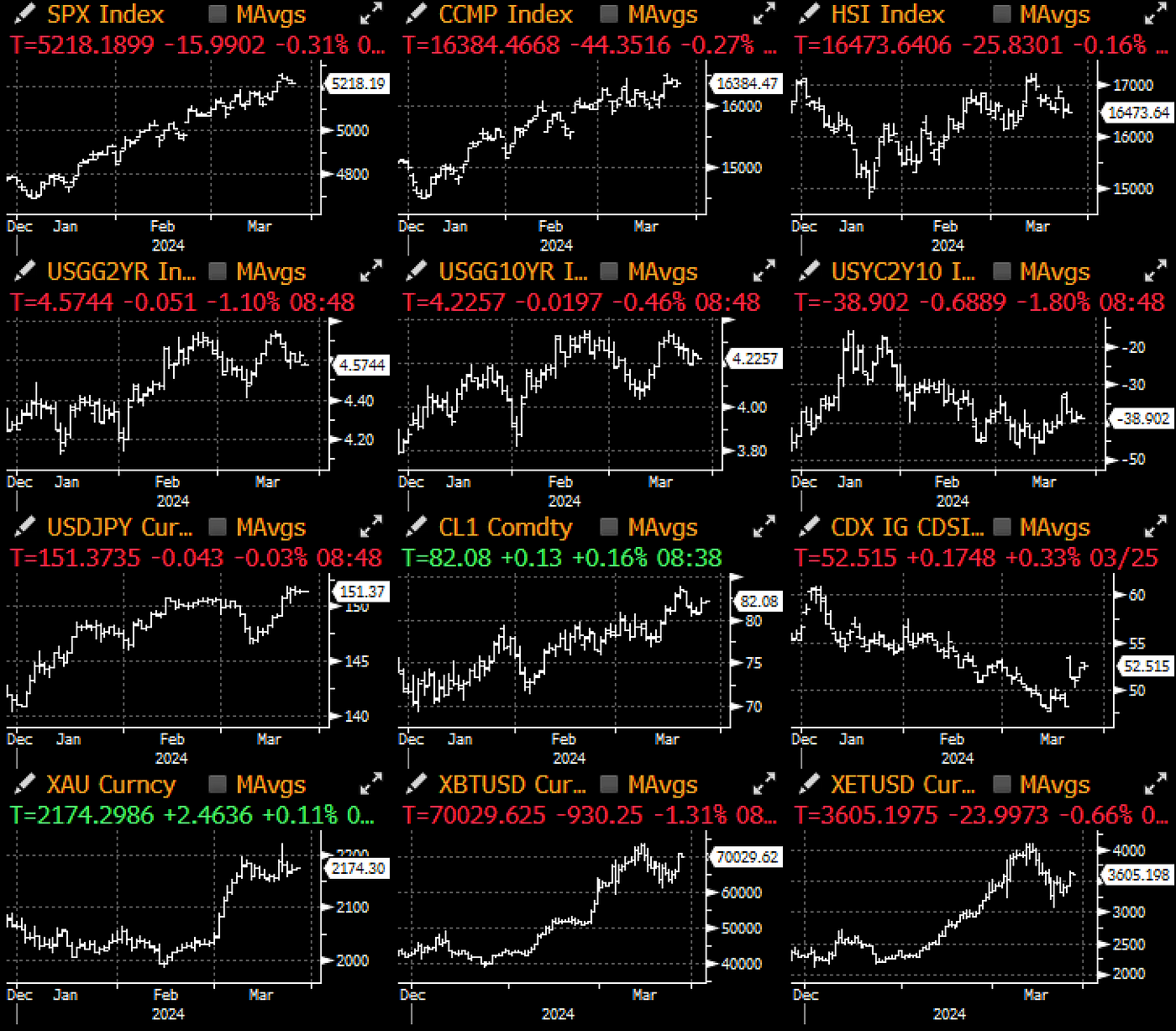

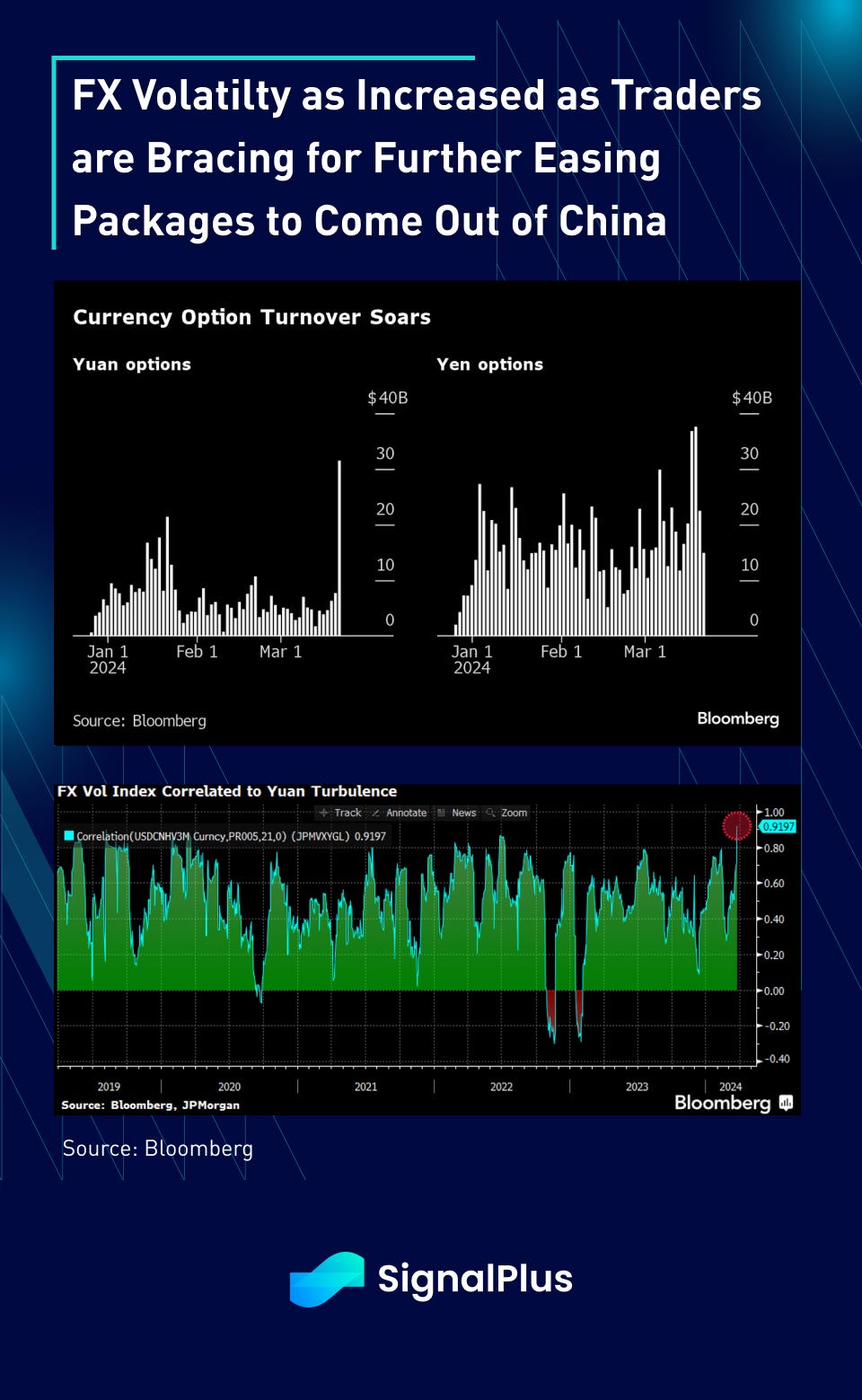

A holiday-shortened week (US Good Friday) led to subdued market activity with volumes at around 70–80% of normal. Most of the near-term focus recently was on FX markets, where there has been an increased focus on both CNY and JPY, both of which have started to trend weaker post the recent PBoC and BoJ meetings.

Volatility has increased for both pairs, particularly for CNY/CNH, as traders are bracing for potentially more easing packages to come out of China. Focus will be on around the ~7.30 level as the interim line in the sand, coinciding with the previous highs seen over the past 6 months.

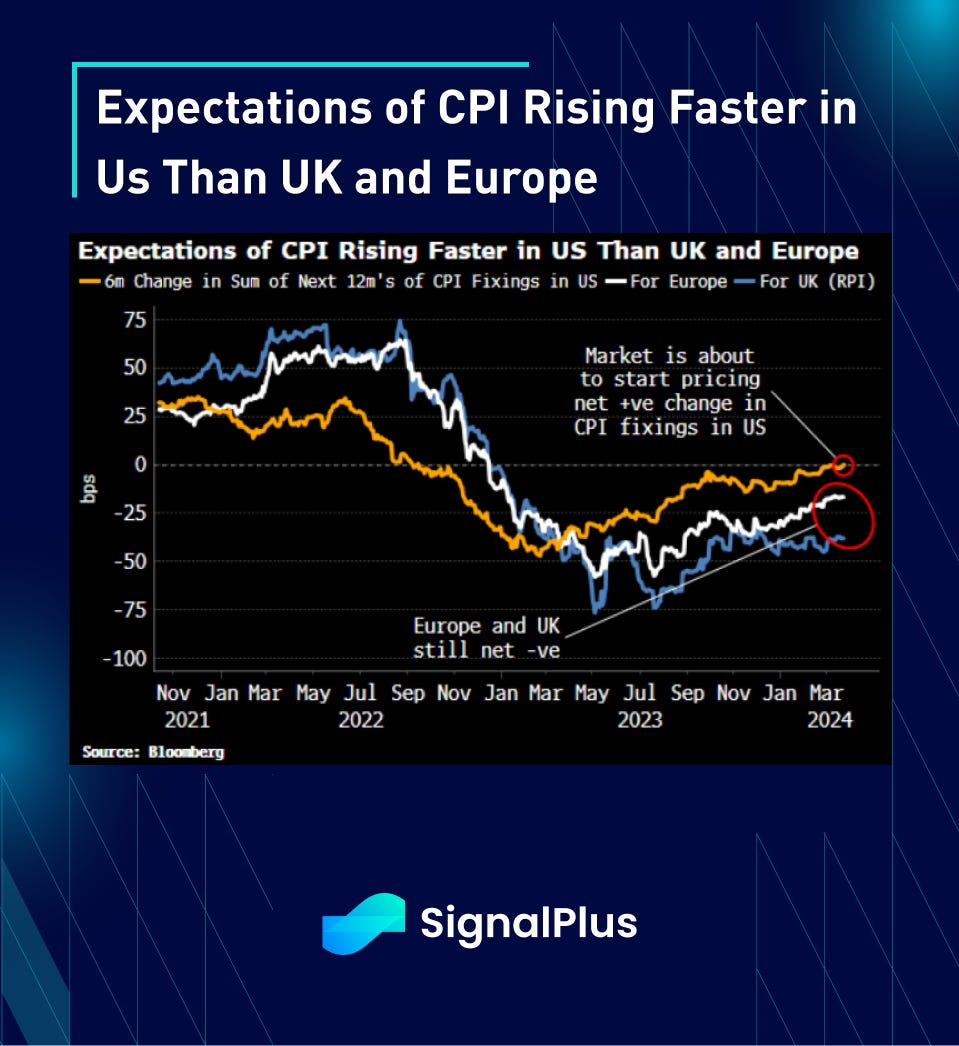

In US markets, Atlanta Fed’s Bostic reiterated his hawkish stance by stating he expects only one more interest cut this year, as the Fed can afford to be patient as long as the economy holds up. In terms of Fedspeak, Governor Waller’s speech this Wednesday might be the main event this week, as Powell’s speaking engagement on Friday will take place when US markets are closed for holidays. As a quick reminder, Fed’s Waller stated “What’s the rush” in terms of the timing of interest rate cuts from as recently as February. Further reiteration of that view will start raising questions on whether Powell is starting to lose his consensus in his dovish mantra.

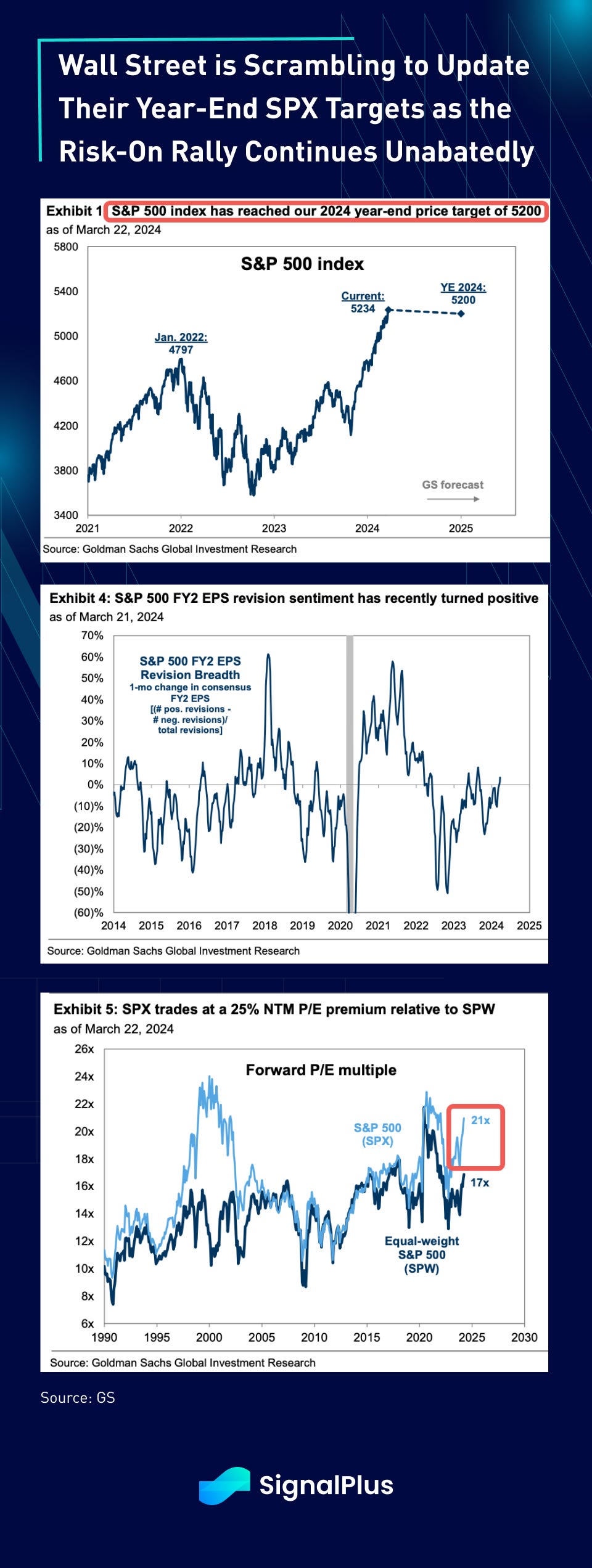

In equities, the recent rally has allowed the SPX to hit a number of Wall Street’s YE targets already, causing strategists around the street to scramble and update their forecasts. Forward PE multiples have expanded as EPS revision has turned higher. Not much insights to add here, with risk sentiment likely to stay buoyed unless we get a real nasty CPI surprise, a sudden collapse in the economy, or an improbable hawkish turn from the Fed over the next couple months.

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Trading Terminal: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Trading Ideas: https://t.me/SignalPlus_Playground

Comments