s BoJ announcement, in addition to the RBA/Fed/BoE decisions later this week. The BoJ continued to manage market expectations by releasing a Nikkei article and Bloomberg headline stating: *BOJ TO END YIELD CURVE CONTROL, ETF PURCHASES TUESDAY. The pre-guidance appears to be working as the Nikkei composite remains close to its ATHs, while USDJPY is back to its familiar ~150 area just ahead of the potential end to Japan’s long-held NIRP.

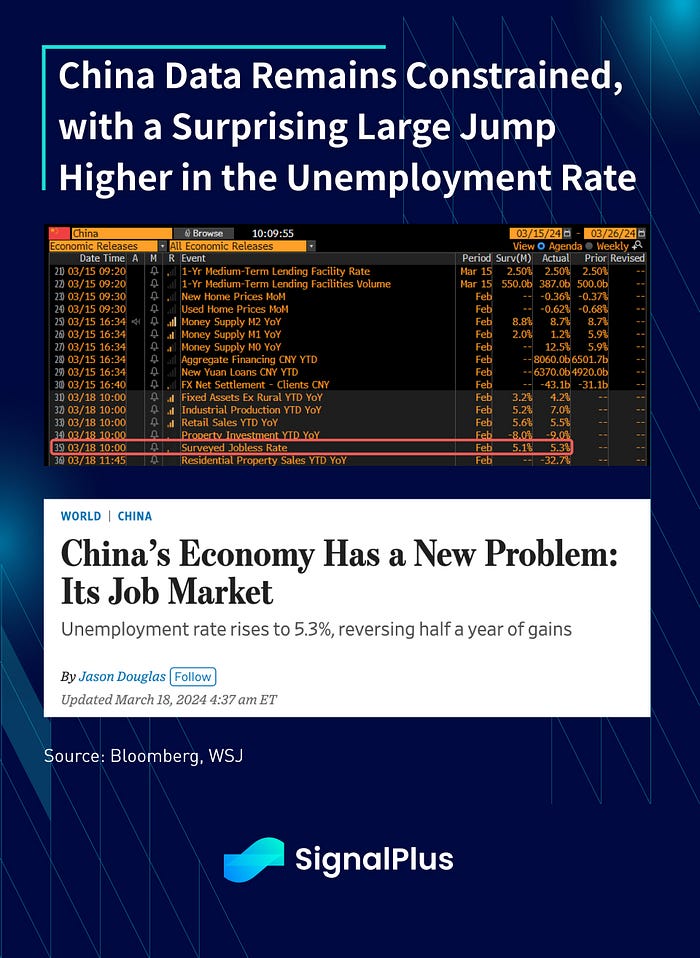

Elsewhere, the post-blackout release of China data continued to show a constrained economy, with an official jobless rate that’s jumped much higher than expected (5.3% vs 5.1%), versus much of the gains made since the post-covid reopening. With that said, Chinese assets have stabilized since the new year and appear to be forming a longer-term base with sentiment close to rock bottom, with hopes that the worst is behind us as officials have adapted a more supportive stance.

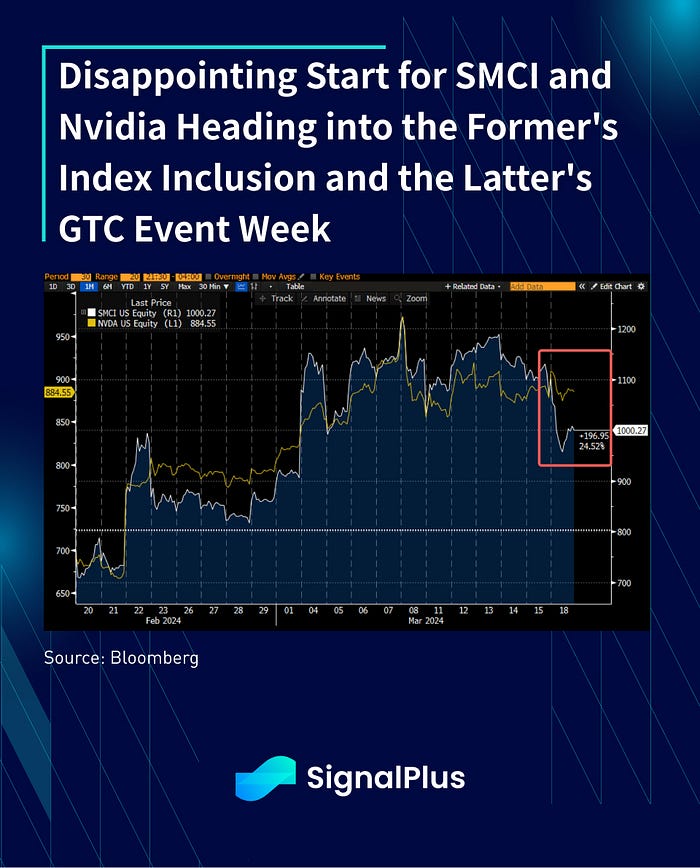

Equities rebounded somewhat on Monday after a rough end to last week, as AI optimism was riding once again with SMCI’s inclusion into the S&P 500, and the beginning of Nvidia’s hotly anticipated GTC 2024 event. Unfortunately, it was not to be an auspicious start with SMCI falling -3.5% on the day on a ‘sell the news’ event, while Nvidia saw a 6% top-to-trough fall despite announcing yet another new chip (Blackwell).

In crypto, prices continue to deflate somewhat from its recent highs, in particular for the majors, though the alternative EVM narrative continues to hold up with Solana and Avalanche outperforming most other top tokens on a weekly basis.

Taking a trip back down memory lane, contrasting with 2017’s ICO craze, it was ETH that benefitted the most as traders (degens) needed to buy and lock ETH in various pre-sales in order to lock in discounted token allocations. The locking and waiting part created a one-way demand for ETH, leading to explosive upside reflexivity and causing ETH to outperform most other majors during the ICO run. However, in the current cycle, the baton has been passed to Solana where most of the meme-coins, pre-sales, and other ‘degen activity’ are taking place . Furthermore, the lock-up and waiting period are much shorter this time around, leading to even faster cycles and intense speculation, which is driving Solana outperformance versus all other majors and alts in the current meme-coin mania.

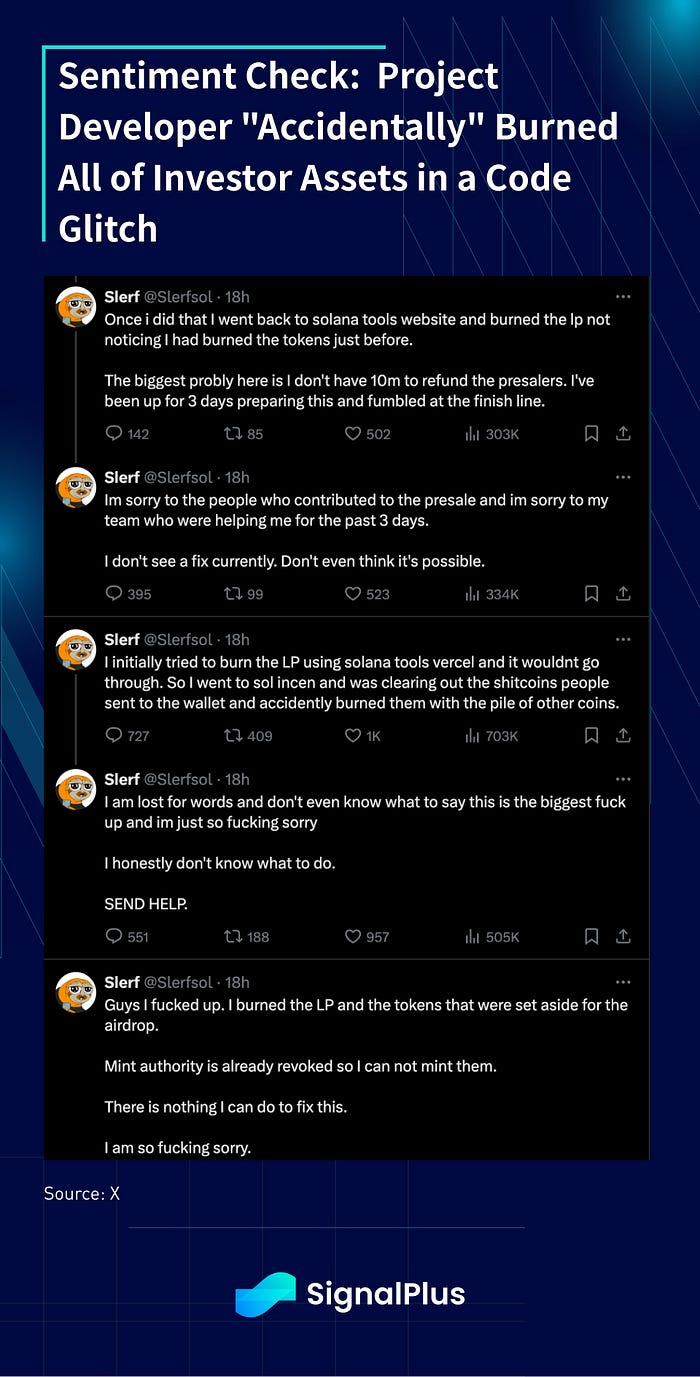

Finally, as an amusing aside on a slow news day, nothing is complete in a crypto meme cycle without another memorable rug-pull (or getting ‘rekt’ed’ in crypto parlance). Yesterday was another one of those days where the developer of a hot token project ‘accidentally’ burned all 10mm (USD equiv) of locked investor assets in a code-glitch just ahead of the token launch, taking us back to the good ol’ days of Wild Wild East before all the fancy institutions came in. As we mentioned last week, things are definitely looking froth and it’s probably wise to adopt a more defensive stance for a while. Stay safe and keep your assets safer everyone!

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Options Toolkits: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Trading Ideas: https://t.me/SignalPlus_Playground

Comments