Welcome to SignalPlus’s 2024 Macro Outlook. We want to thank all our readers and supporters for their tireless support and hope to be able to continue value-added insights and tech solutions to our clients in the many years ahead. Please reach out to the team at any time via TG / X / WeChat / Emails and we would love to hear from you!

Almost Everyone Got Their Calls Wrong in 2023… Why Do We Even Bother With Outlooks Anyway?

As we head into the new year with a fresh start, it’s worthwhile to do a post-mortem for the past year, to see what the market called right and what it didn’t. For the most part, it’s probably fair to say that the ‘Street’ was very off its mark in its 2023 forecasts.

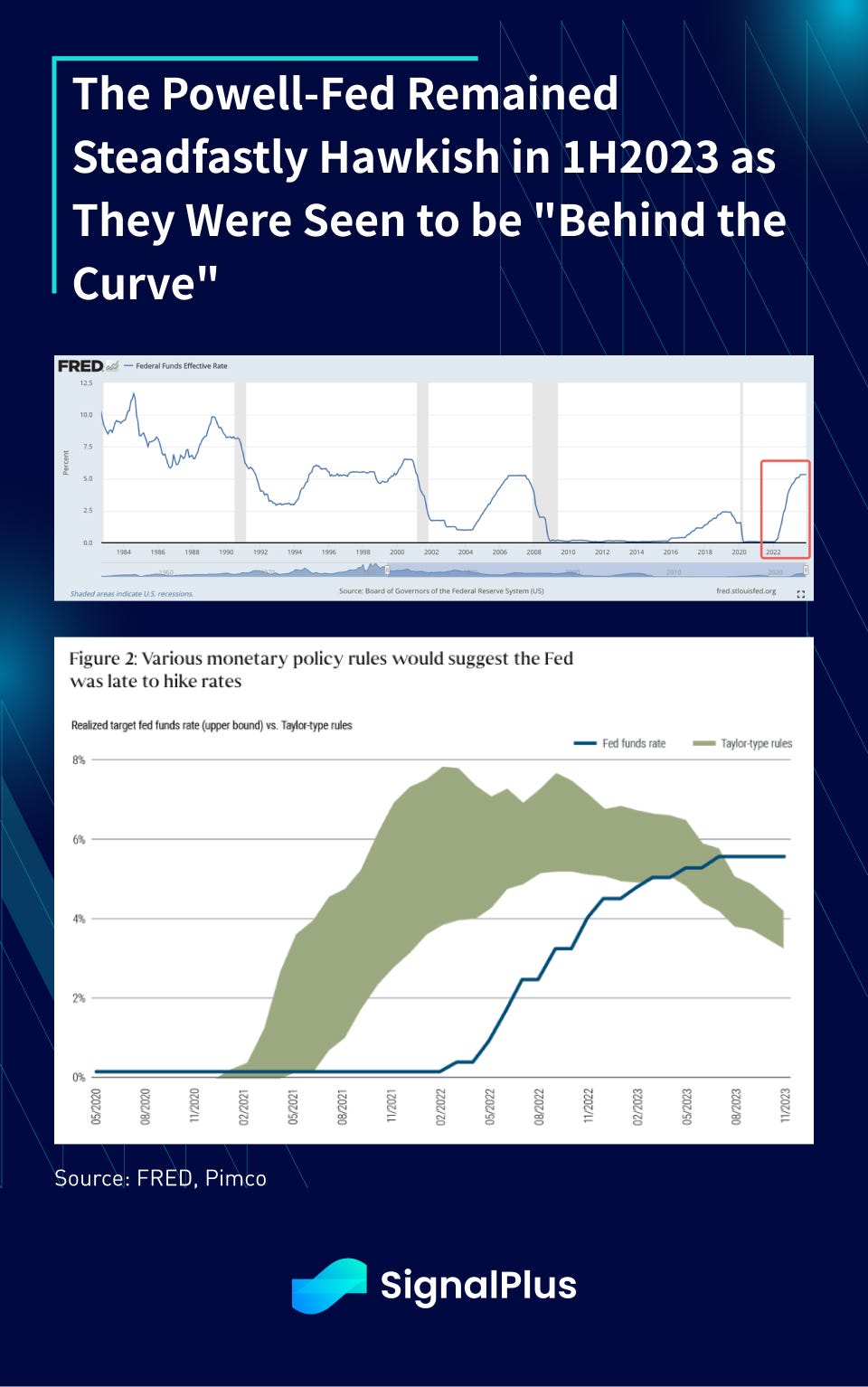

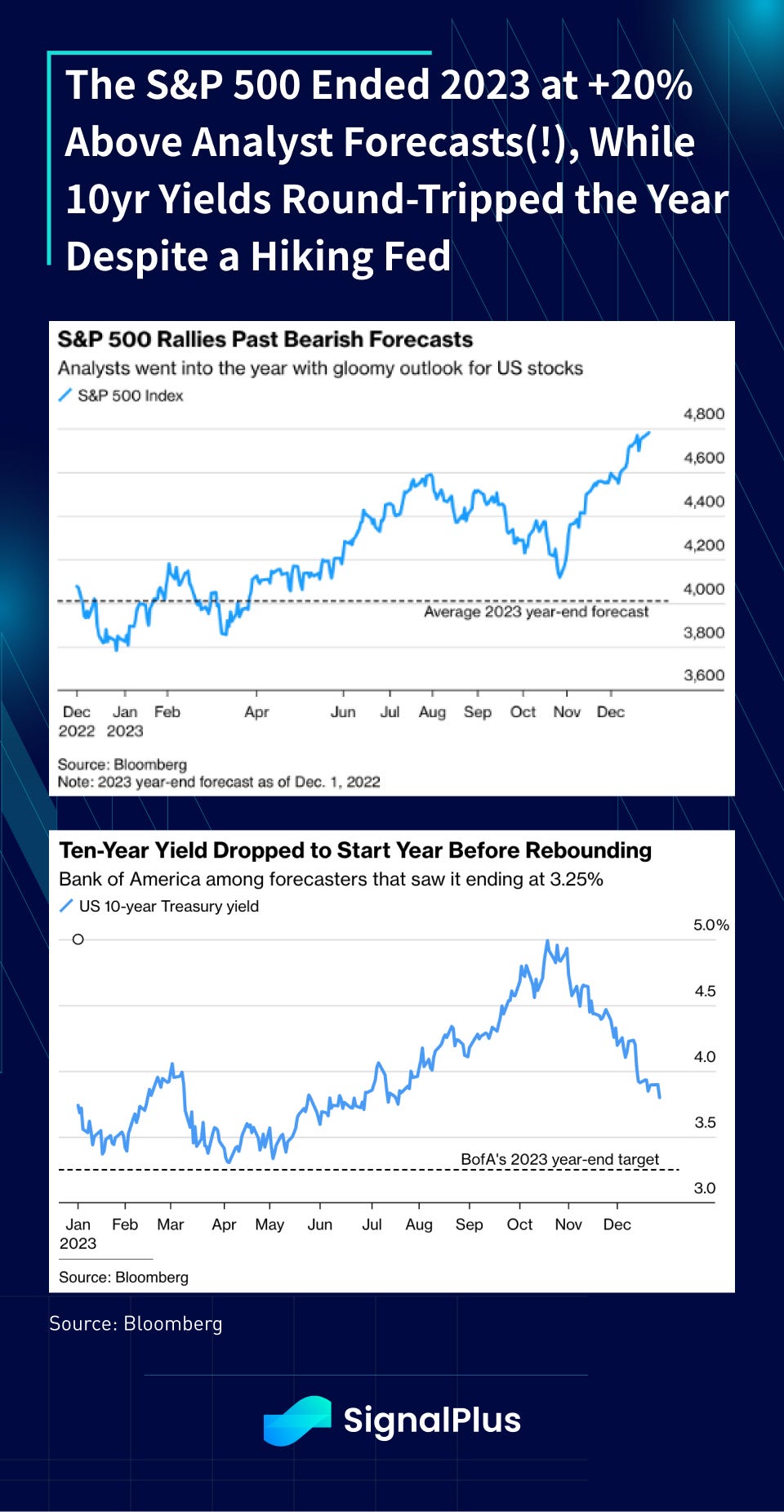

Asset prices were widely expected to fall off a cliff, with bond yields at risk of a ‘taper-tantrum’-redux as the Fed went on an unprecedented rate tightening campaign. The first half of 2023 continued with the Powell-led Fed that remained steadfast with its inflation-fighting narrative, challenging asset markets that were fighting the FOMC nearly every step of the way.

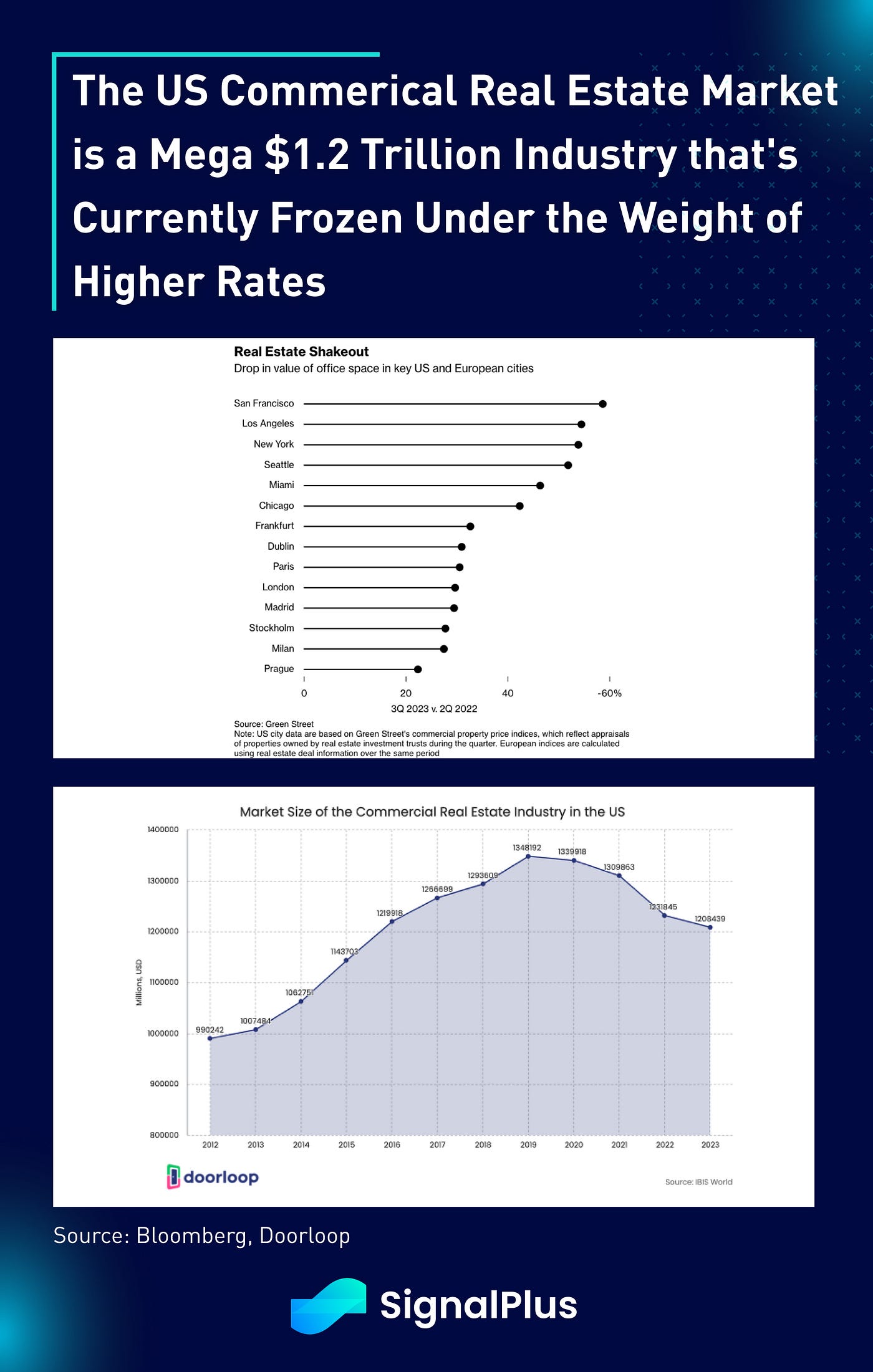

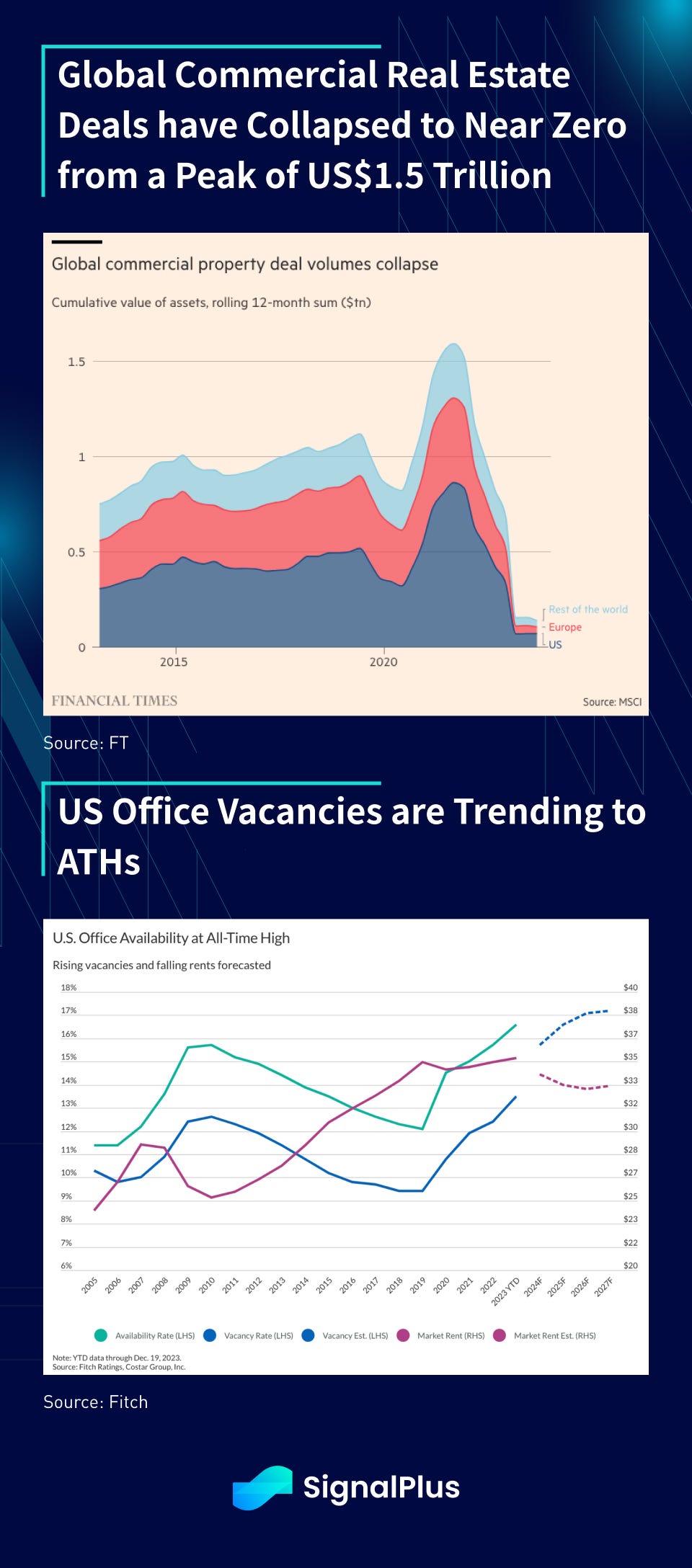

The steadfastness in rate hikes led to significant losses in interest rate-sensitive assets, such as mortgage-backed bonds and underlying real estate assets. In particular, we saw significant revaluations of the entire commercial real estate (CRE) sector, with deal activity in deep freeze territory, and many US gateway cities seeing office prices fall by 50% or more in 2023.

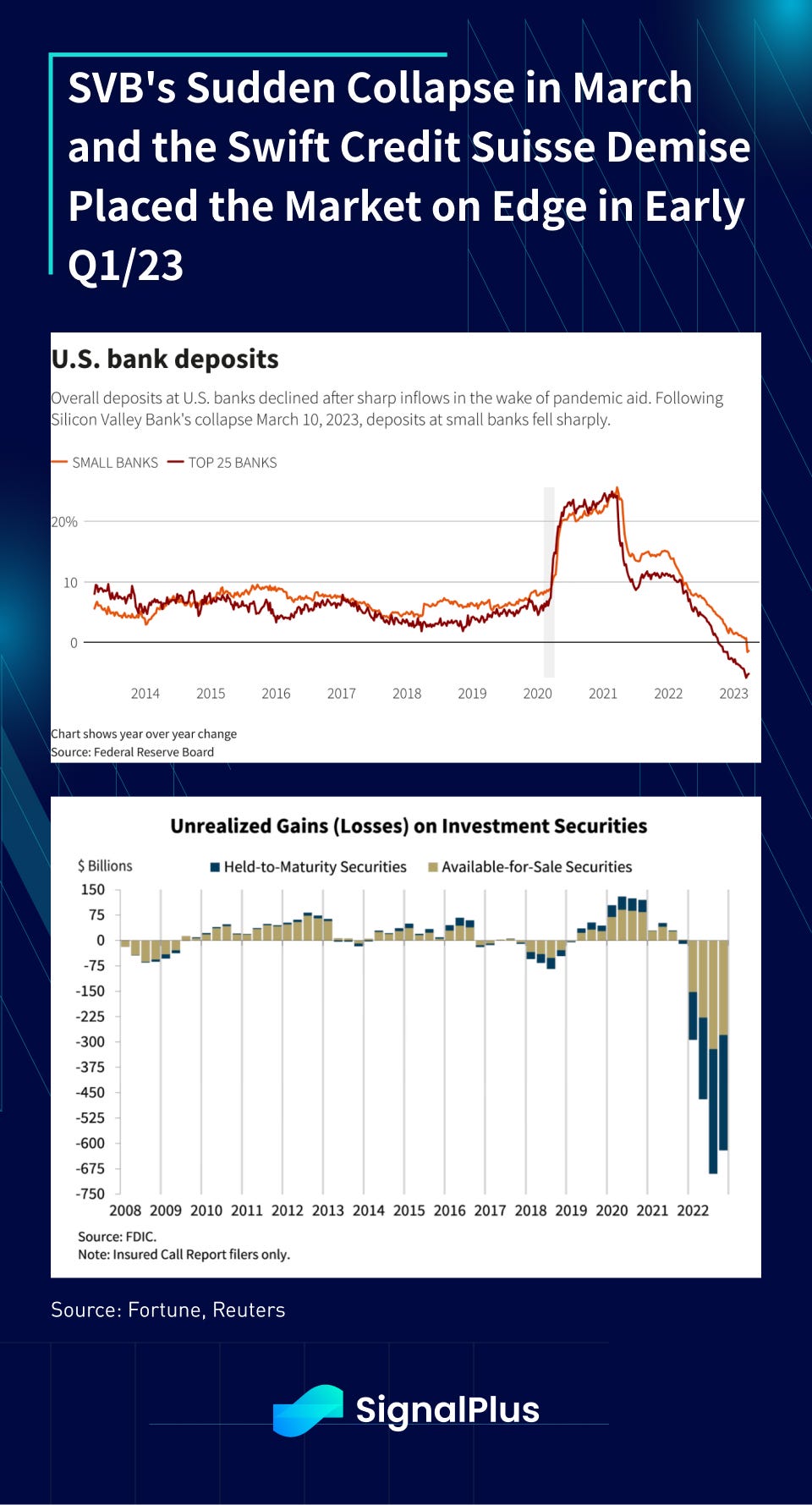

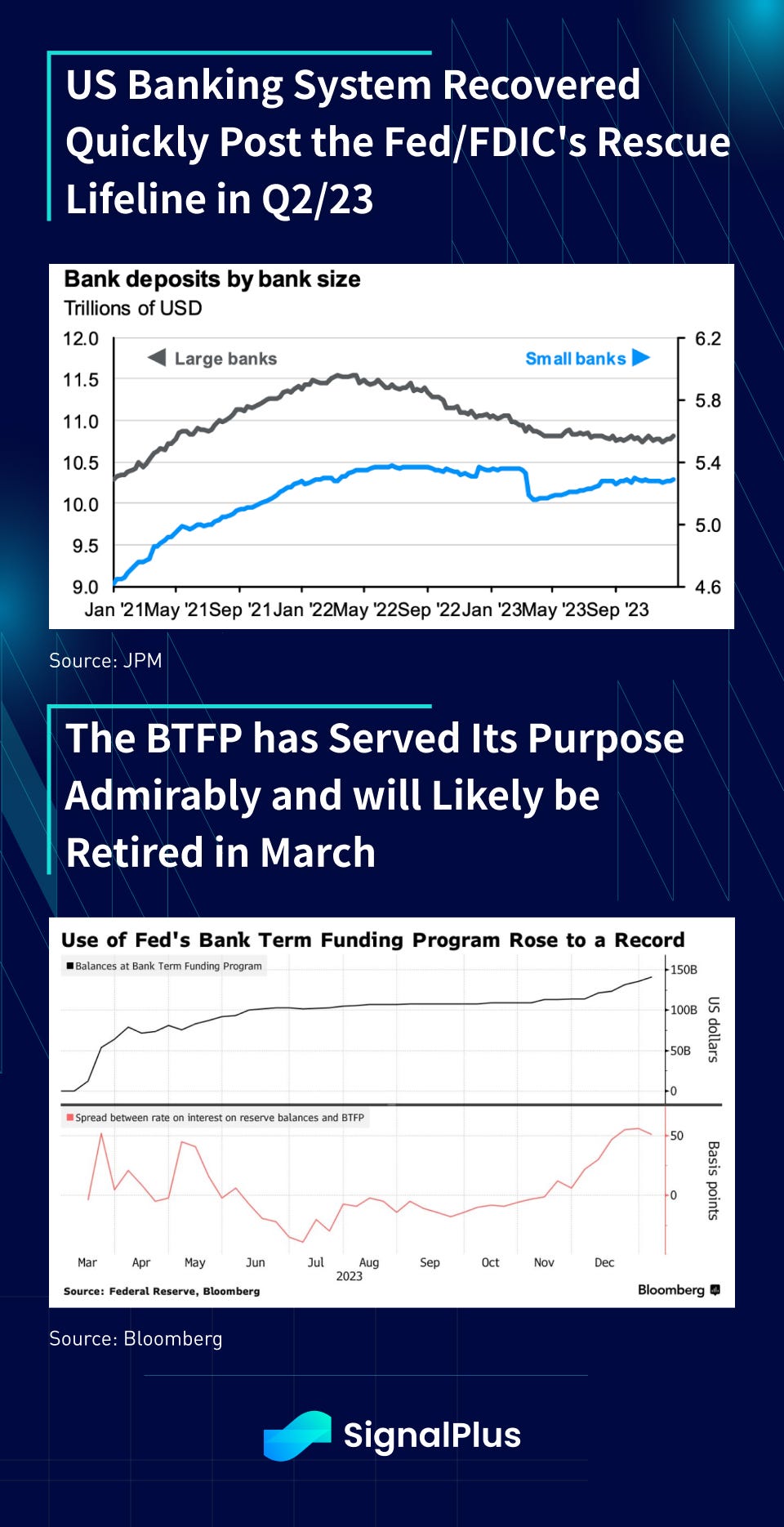

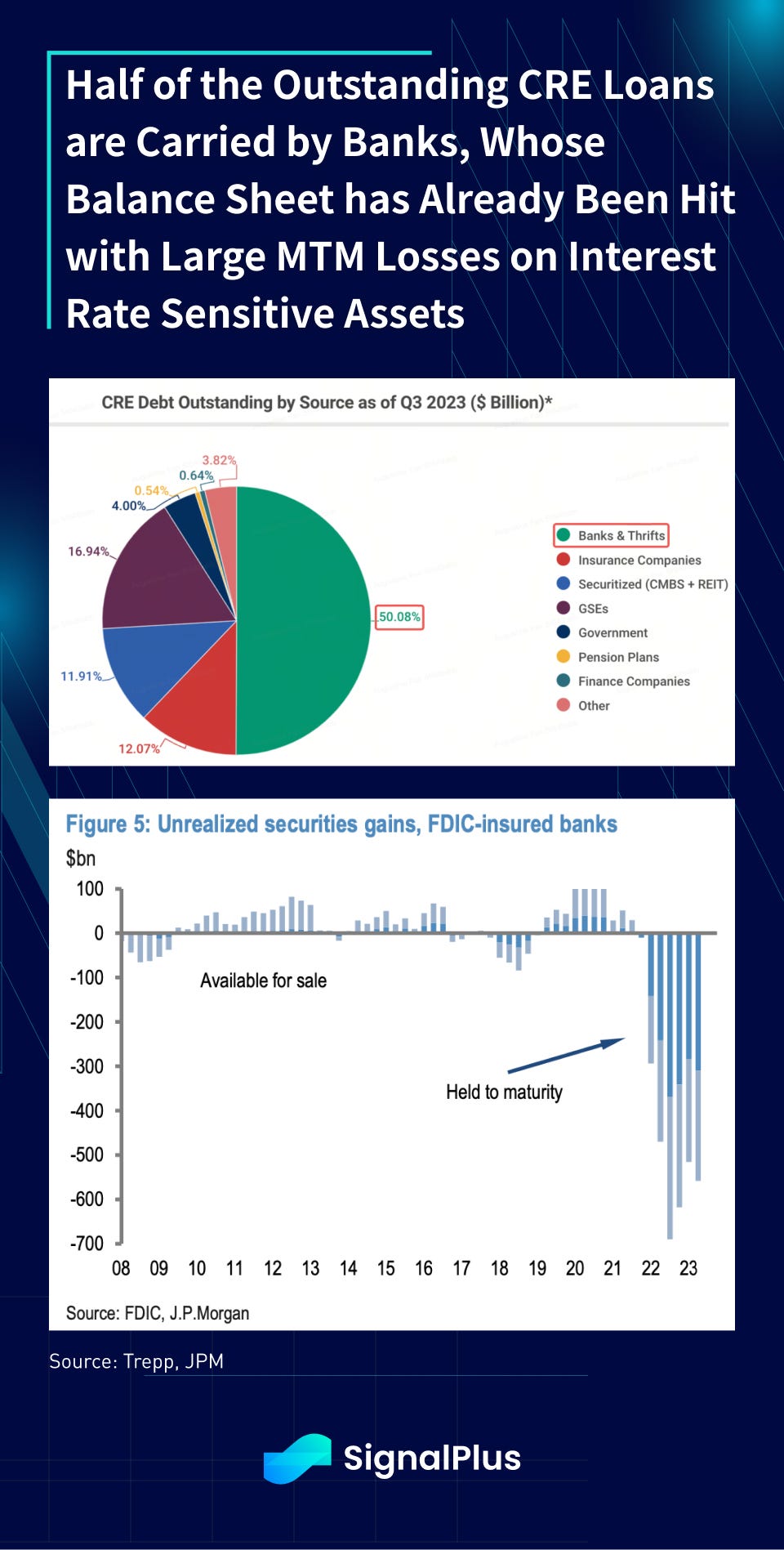

While the troubles in high-value, institutional-owned CRE assets might seem limited to professional investors only, the rate-tightening pain quickly spread into the regional banking system, including long-duration loan assets, threatening systemic spillover risks into the greater economy. ‘Held-to-maturity’ balance sheet positions saw massive NAV drawdowns as terminal discount rates jumped, paving the way for a sharp panic over the regional banking system, ultimately culminating in the rapid collapse and bailout of Silicon Valley Bank (SVB) in Q1/2023.

Surely, with inflation still running above trend, the US banking system threatening a Lehman-esque contagion, CRE and private equity sectors stuck in suspended animation, and a Fed that remains gung-ho on its inflation-fighting crusade, US risk markets should suffer, and equities should finally be due for a long-awaited reckoning, right?

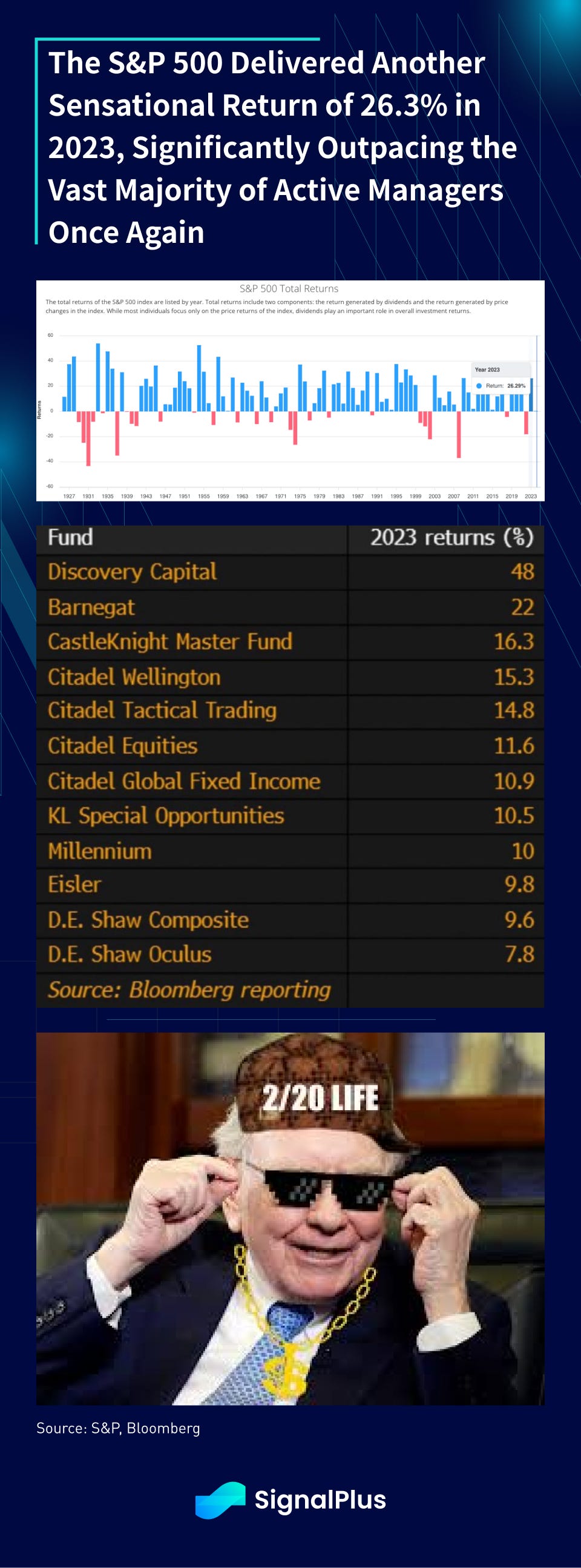

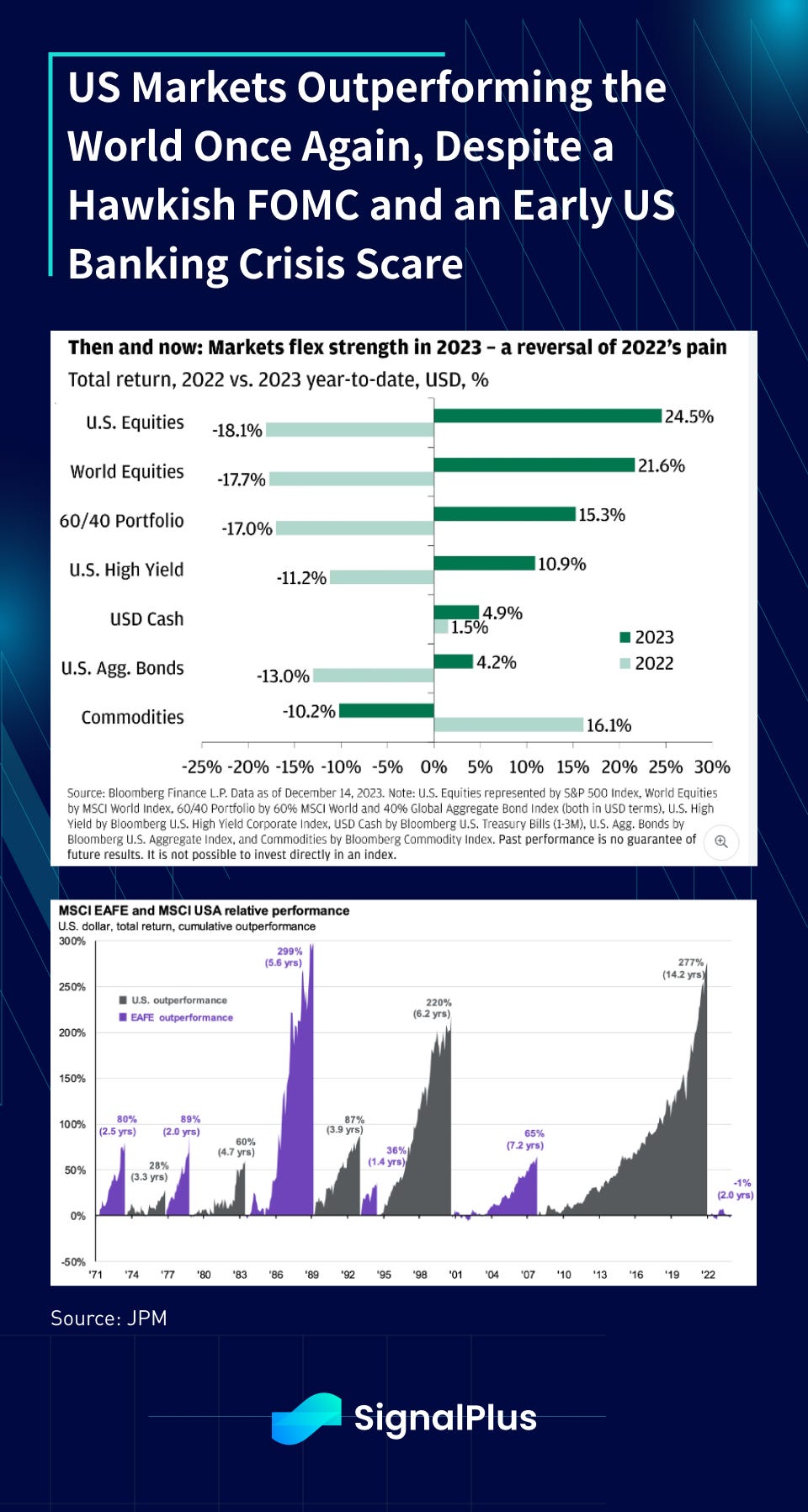

If you felt that way, the joke is on you. Instead, we saw the S&P return a remarkable 26.3% in 2023, the Nasdaq returning a whooping 54%, 10yr yields ending 2023 basically unchanged at 3.8% despite overnight rates spiking by +100bp. Active managers significantly underperforming indices again (what else is new), and US equities once again outperforming everyone else in the world.

In fact, things were so good that you didn’t need to be a crypto-degen to have had a great 2023, and could have basically thrown a dart blindly at the bingo-like board below and boasted a 10–15% return. Even cash gave 5% to the most cautious of investors. 2023 was a surely year for record books.

How Did 2023 End Up to be Such a Strong Year?

1.Investors were Under-Invested after a Rough 2022

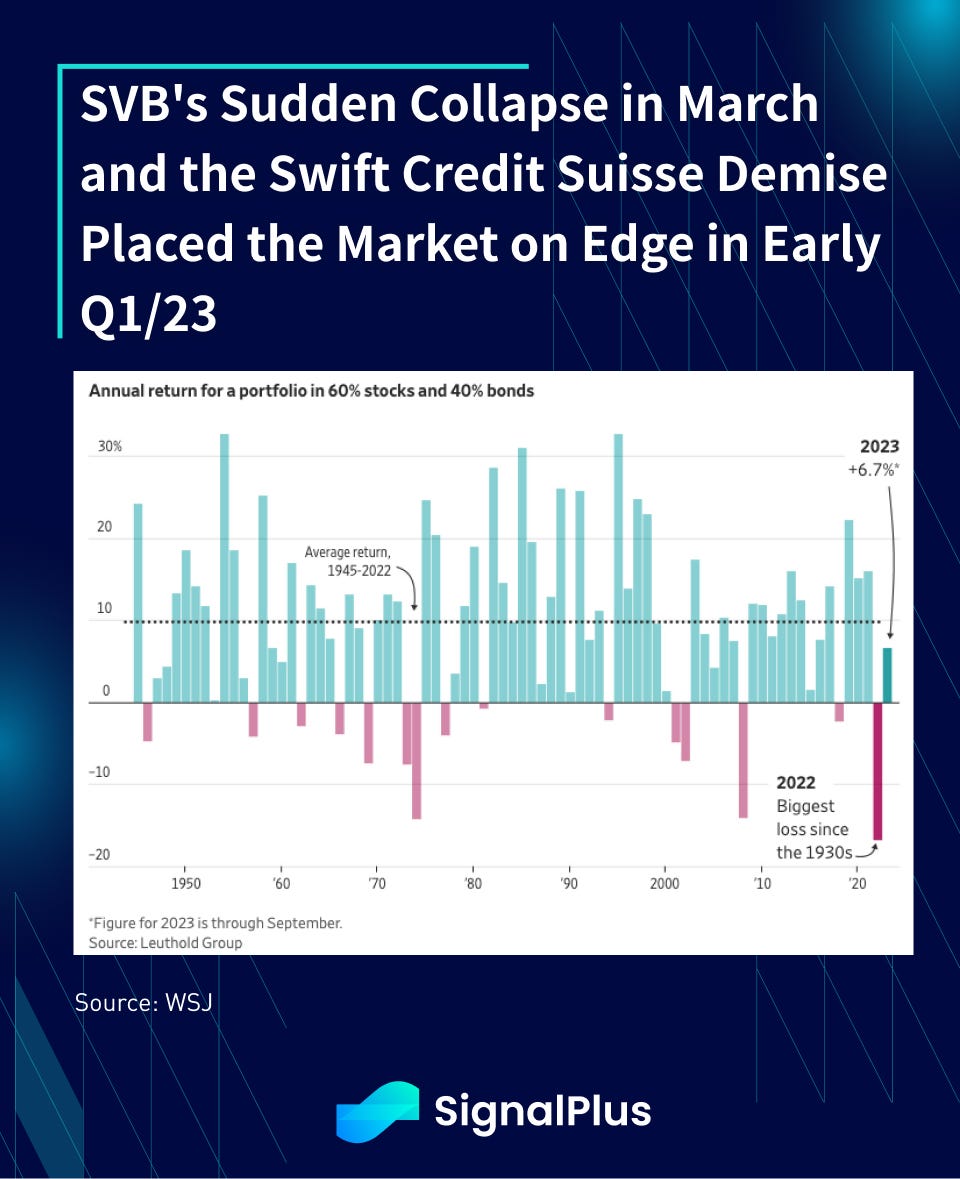

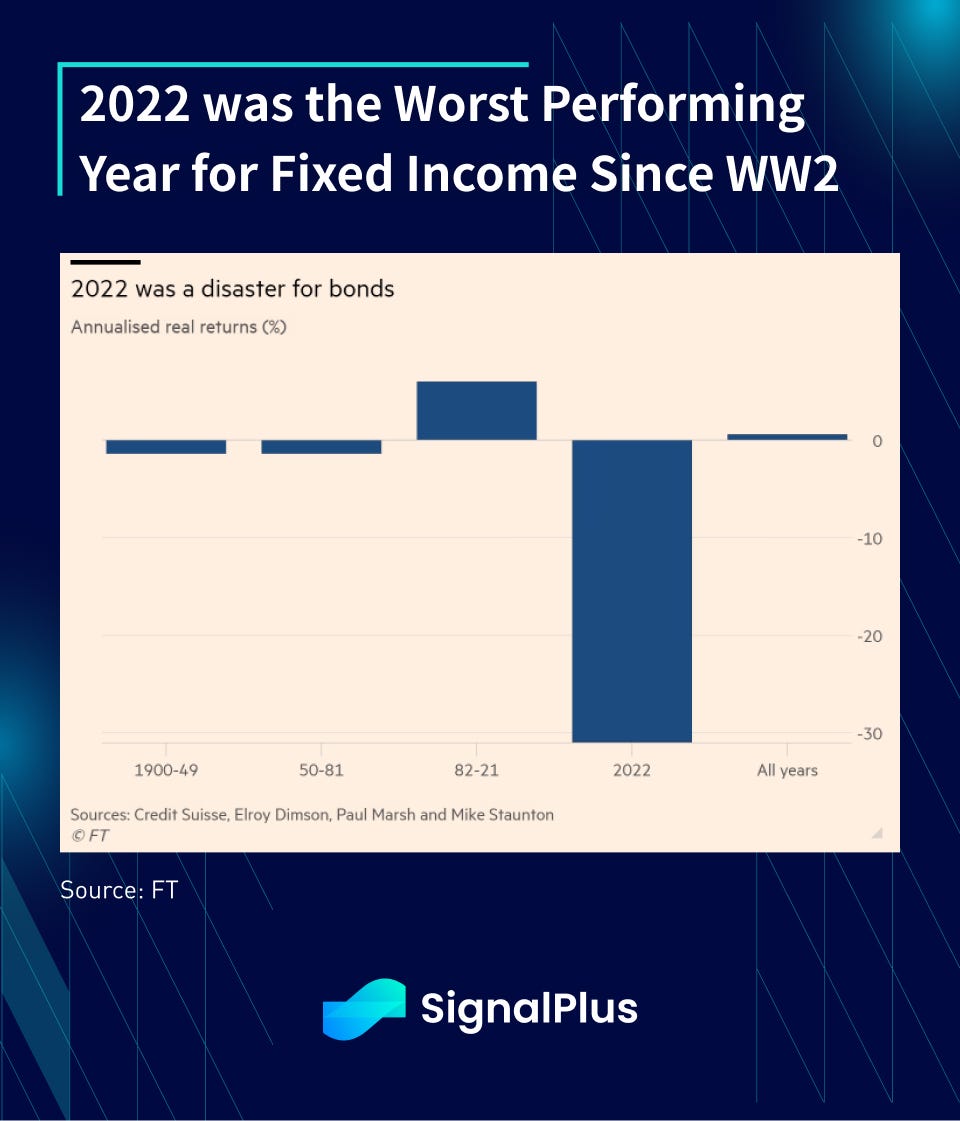

Fresh off record losses for the conventional 60/40 portfolio in 2022, investors understandably started 2023 with ‘paper hands’, and were generally negatively biased in their macro outlooks. Risk exposures were low to start the year, and animal spirits were non-existent across the board.

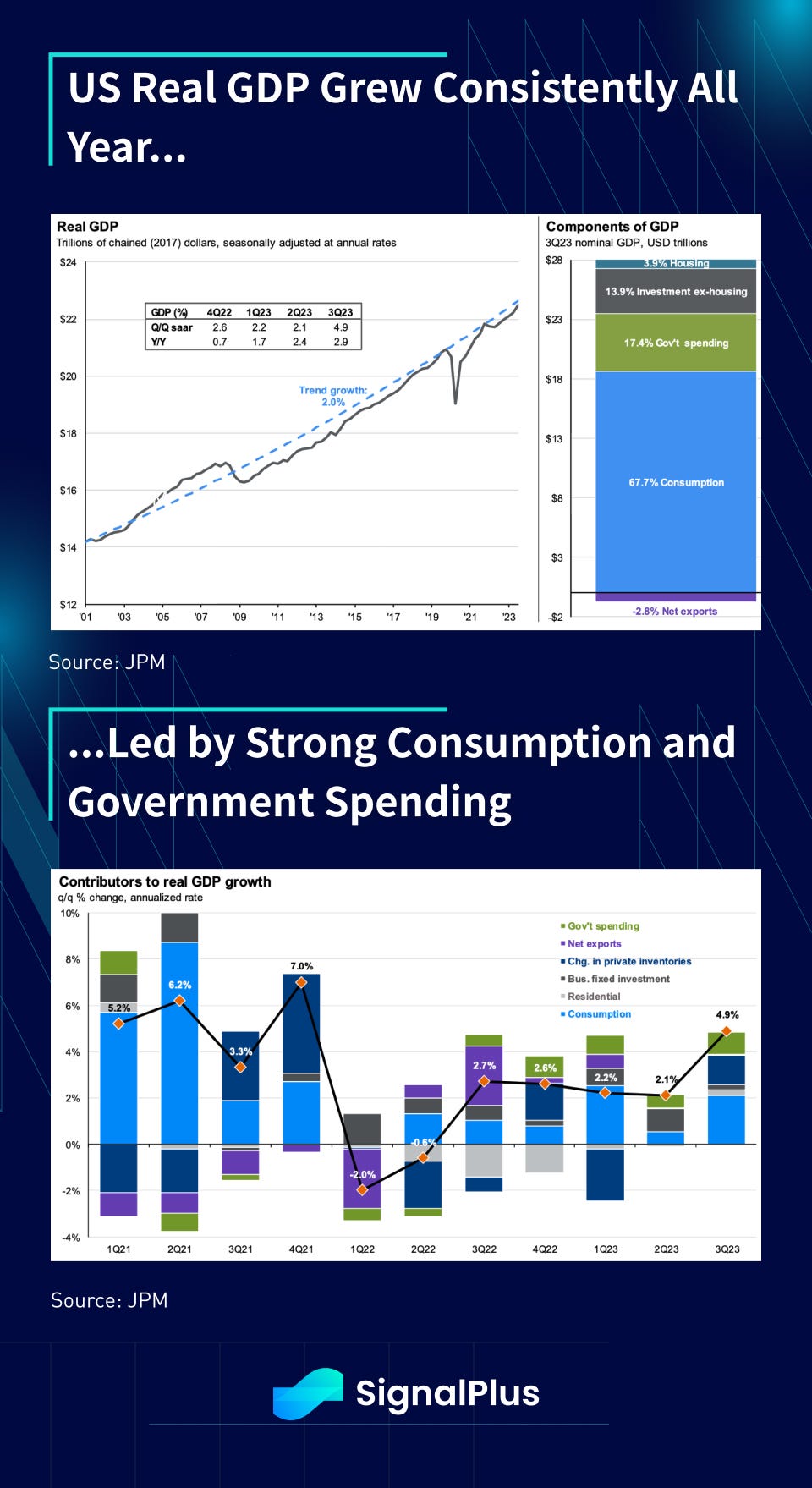

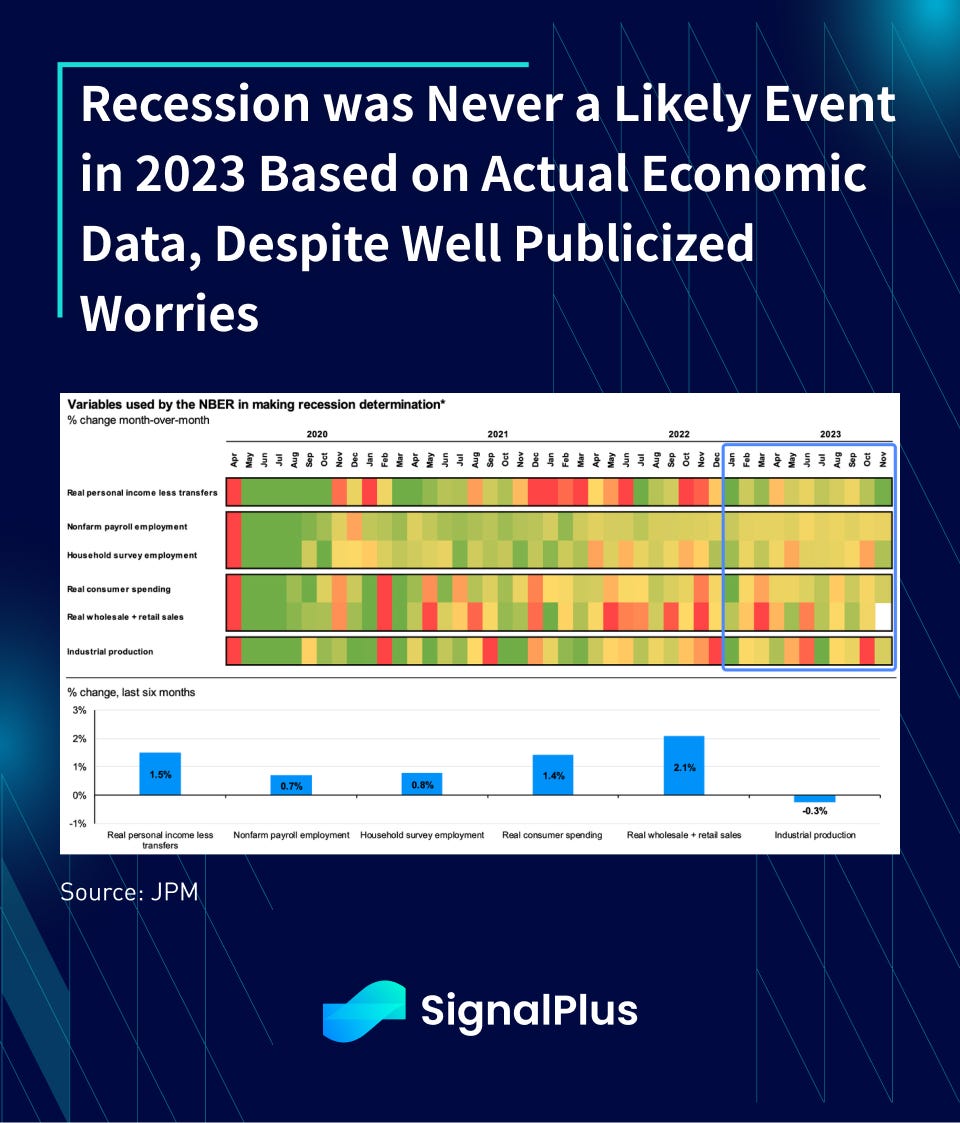

2.The US Economy was Never Close to a Recession

Despite the repeated bearing preachings of a global slowdown, and endless references to the inverted yield curve as a ‘guaranteed’ signal for an incoming recession (our readers would have known better), the US economy never even came close to a recession, with consumption leading the way higher all year.

3.Glass Half Empty

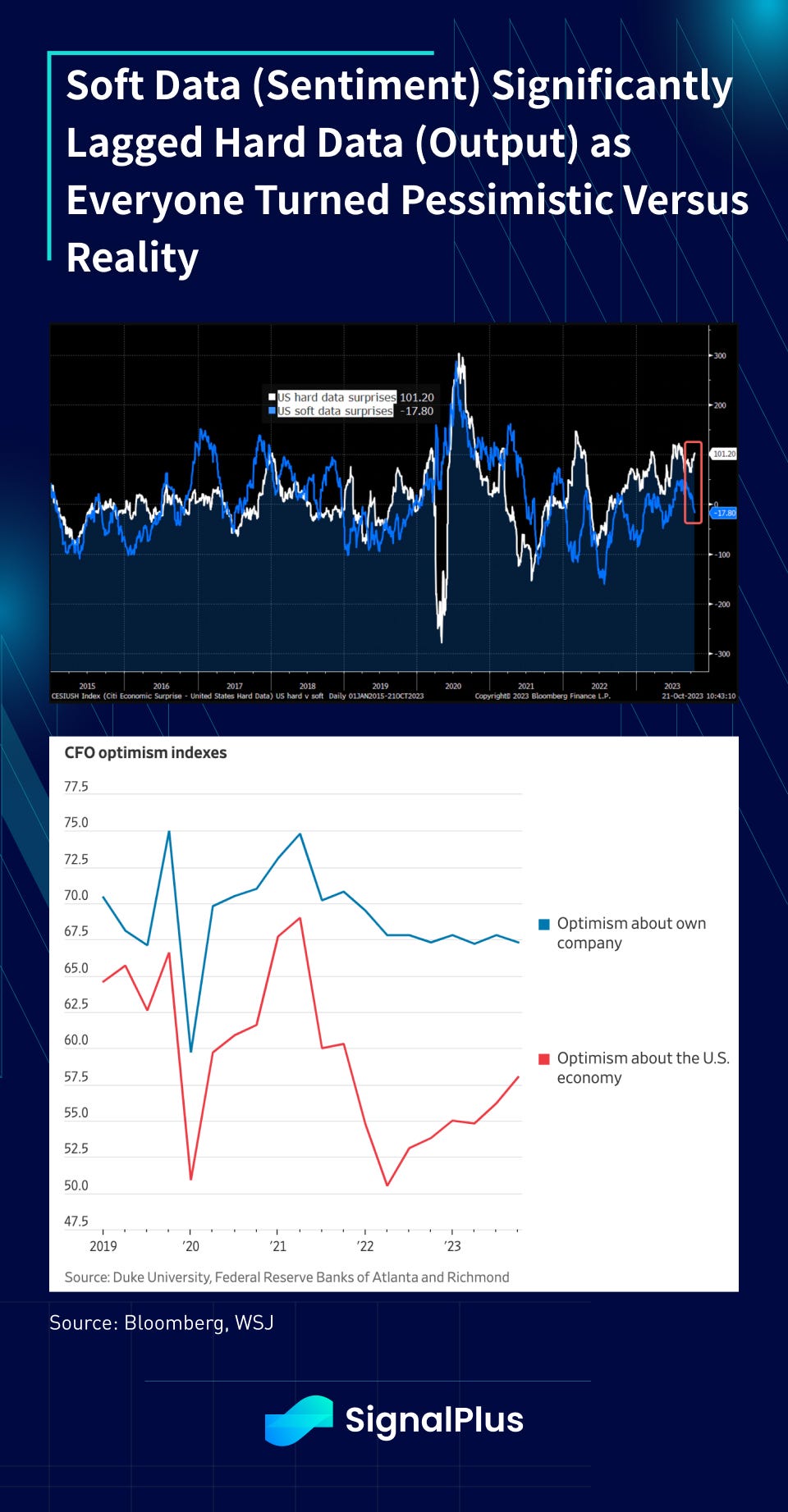

Despite economic data that suggested otherwise, investors chose to remain in the ‘glass half empty’ camp with soft data sentiment surveys consistently underperforming hard data outputs — all year — as if being a contrarian-bear represented some macro badge of honour.

Granted, there are always good reasons to be cautious, but we should generally remember that developed economies and professionally-run businesses are often self-correcting, and humans are usually decent at learning from our mistakes. There’s a reason why macro observers rarely become business builders.

4. The Teflon US Consumer

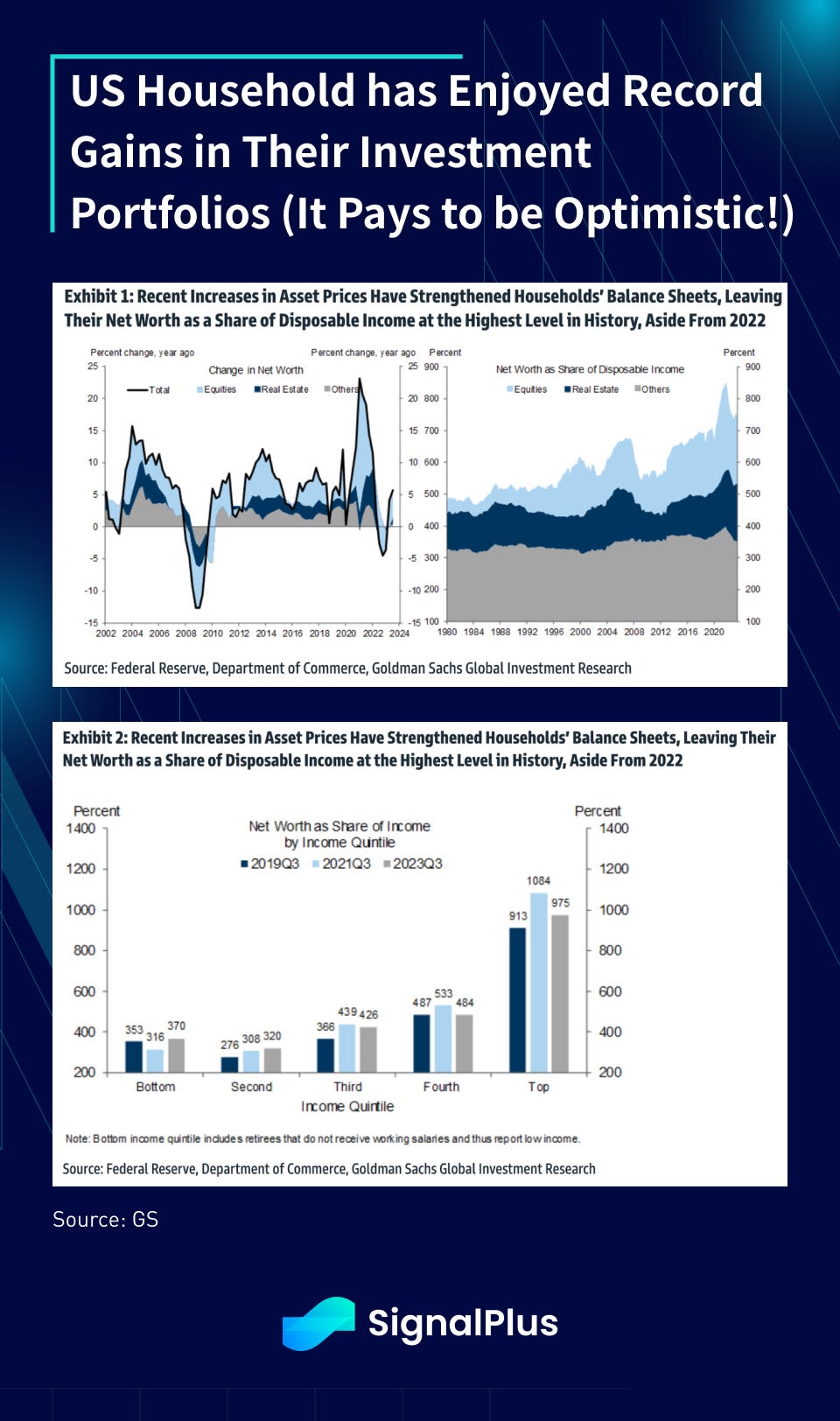

For what seemed like the longest time, I have always been told that the US consumer is persistently over consuming and the situation is untenable. Yet, in 2023, US households’ net wealth (inclusive of debt) remains close to record highs, continuing a 40-year ascension barely skipping a beat.

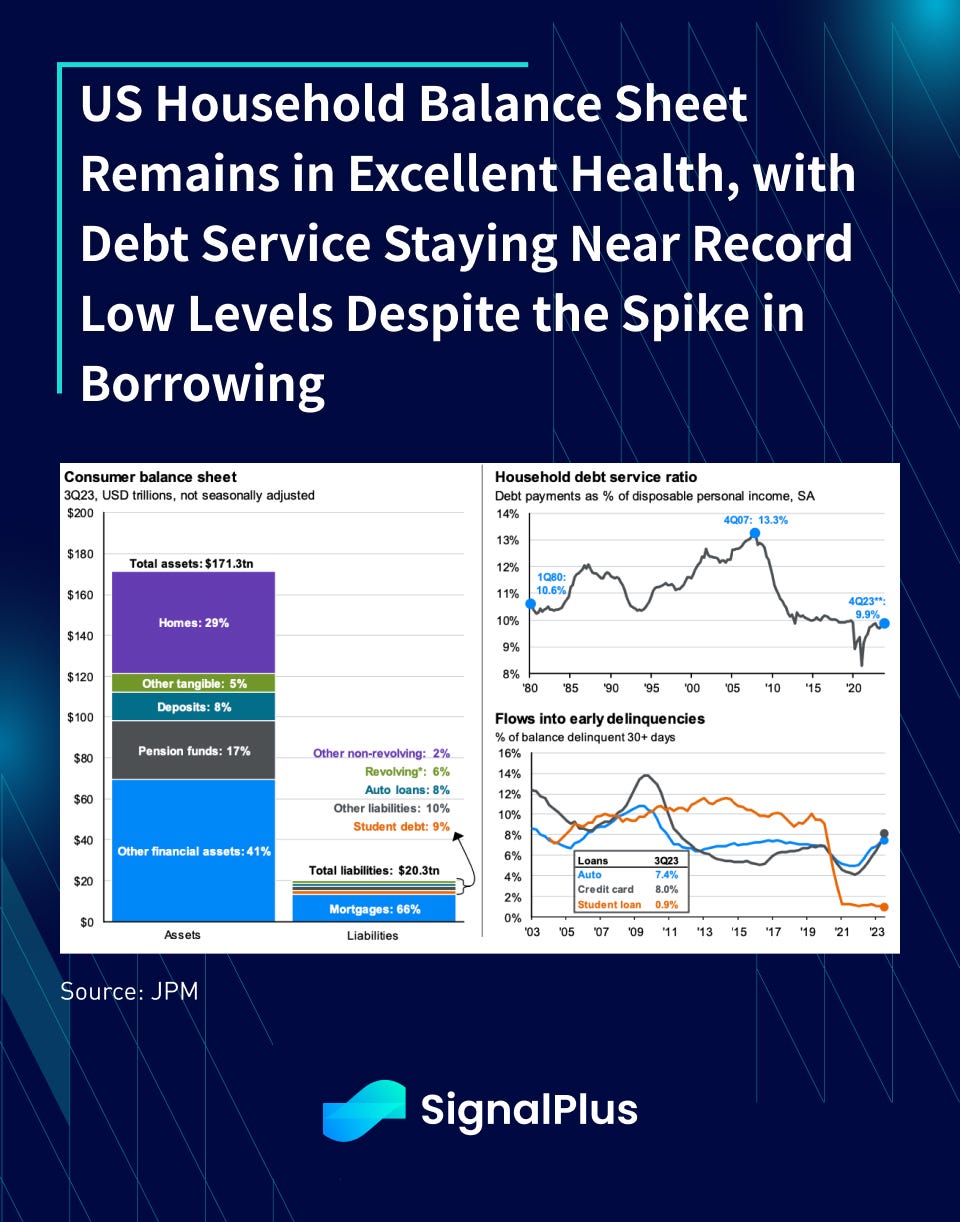

While the absolute debt level of consumers has risen, they pale to the dramatic rise in home values, stock investments, pension holdings, and other financial investments as a collective, with US consumer’s balance sheet sitting at $171 trillion versus liabilities of merely $20 trillion in Q3/23. Furthermore, 66% of the liabilities are in home mortgages, which is probably the “right” debt one wants to carry versus pure consumption-based borrowing.

Even more impressively, despite a rapid rise in borrowing costs that have led to well publicized troubles in regional banks (SVB), commercial real estate, RE funds (Blackstone investor redemption gates), and Chinese developer defaults (Evergrande), the US consumer has, ironically, been a bastion of stability, with their debt service ratio stable at 40 year lows (10%), and household debt to GDP the lowest it’s been in many decades.

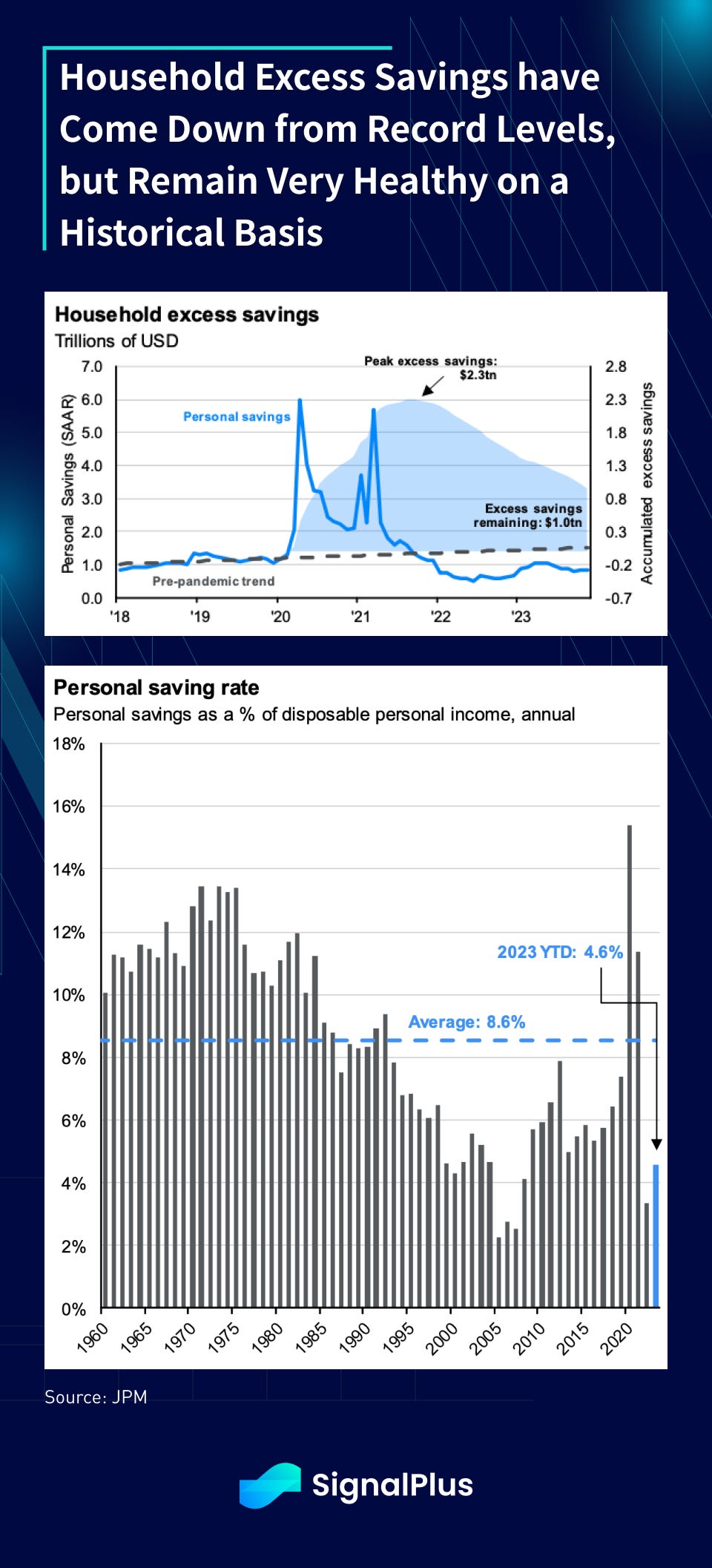

Now, while households’ excess savings rate and balance sheet (a whopping $2.3 trillion at the peak) have declined from the pandemic highs, they remain very healthy by historical standards, and much of the drawdown has been used to pay off debt, make equity investments, and fuel retail spending.

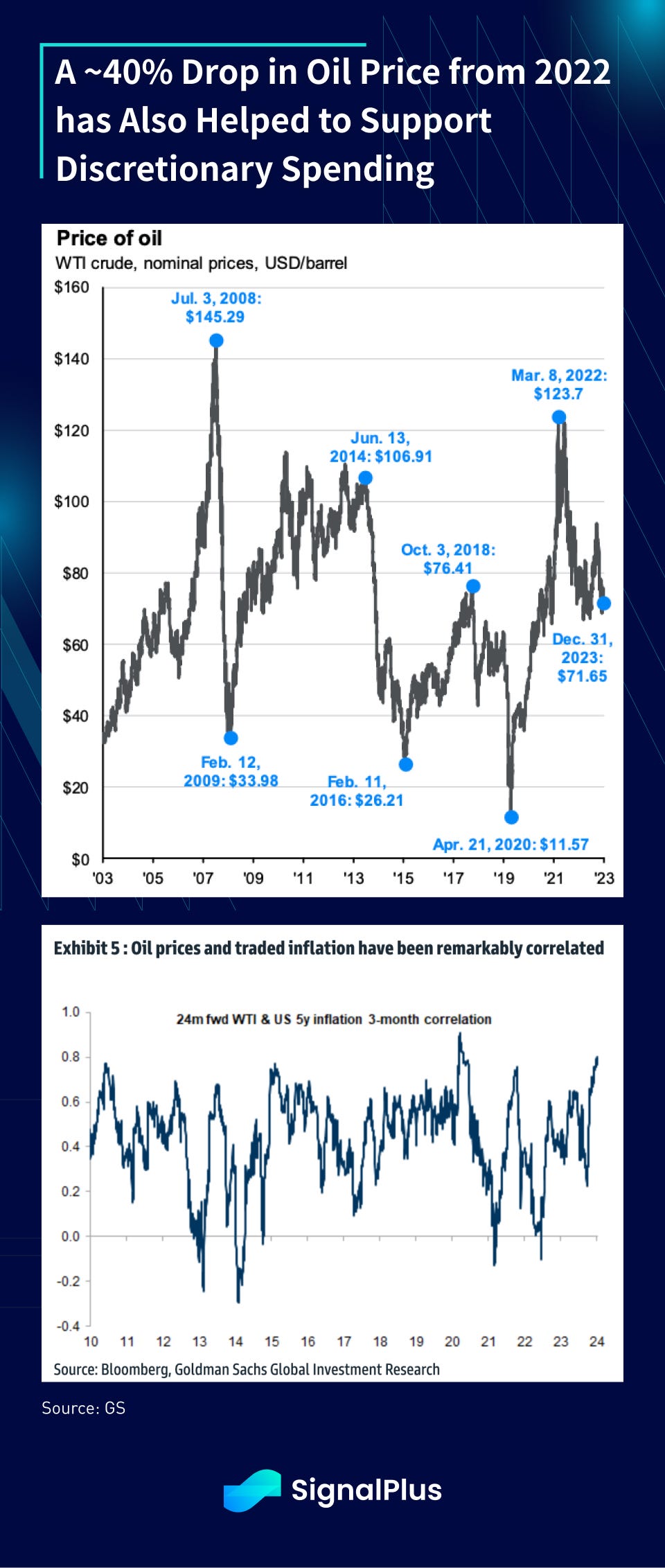

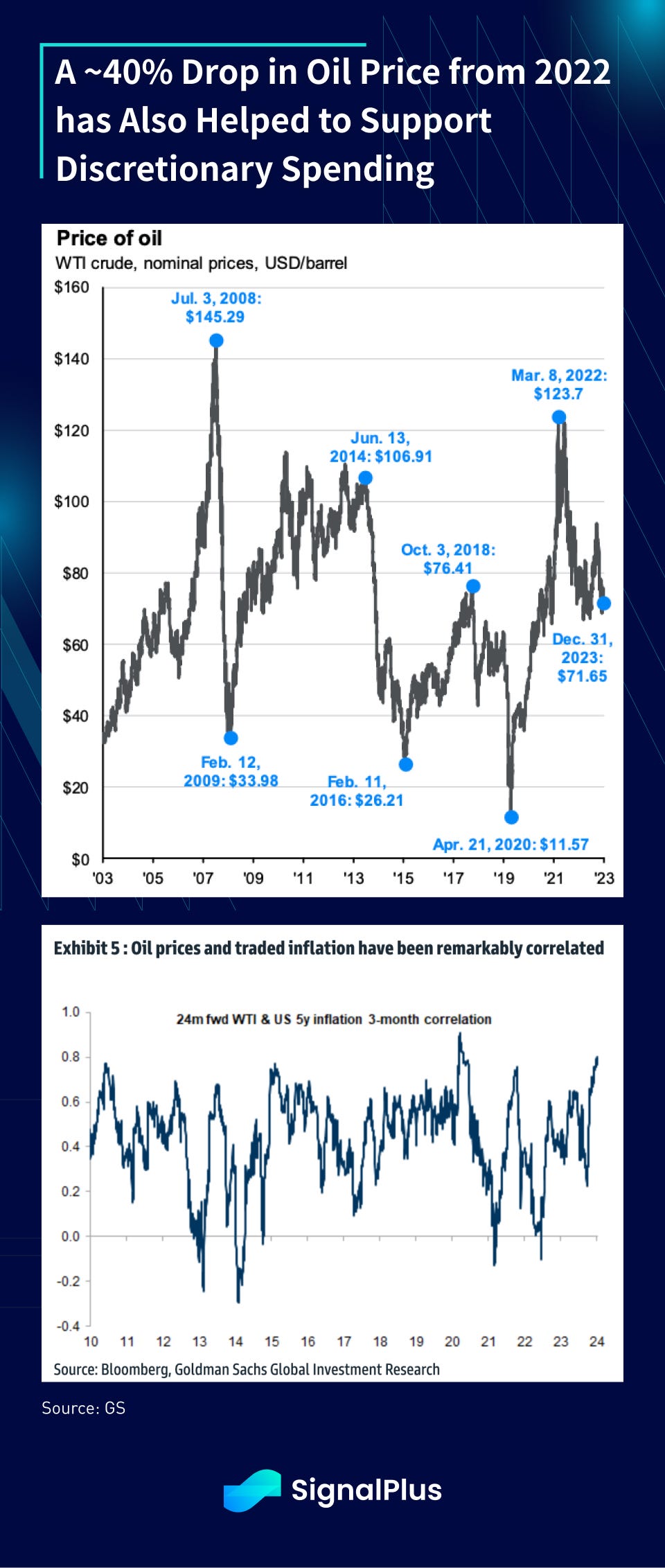

Furthermore, a ~40% drop in WTI crude from the March 2022 peak gave consumers yet another powerful boost to their spending budget, with oil prices retaining their elevated correlation to inflation expectations.

5. Help Wanted!

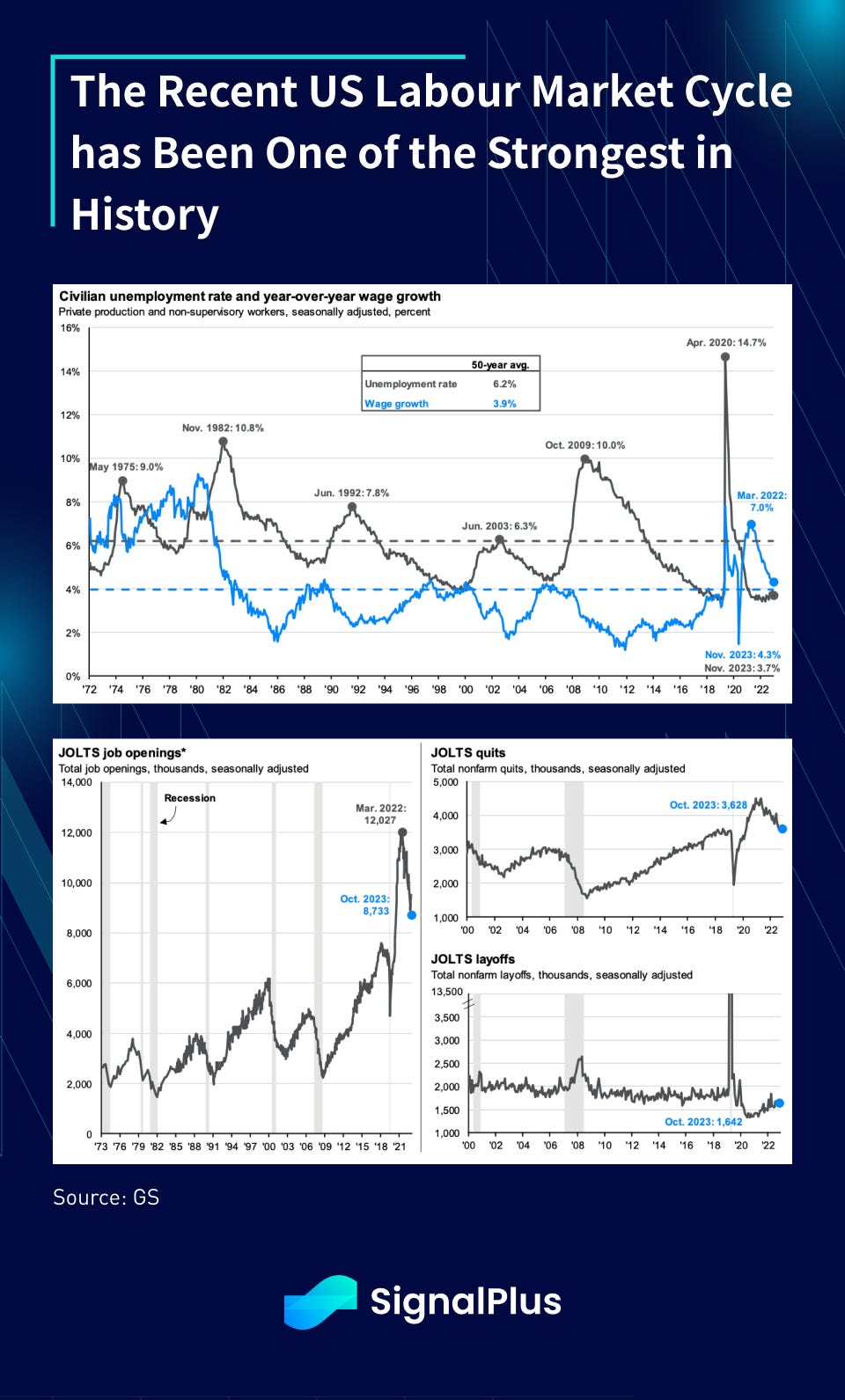

As you no doubt have heard, the current US labour market has been one of the strongest cycles in history, with record low layoffs, elevated job openings, and wage growth trending at 40-year highs and well above GDP. A number of labour unions (e.g UAW) secured high-profile and record concessions in their labour disputes, as wage workers continue to gain bargaining power through this growth cycle.

Simply put, things haven’t been this good for US wage earners in a long time, translating to strong spending and resilient confidence.

6. US Housing Returns to Up-Only Mode

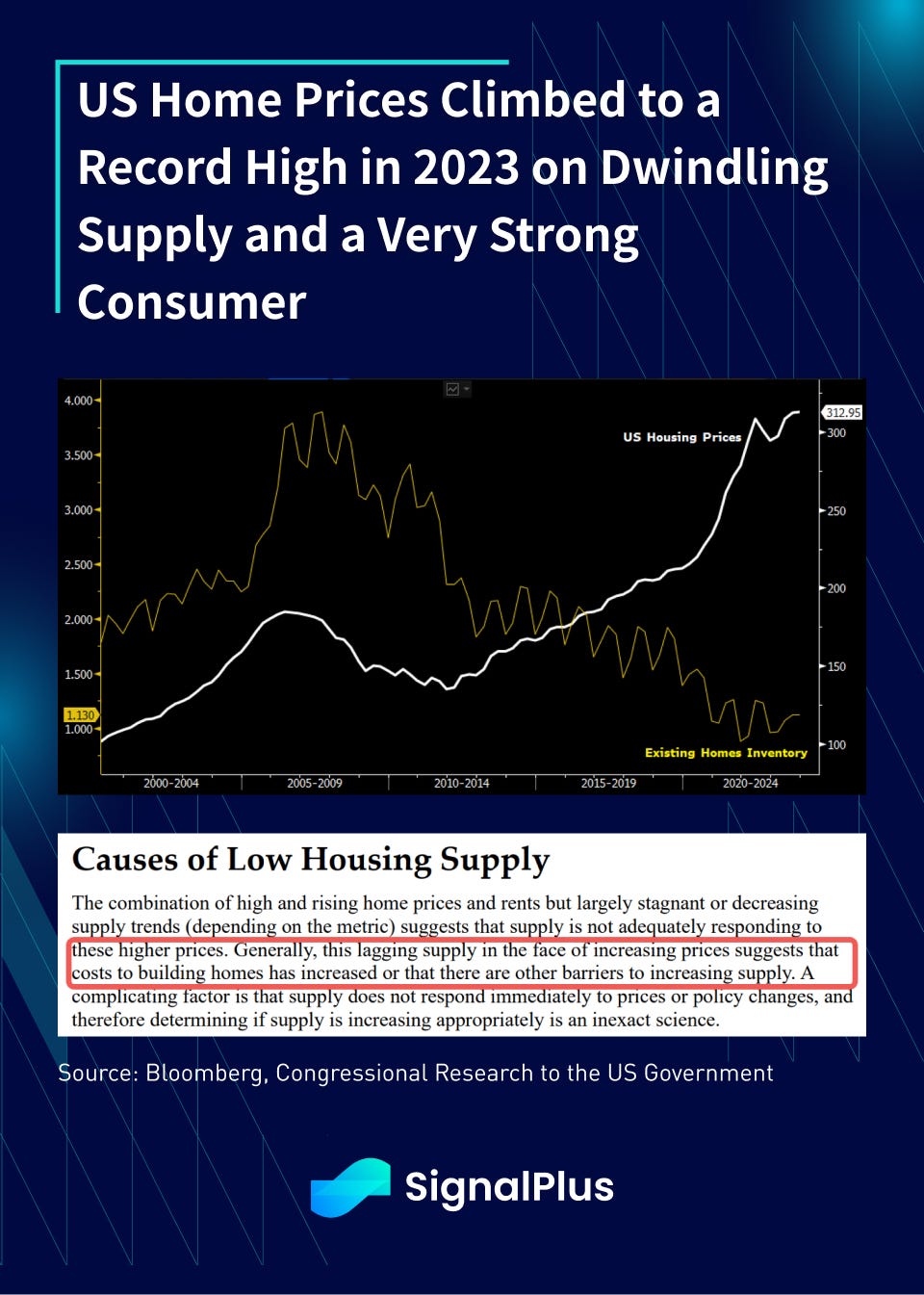

Normally, with mortgage borrowing costs spiking from a low of ~3% to nearly 8%(!!!) in the course of just 2 years, you would assume to see collapsing housing prices, a tsunami of negative home equity values and rising housing foreclosures.

However, as we are in anything but a normal economic cycle, housing prices have risen throughout 2023, and printed record highs at year-end as homes for-sale inventory dwindled to 20 year lows. A combination of a strong economy, an excellent labour market, healthy inward immigration, and sky-rocketing construction costs have contributed to the anemic supply of homes for sale.

Interest rates might affect overly-leveraged borrowers and home prices in the short-run, but hard asset prices are ultimately driven off supply and demand fundamentals in the long-run.

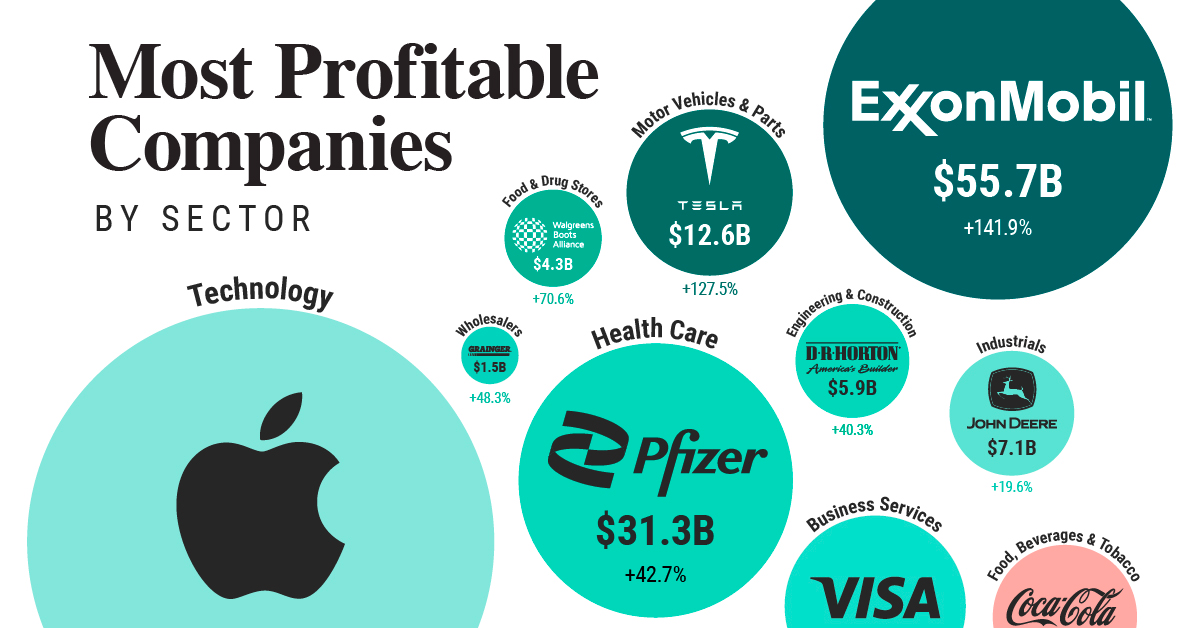

7. The Biggest Companies Can’t Stop Making Money

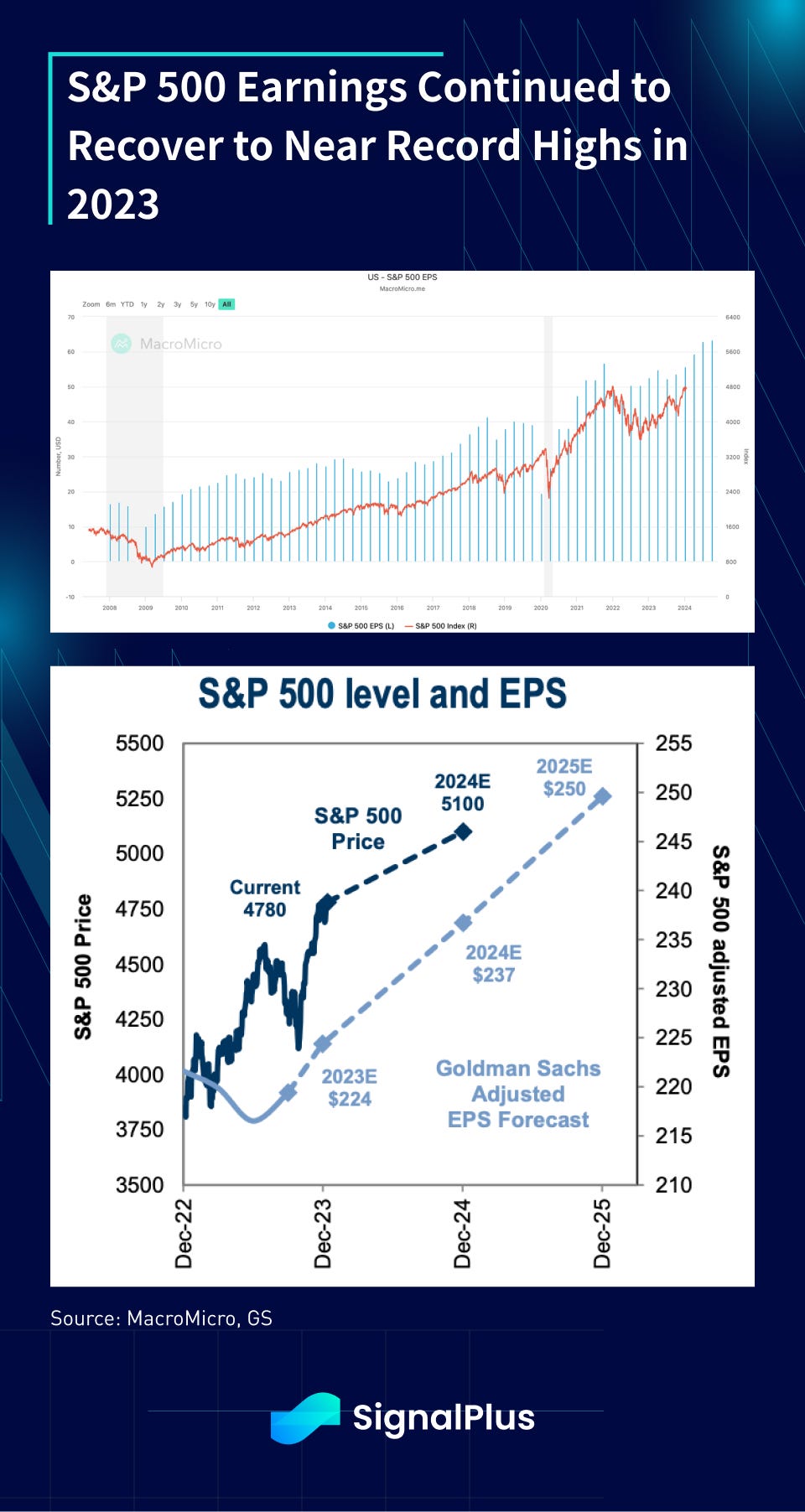

S&P 500 EPS continued to rebound in 2023, ending the year back close to record highs just after the pandemic. EPS growth was up 0.4% vs 2022, an impressive feat given the high watermark and the massive withdrawal of central bank liquidity worldwide.

In addition, profit margins remained near 20 year highs at 12%, substantially above the 9% average over the past two decades, as companies found ways to pass on higher input costs to consumers without affecting turnover. Yet another example of resourceful management finding ways to adapt to tough macro headwinds.

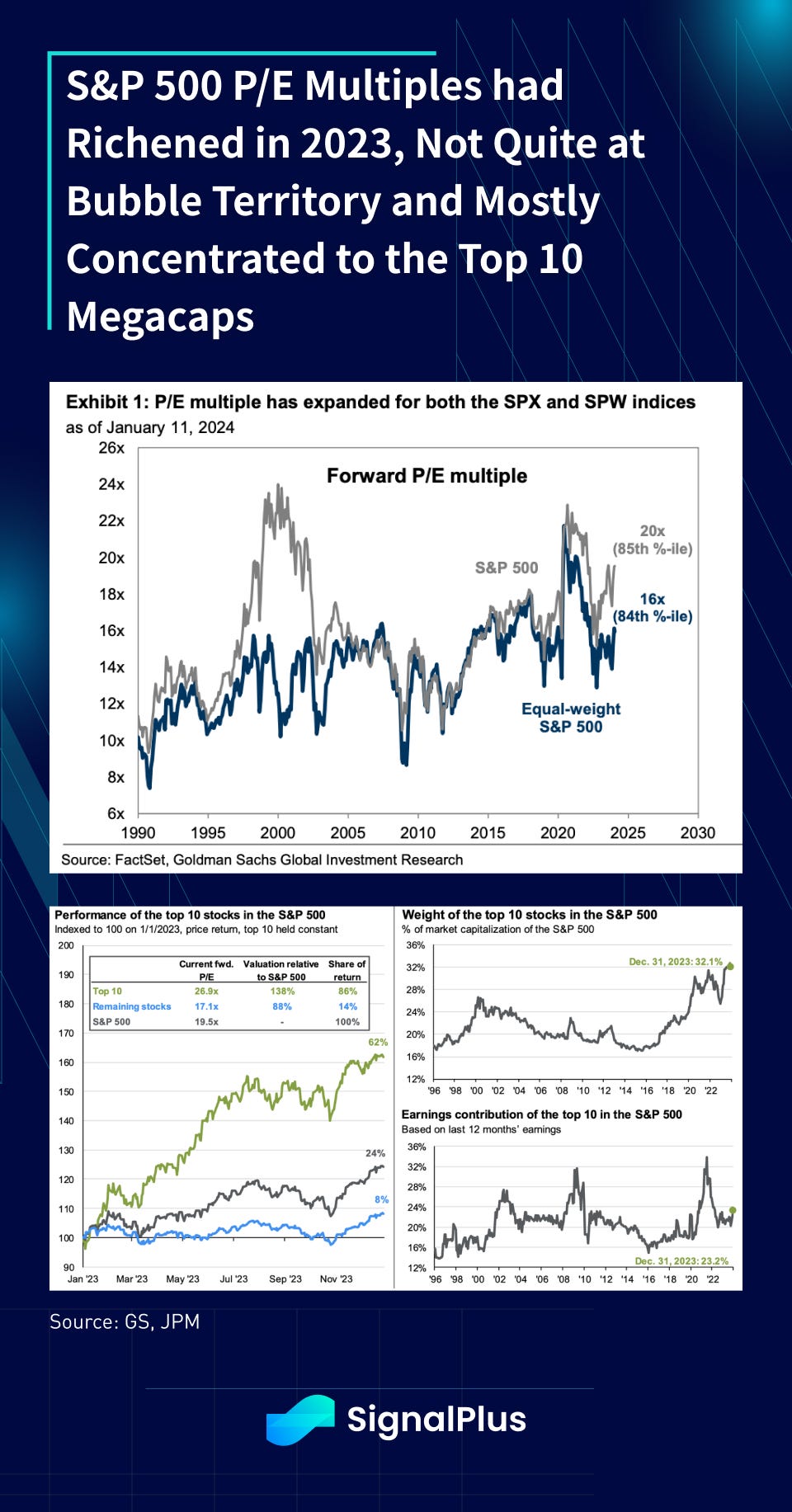

SPX P/E multiples had richened, but not quite to extreme levels and largely concentrated to the top megacap names (the ‘magnificient 7’). Furthermore, valuation never quite got so stretched to be ‘bubble-like’, with 2023’s intra-year sell-off of -10% much more benign than the average of the past 40 years.

8. The Fed’s Newest Alphabet Soup

While we might all have our greivings with the Fed on how they have handled QE and ZIRP in the past, credit must be given where it’s due, as the Fed (and FDIC) were swift in providing a surgical response to the regional banking crisis, stopping the contagion risk dead in its tracks before anyone can say “Lehman 2.0”. Furthermore, the rescue plan was much less of a blanket bailout compared to previous iterations (ie. not-QE), with real losses imposed on equity shareholders (zero’ed out) and subordinated borrowers (eg. AT1s), costly borrowing use (OIS+10bp), designed with a primary mission of making depositors whole.

The BTFP program served its mission by quelling deposit-flight and stabilizing bank deposits, and is likely to be retired in March as emergency support is no longer needed. Usage of the facility has ballooned to record highs in recent months, as a drop in OIS funding has led to (yet) another exploitable arbitrage opportunity for banks.

In any case, this was a textbook case study of how a well designed rescue package should work, and it further shows how policymakers are constantly learning from past experience, just as US public market CEOs have done as we navigate the ever-changing macro landscape over time.

9. The Gen-AI Wealth Effect

While dinosaur macro observers (like myself) were fretting over borrowing costs and inflation, the arrival of Generative-AI almost made a mockery out of everything else we were worrying about. To quote some stats and charts from Accel’s annual Euroscape study:

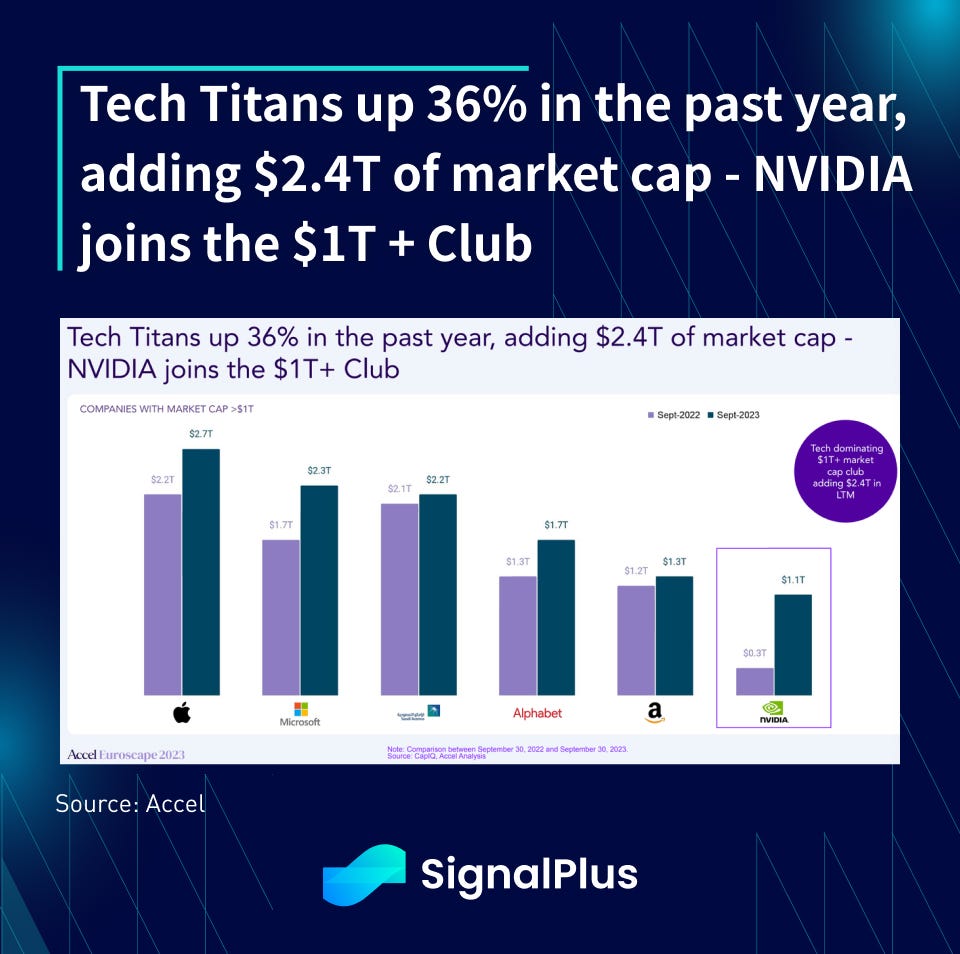

- Generative-AI added over $2 trillion in marketcap to US stocks in 2023, with Nvidia adding nearnly $1 trillion on its own due to chip demand. For those of us that are counting, Nvidia added nearly 70% of crypto’s total market cap all within the year.

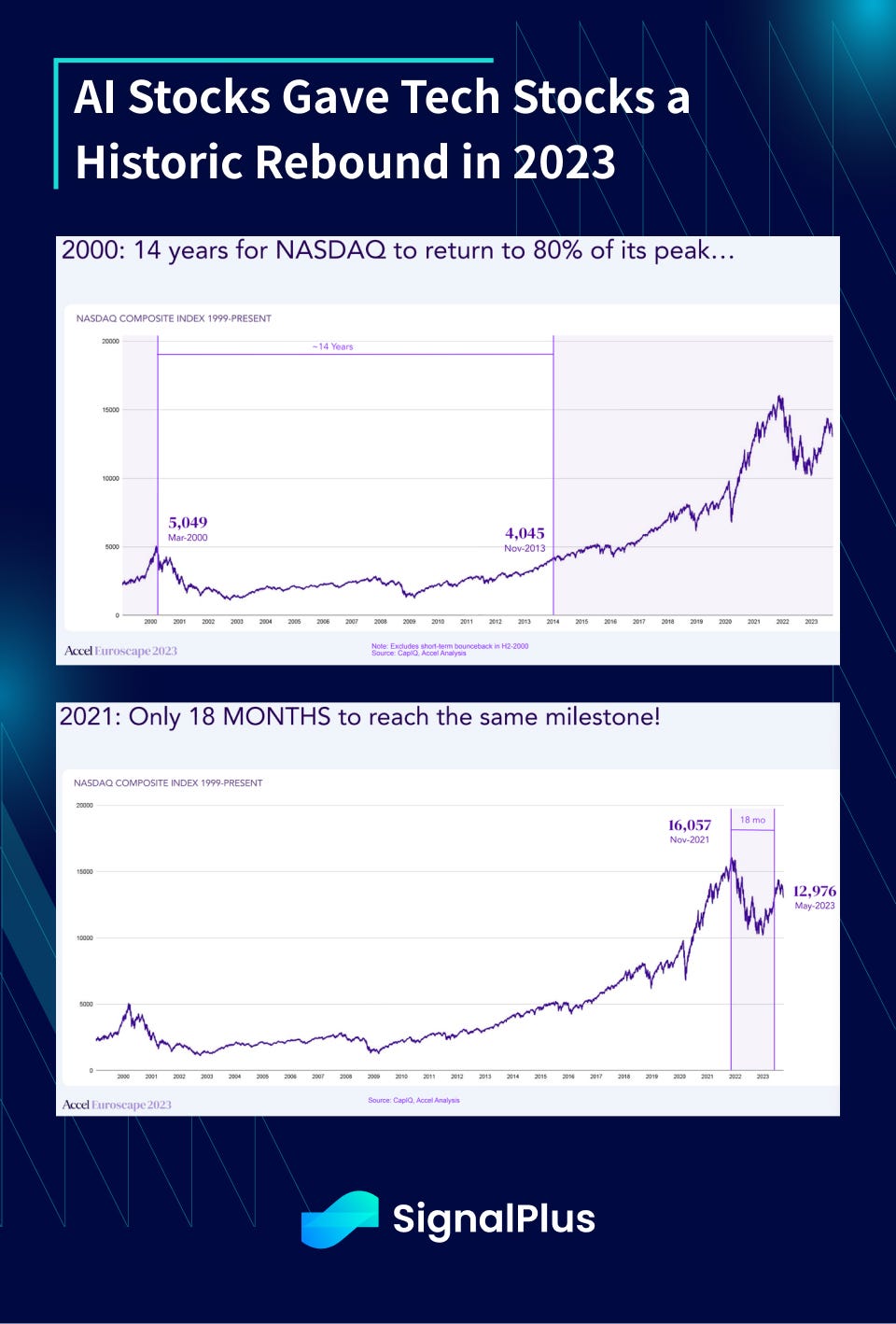

- It took a mere 18 months for the Nasdaq to recover 80% of its peak-losses from 2021, vs 14 YEARS in 2000.

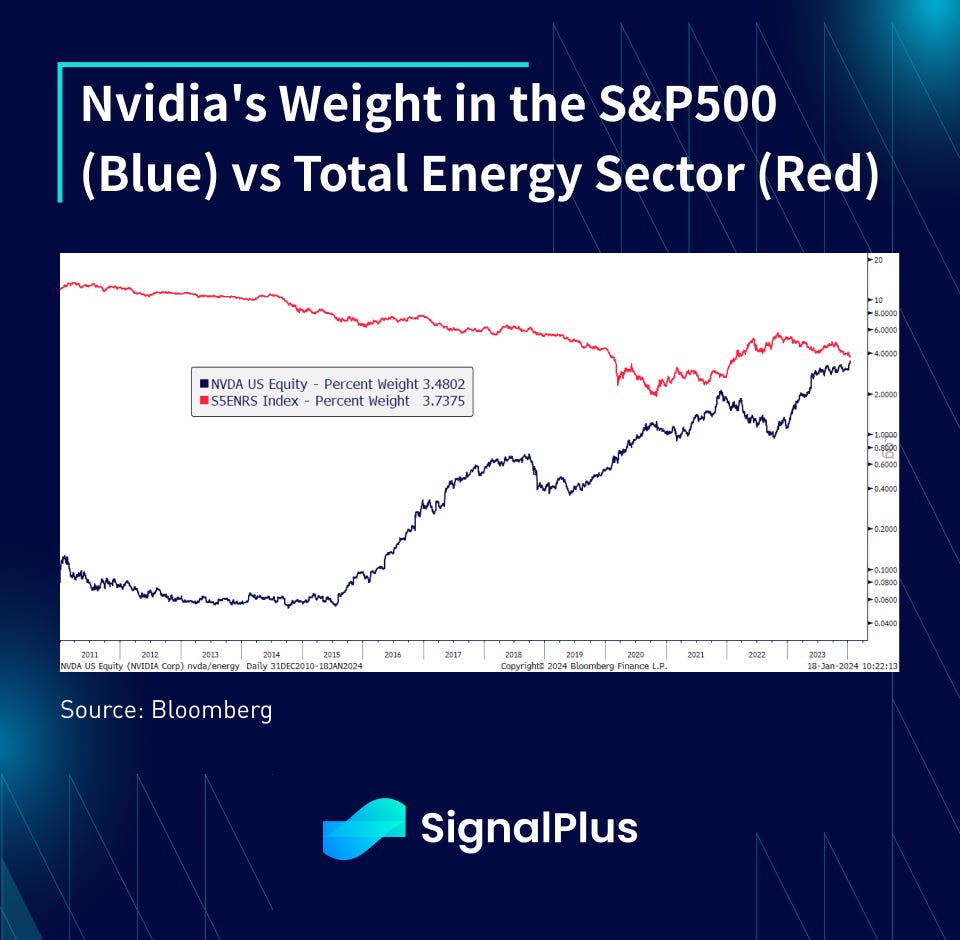

- Nvidia now has almost as large of a weight in the S&P500 index as the entire energy sector combined.

- Roughly 60% of all unicorns are now driven by Gen-AI related startups, growing at the expense of traditional SaaS and Cloud companies

In short, if QE, ZIRP, and easy money policy were responsible for driving wealth effects in the past decade, Gen-AI has taken the mantle of keeping the FOMO going, at least in the near-term. Furthermore, AI has the added benefit of distributing the FOMO wealth to a wider audience than crypto ever did, thus creating a higher ‘wealth-velocity’ multiplier in terms of its boost to the greater economy.

10. “The Pivot”

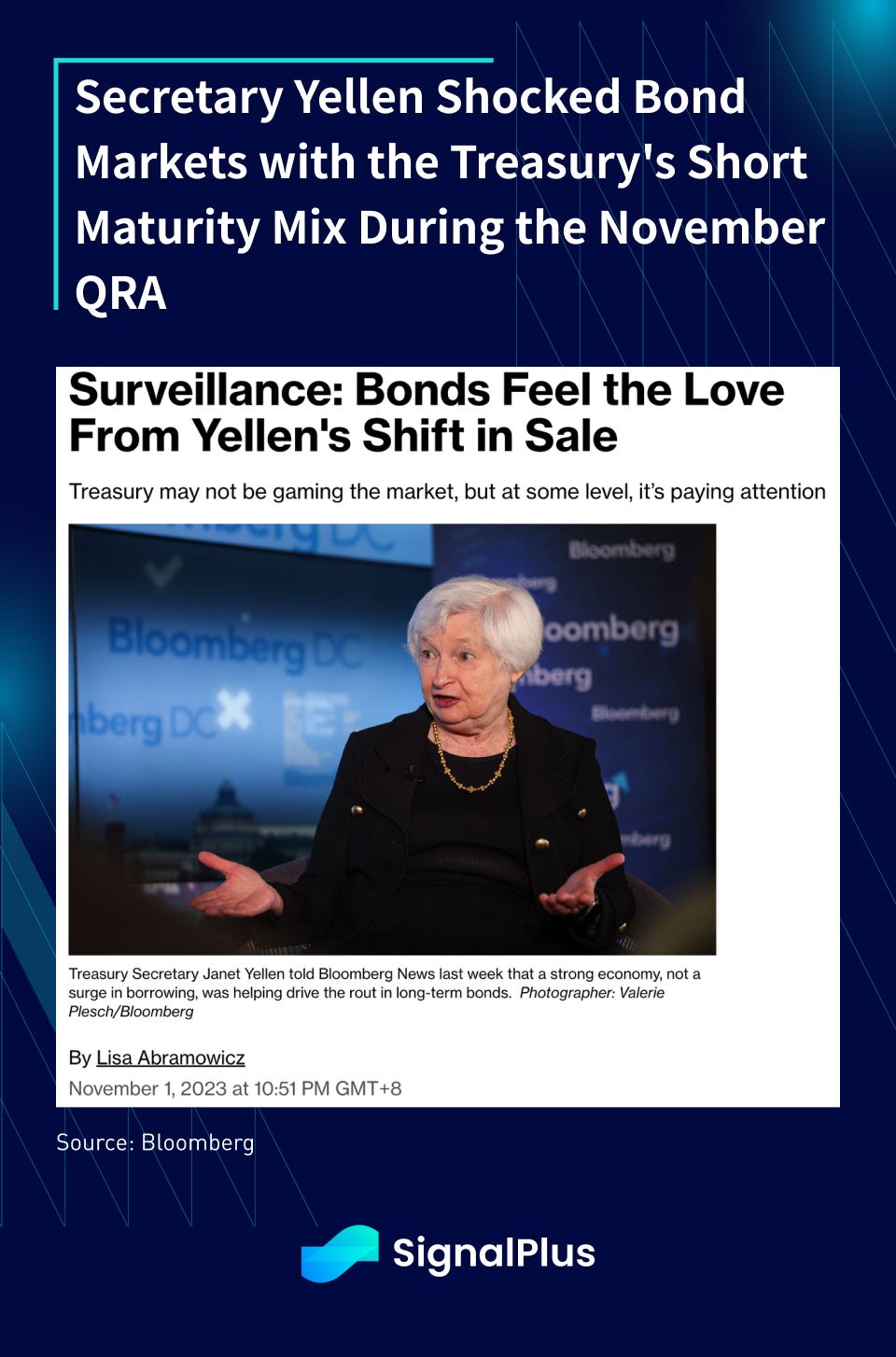

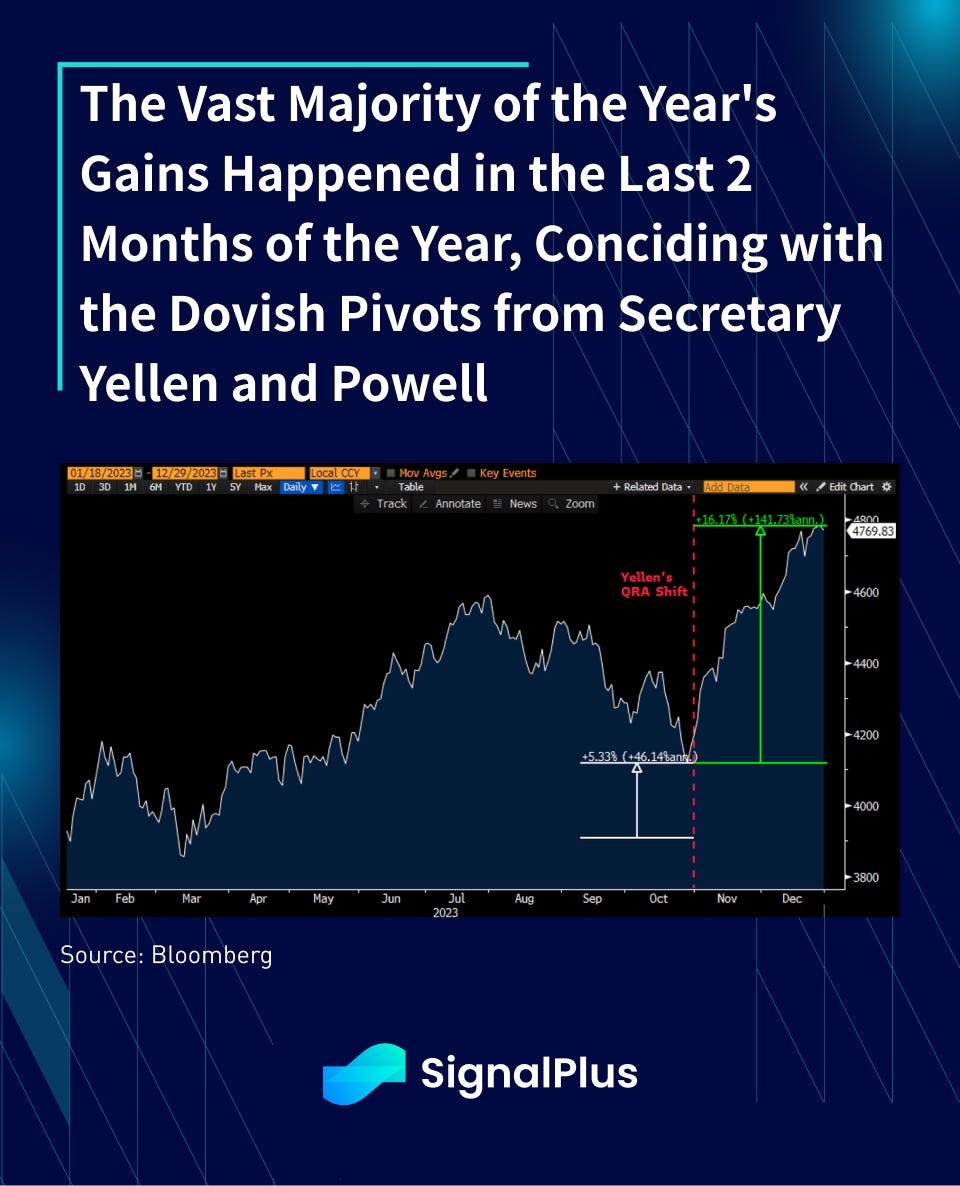

Of course, no macro conversation is complete without mentioning the Fed and the Treasury. After fighting tooth and nail with the markets on waiting for inflation to return to 2%, there was a notable crack in the facade as Treasury Secretary Yellen and Fed Chair Powell gave a decisive 1–2 punch to signal that the tightening cycle is all but over.

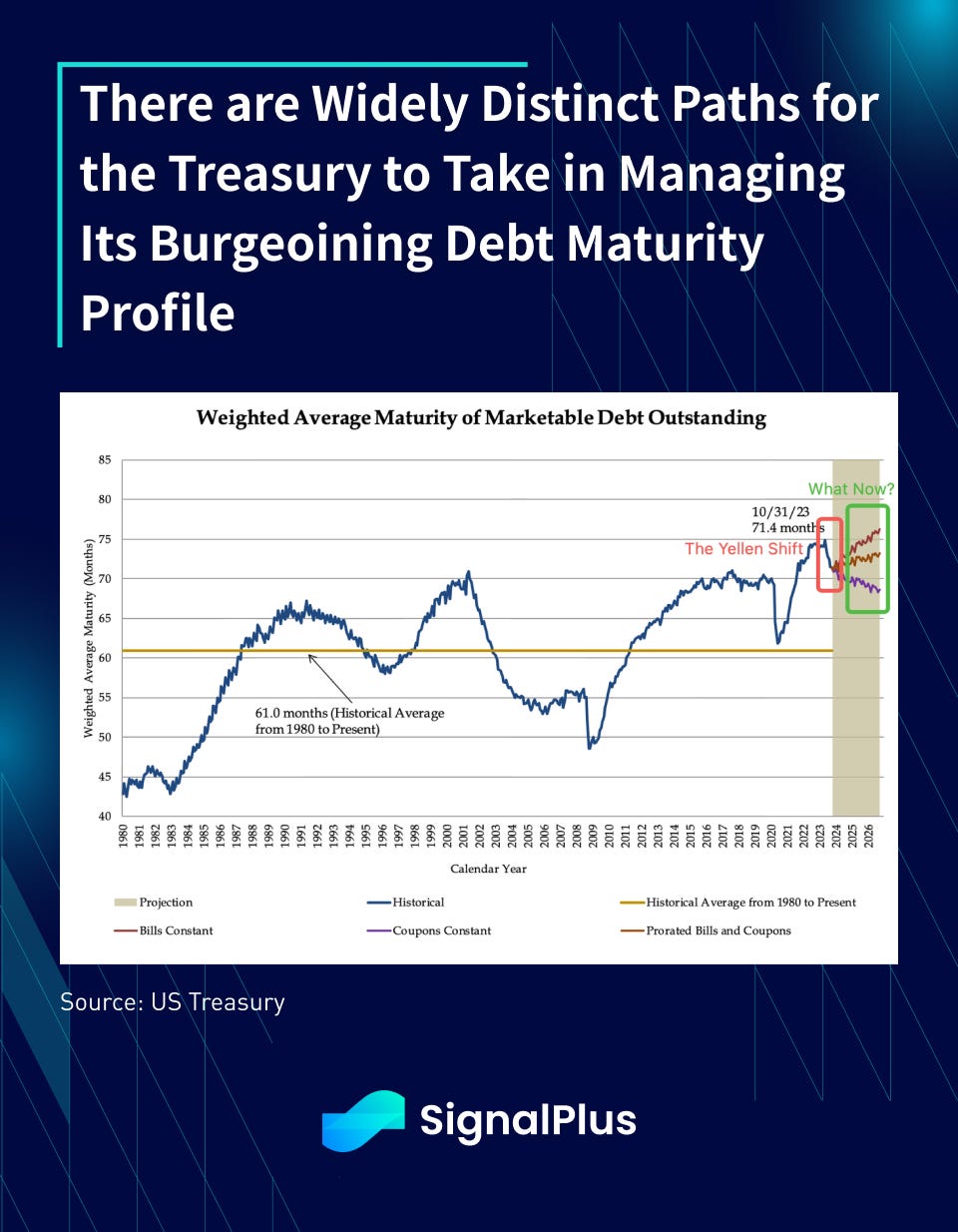

The opening salvo came in the November QRA (Quarterly Funding Announcement), when Yellen surprised investors by announcing that the Treasury had shortened the maturity profile of the Treasury’s Q4 debt sales. This was widely seen as a gesture from the treasury to alleviate supply pressure over the back-end of the yield curve, even though it would have been fundamentally wiser for the Treasury to lock-in lower funding rates with the heavily inverted yield curve.

Think of Yellen’s shift as a soft ‘yield curve control’ (YCC) or ‘operation twist’ — for those of you that were around from the previous cycles.

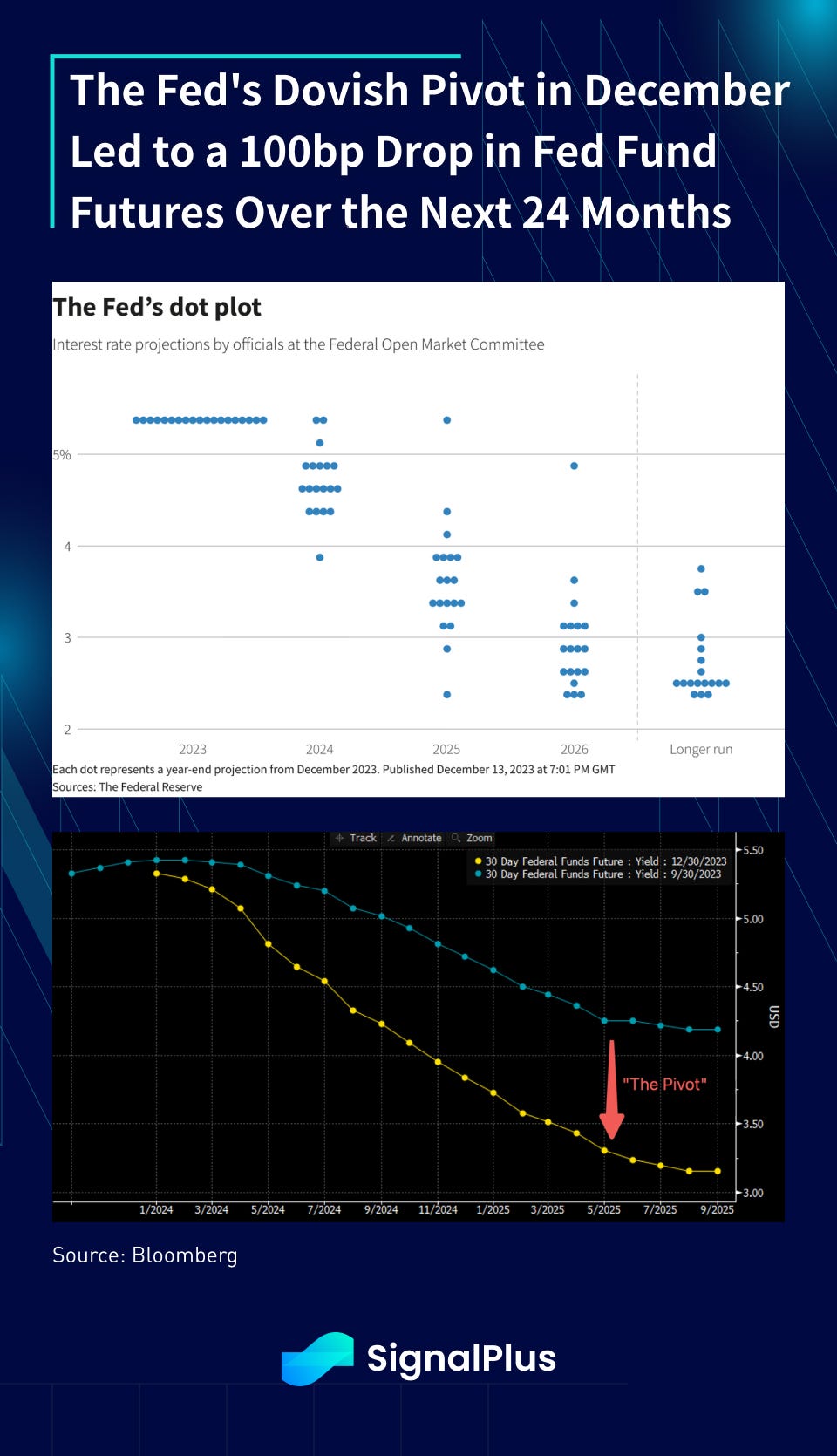

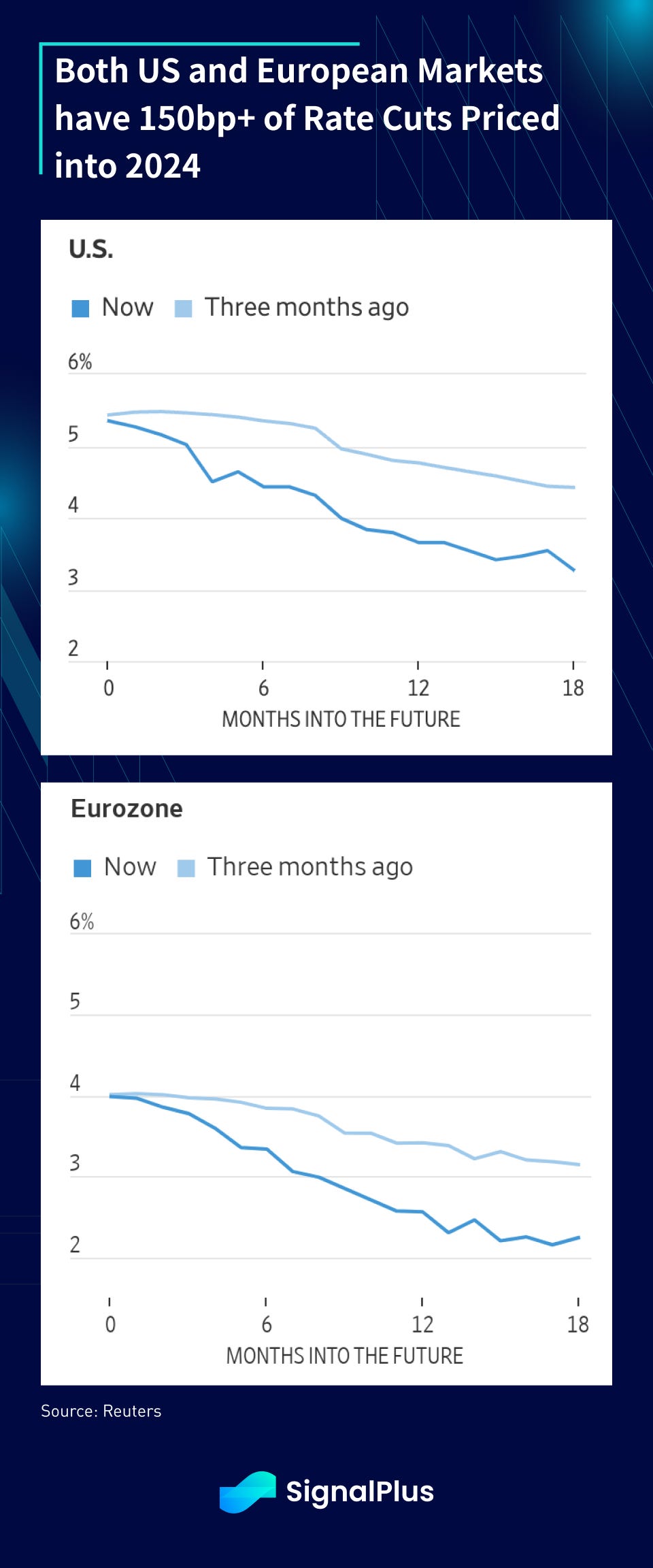

Not long after, Powell followed suit with the Fed’s ‘dovish pivot’ of their own in the December FOMC, where their interest rate dot-plot was revised significantly lower, powering a ~100bp downward shift in Fed Funds forwards and over 150bp of easing priced into 2024.

All of this was happening against a backdrop where core inflation was coming down, but still substantially above the Fed’s own 2% target. Now whether this was done in response to worries over a slowing economy, Taylor-rule suggestions that the Fed is ‘behind the curve’, or attempts to resuscitate the frozen CRE/IPO markets, the result is the same all together — an explosive risk-move on into year end.

11. You Snooze, You Lose

As with everything in life, timing is everything. Despite everything that has been covered, the lion’s share of the year’s gains happened in the last 2 months of the year, effectively coinciding with Yellen’s QRA shift in November, and further punctuated by Powell’s dovish pivot before year-end.

At the end of the day, it always comes full circle back to the Fed, doesn’t it? Respect your monetary overlords…

So What Should We Look Out for in 2024?

As we jestingly pointed out at the beginning of this article (thanks for making it so far), I certainly do not possess any better clairvoyance than your average observer, so any views I have are likely going to be (very) wrong and ridiculed in hindsight. But hey, life is short, so what’s wrong with having an opinion?

Here are some of the developments I think investors should be paying attention to in the Year of the Dragon.

- Is Inflation Truly Dead and Buried?

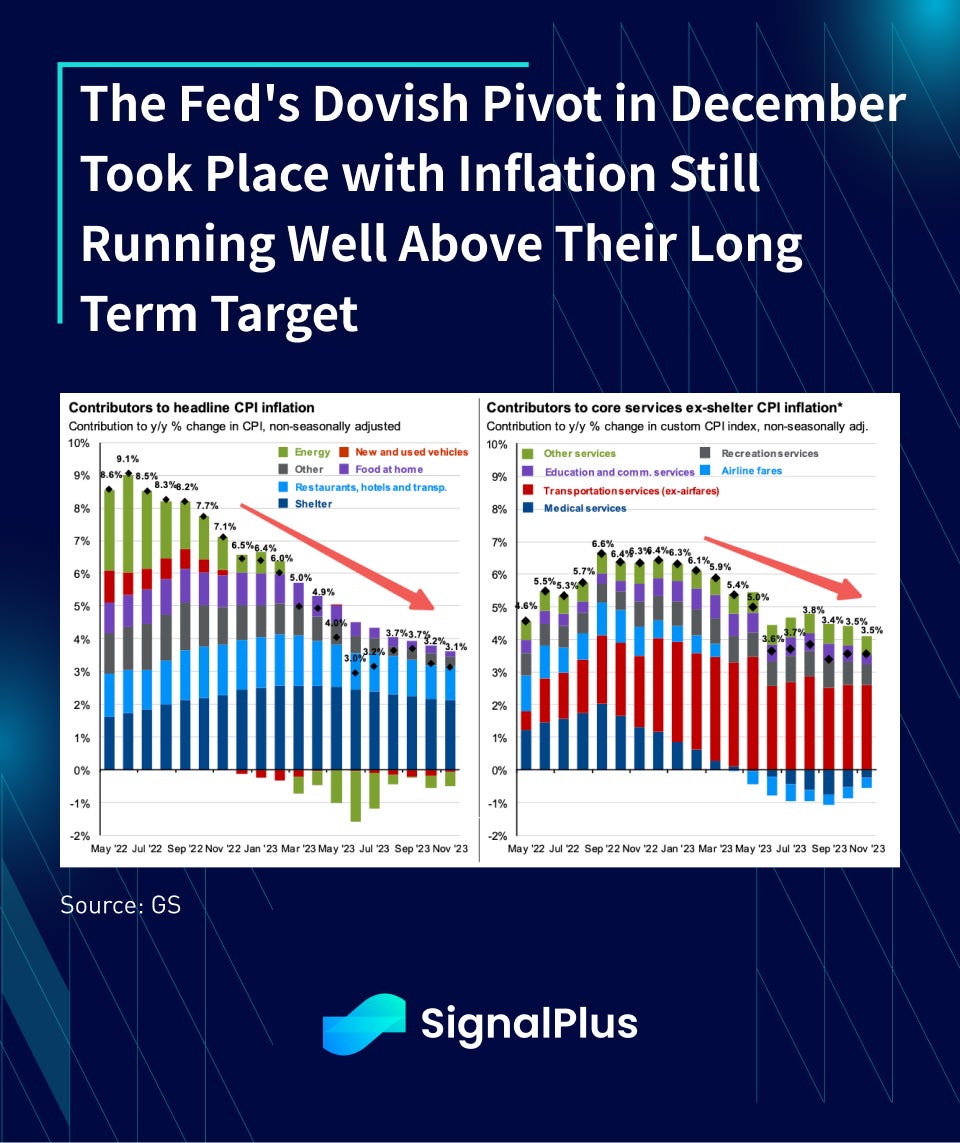

As we touched on above, the big story of 2H2023 was about falling inflation and the Fed pivot, and the great asset rally of 2024 is (supposedly) going to be driven by a year of global interest rate cuts. Both Europe & US have over 150bp of cuts priced in this calendar year, even though core inflation readings in both regions are still comfortably above policymakers’ targets.

Against a backdrop of consistently weak manufacturing PMIs, a long-awaited drop in the overall level of inflation and nascent signs of labour market weakness in Q4 gave asset markets the green-light to go ‘all-in’ on the nasing narrative.

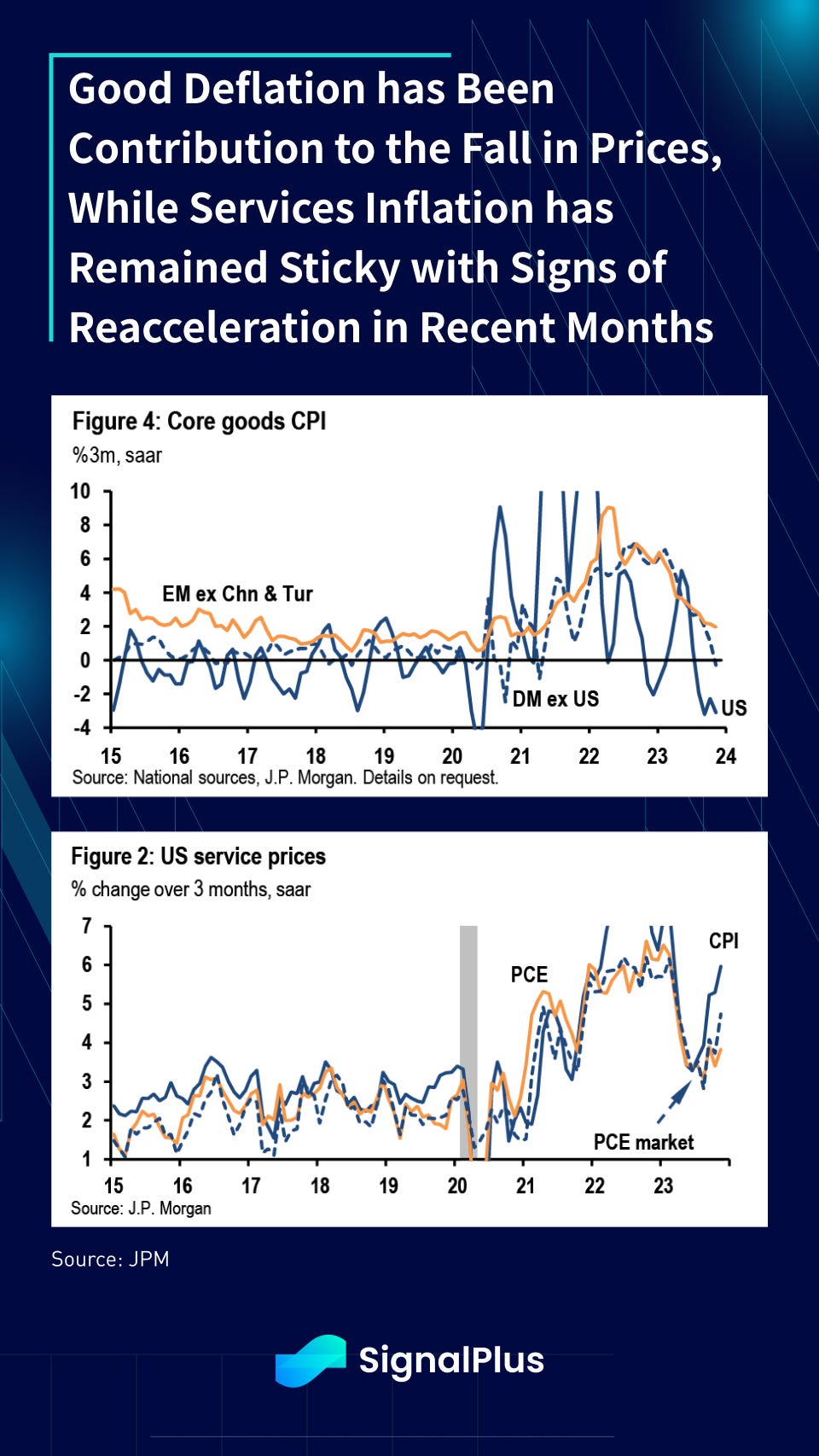

However, a deeper look underneath the inflation data shows that goods deflation has been primarily responsible for driving headline prices lower, while services CPI has stayed stubborn, and have in fact rebounded considerably from their 1H23 lows already.

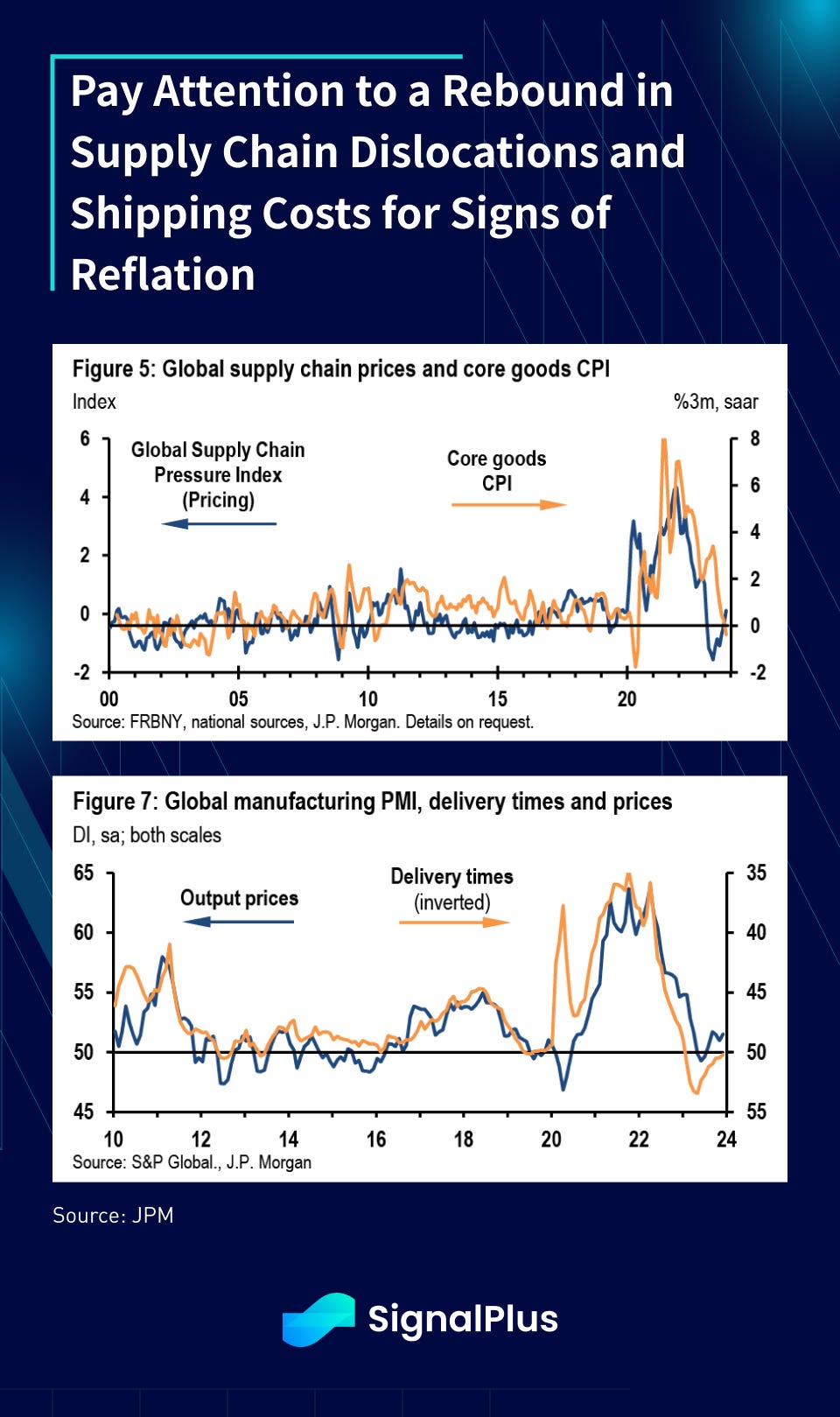

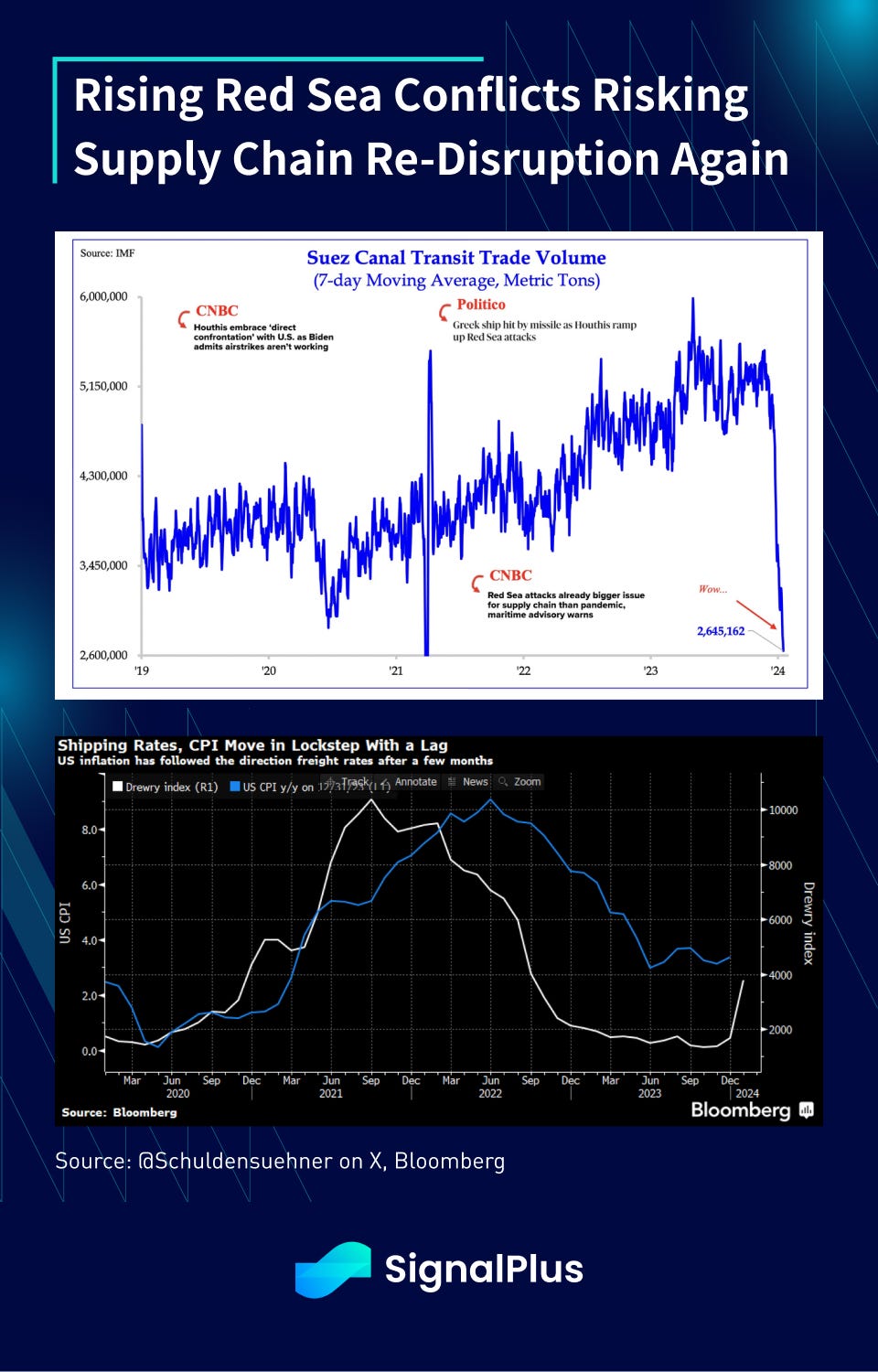

Furthermore, while the easing of supply chain dislocations was responsible for much of the goods deflation in 2023, the base effect benefits will dissipate this year, and the recent conflicts in the Red Sea have started to skew shipping rates much higher in the foreseeable future.

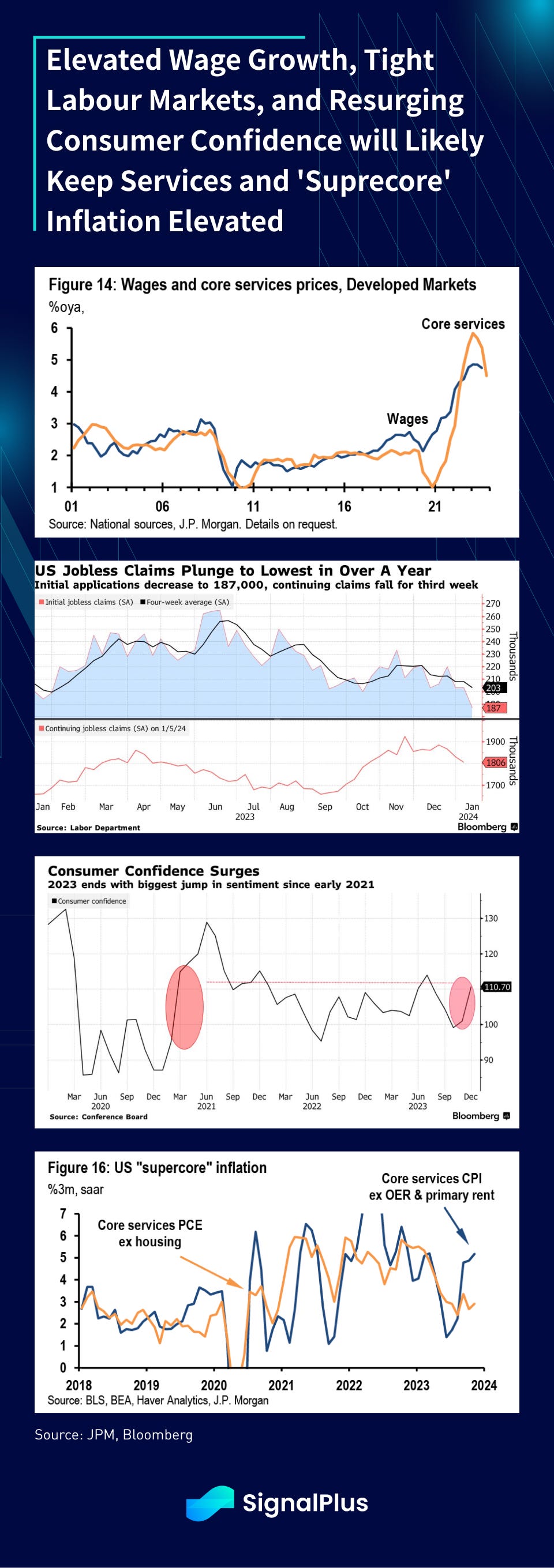

On the services side, the combination of still highly elevated wage growth, secularly tight US labour markets, and resurgence of consumer confidence will likely keep services and ‘supercore’ inflation much higher than the Fed wants to see.

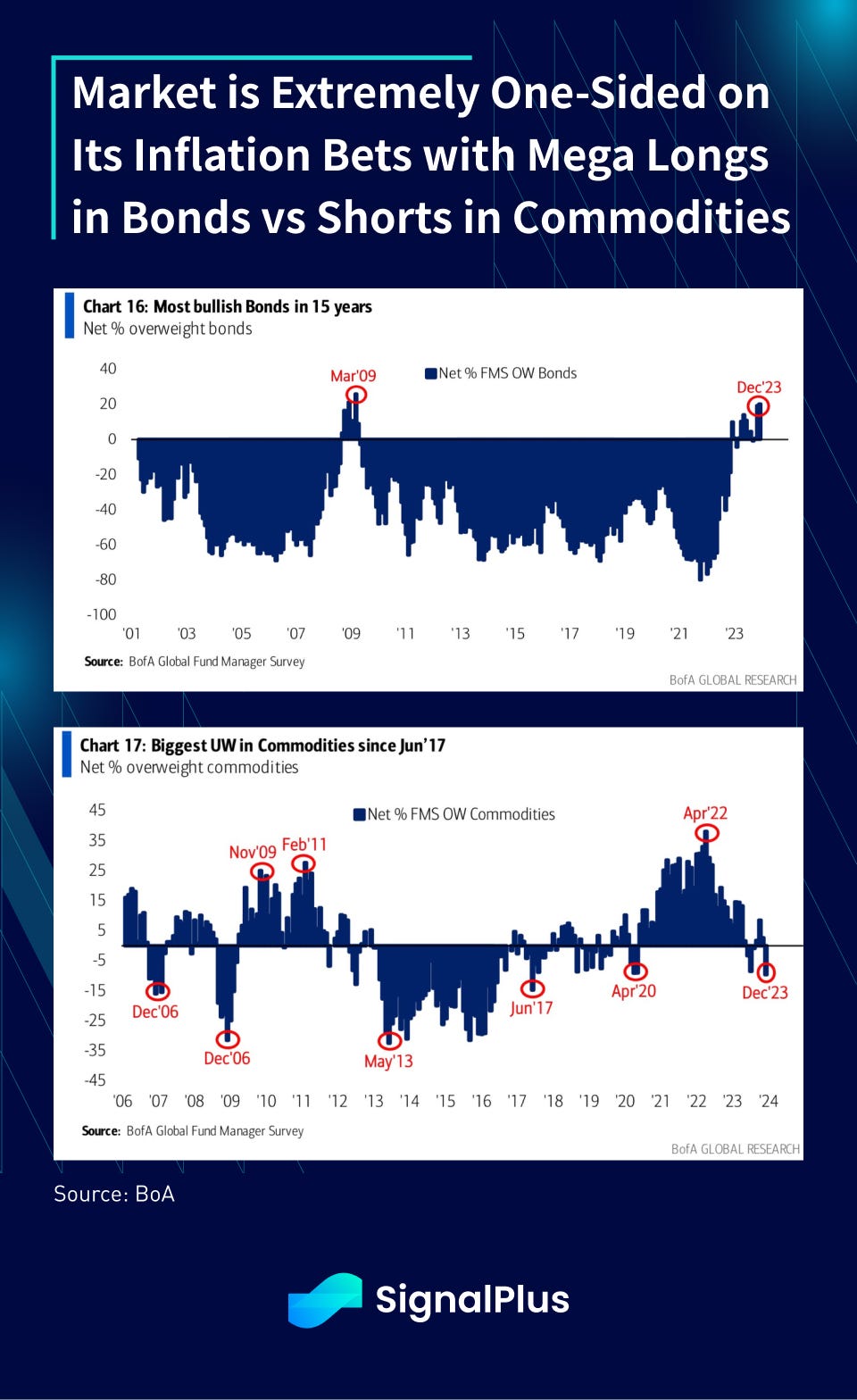

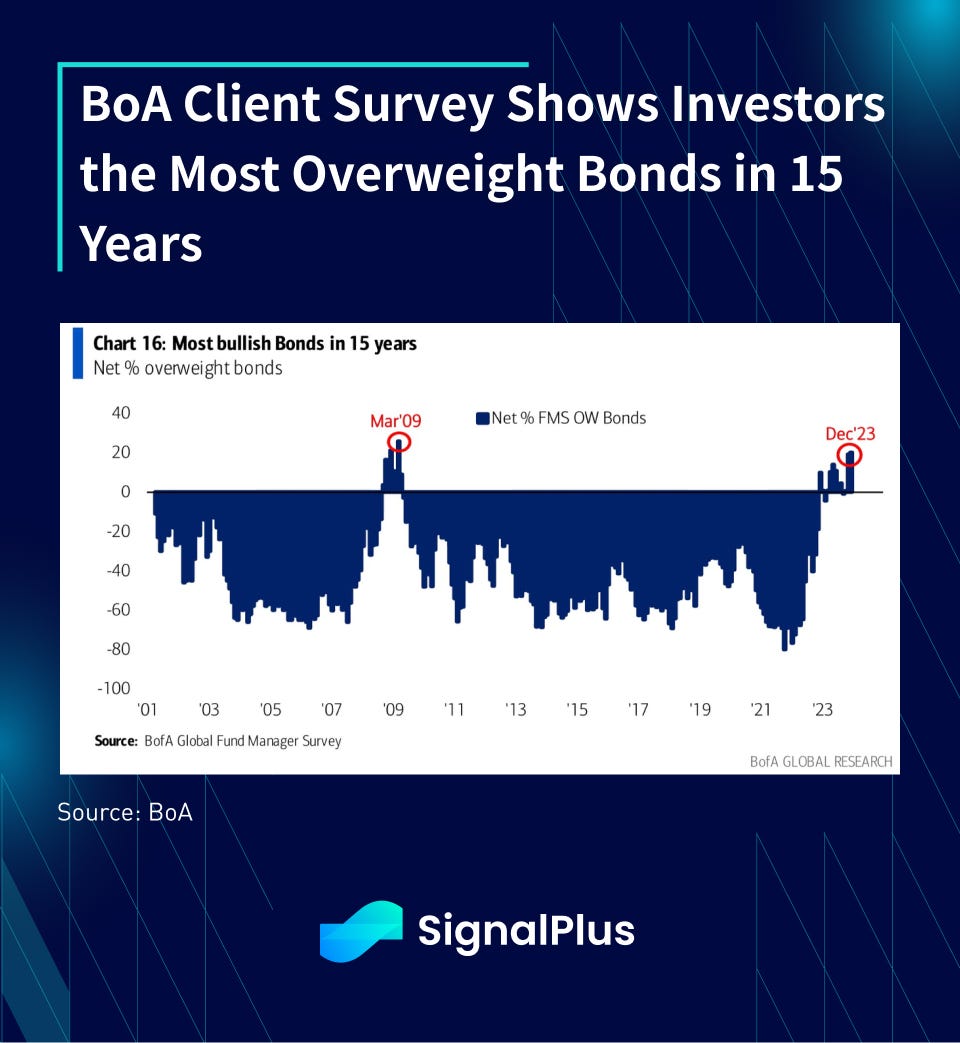

Finally, all of this is happening just as investors have turned the most bullish in bonds in 15 years, while being significantly underweight commodities as inflation hedge. It’s probably pretty fair to say that the market is poorly positioned for any bouts of reflation in 2024.

2. Treasury Refunding and the Debt Maturity Profile

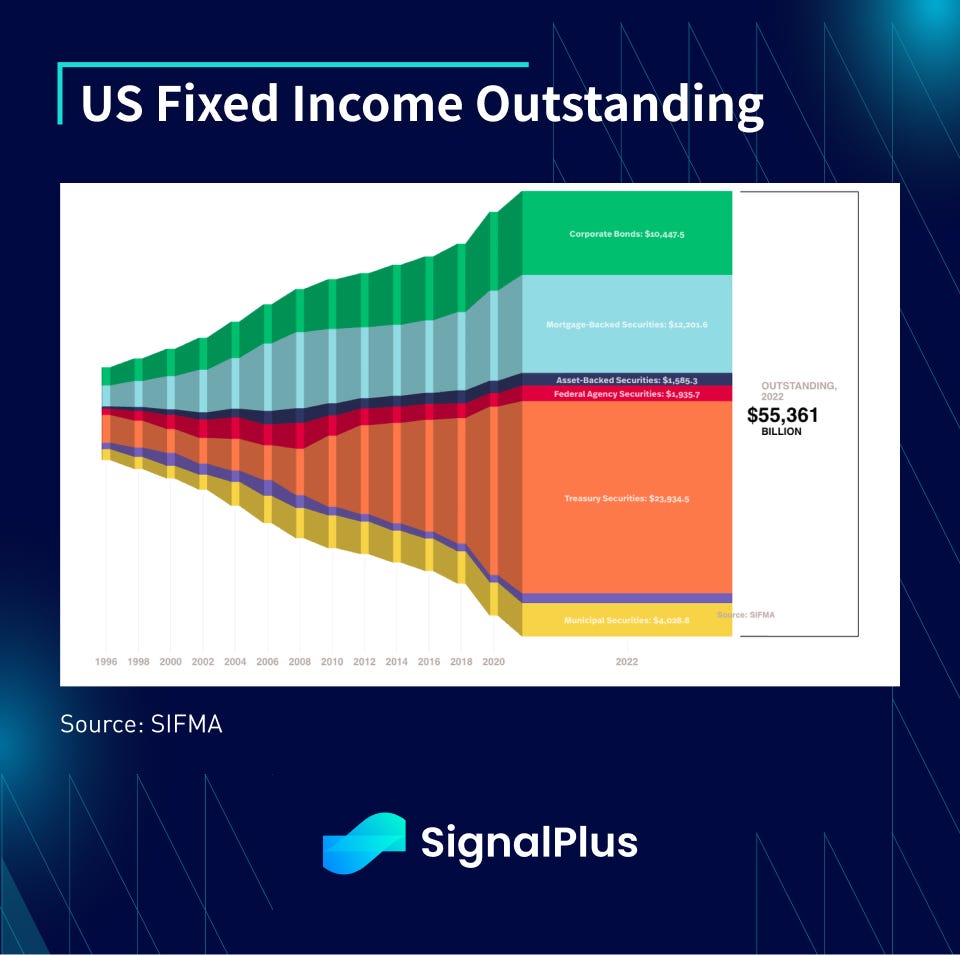

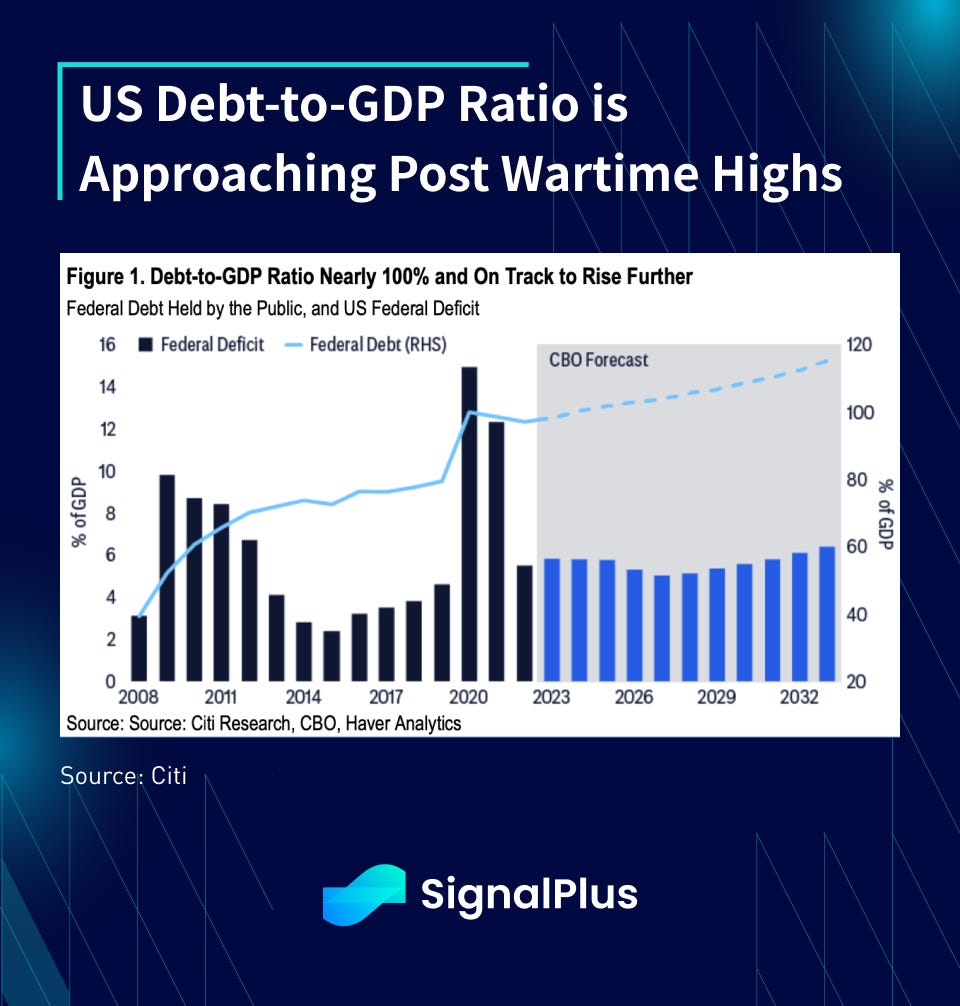

Not a day goes by without a bearish prognosis about the US government’s ‘runway’ debt problem, citing a debt-to-gdp ratio that’s approaching the highest levels since WW and a debt interest bill that surpassed $1 Trillion a year.

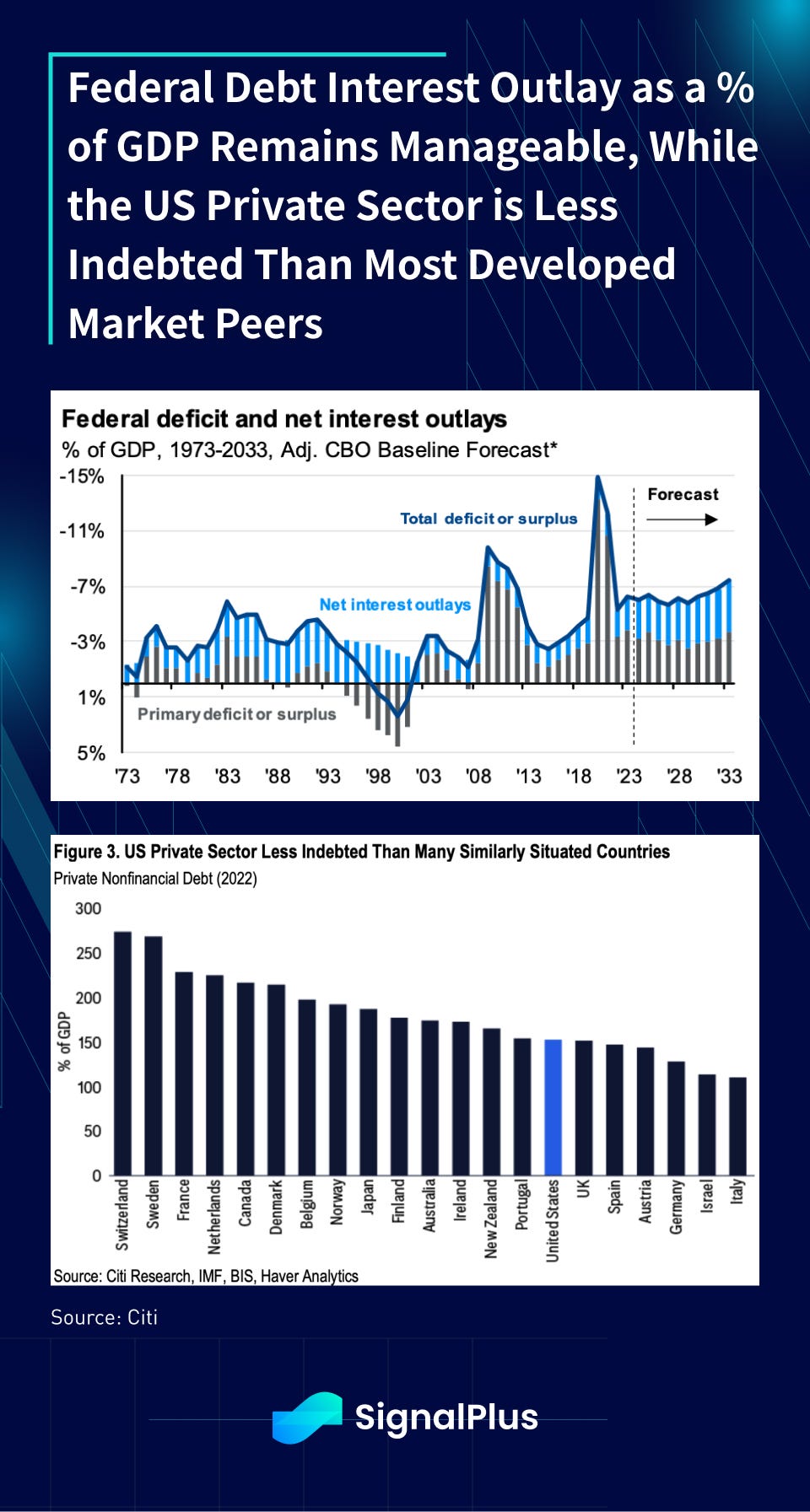

However, on a debt-coverage basis, interest outlays as a % of GDP remains manageable at around -6%, significantly below covid levels (-13% to -15%) and even the GFC (-8% to -10%). Furthermore, with US consumers diligently paying down debt, the US private sector is actually in much better financial shape than most developed market peers.

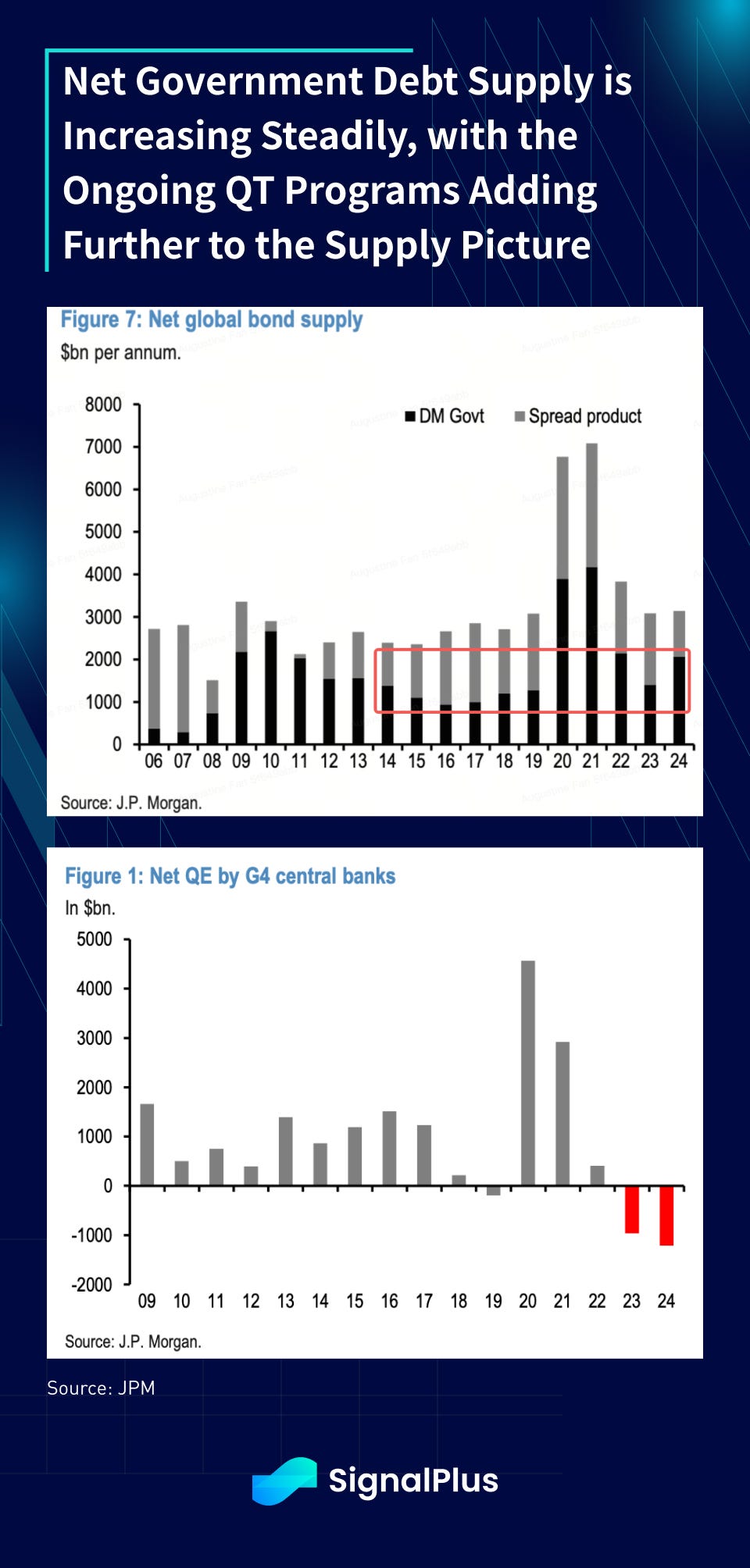

With that being said, the net marginal supply of government bonds is increasing over time, with the central banks QT (tightening) programs adding further to the selling pressure in 2024. As such, there is now a growing and acute focus on the Treasury’s quarterly refunding announcements (QRA), the last one of which had catalyzed the year-end risk rally which we highlighted in the sections above.

Secretary Yellen’s tactical shortening of the debt maturity profile was a crafty gambit that paid off in crushing long-end yields lower. However, was that a one-off bluff or will she continue to utilize this newfound tool to manipulate investor sentiment further?

The Treasury Borrowing Advisory Committee (TBAC) outlined three possible, but widely diverging outcomes of the debt maturity profile depending on the upcoming issuance mix between bills and coupons. A continued shift to shorter maturities plus smaller than expected auction sizes will be a boon for risk-assets, and vice versa the other way.

The next QRA will take place on January 31st, 2024, straddled by JOLTS data on the 30th, ISM/FOMC on the 1st, and NFP on the 2nd. Be sure to mark your calendars for the first important macro week of the year!

3. Tapering the Taper

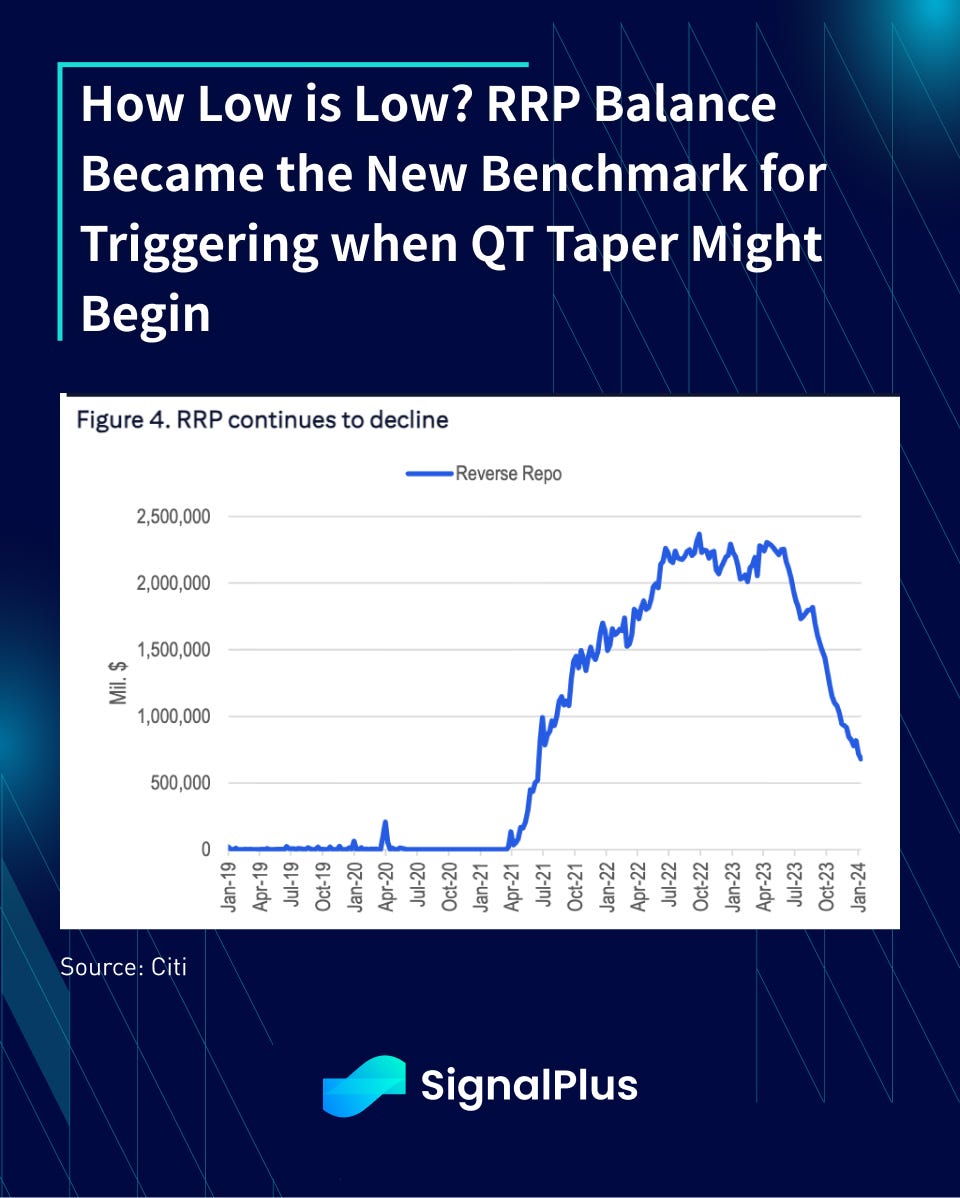

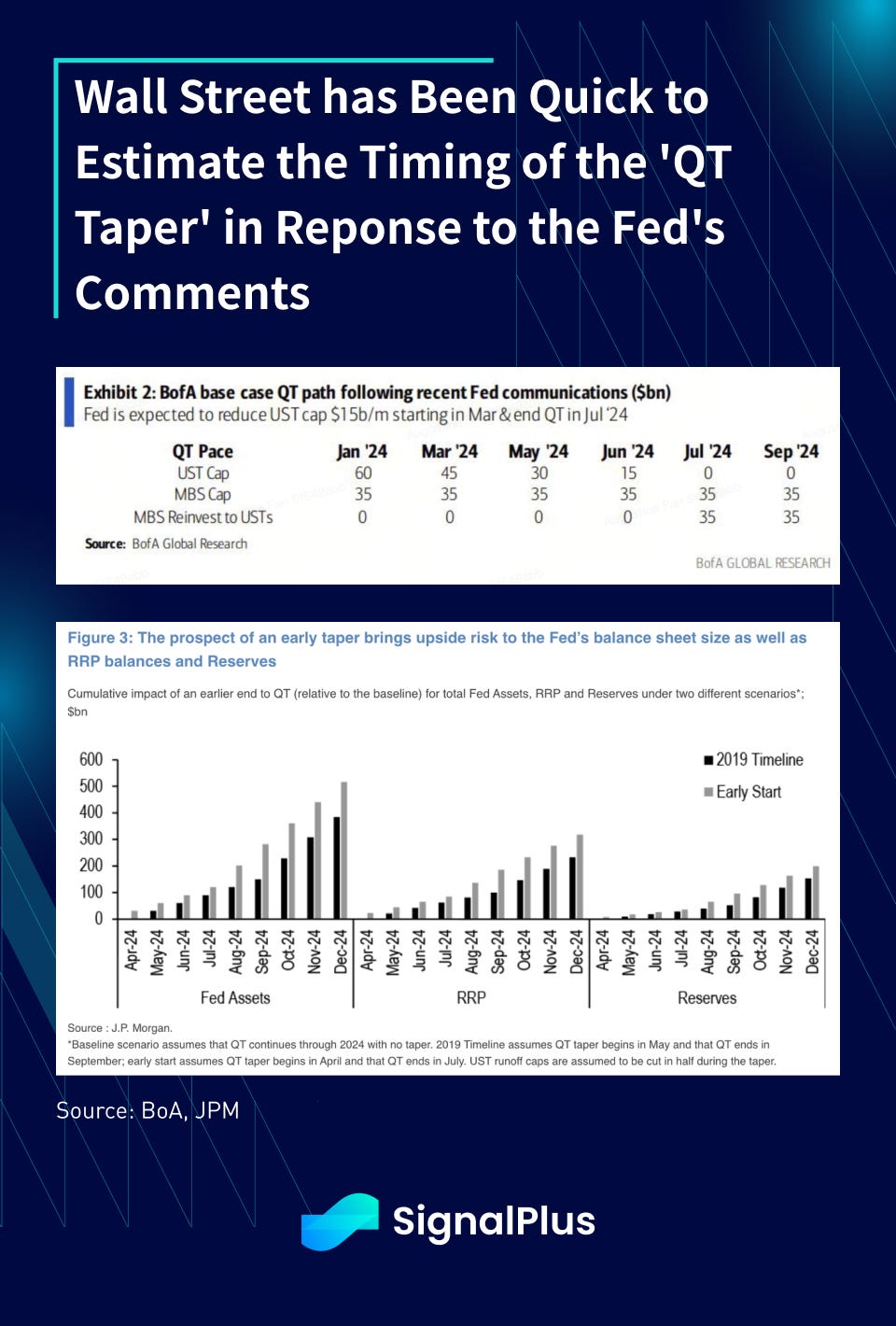

When it rains, it pours. The December FOMC minutes floated the idea of stopping their balance sheet reduction early (ie. tapering the taper) based on some technical arguments about a shrinking RRP balance (reverse repo). Key quote from the minutes:

“Several participants remarked that the Committee’s balance sheet plans indicated that it would slow and then stop the decline in the size of the balance sheet when reserve balances are somewhat above the level judged consistent with ample reserves. These participants suggested that it would be appropriate for the Committee to begin to discuss the technical factors that would guide a decision to slow the pace of runoff well before such a decision was reached in order to provide appropriate advance notice to the public.” — Dec. 12–13 FOMC minutes released January 3.

Dallas Fed President followed up a few days (Jan 6th) later stating that it would be appropriate for the Fed to slow down the pace of balance sheet reduction as RRP balances became ‘low’ — however that is defined. NY Fed Williams later mentioned (Jan 10) that the Fed does not seem to be close to the point of slowing balance reduction (yet), which was further echoed by Cleveland Fed’s Mester (Jan 11) that “we still have a lot of reserves in the system so we don’t have to do that imminently at all, I think there’s time… I’m sure this year will be when we start having the conversations and what plan would look like”. Finally, Governor Waller was the latest to chime in on the issue (Jan 16) that “I would say sometime this year will be a resonable thing to start thinking about it”.

Whenever the date may be — don’t say they didn’t warn you. The easing calvary has been called on alert.

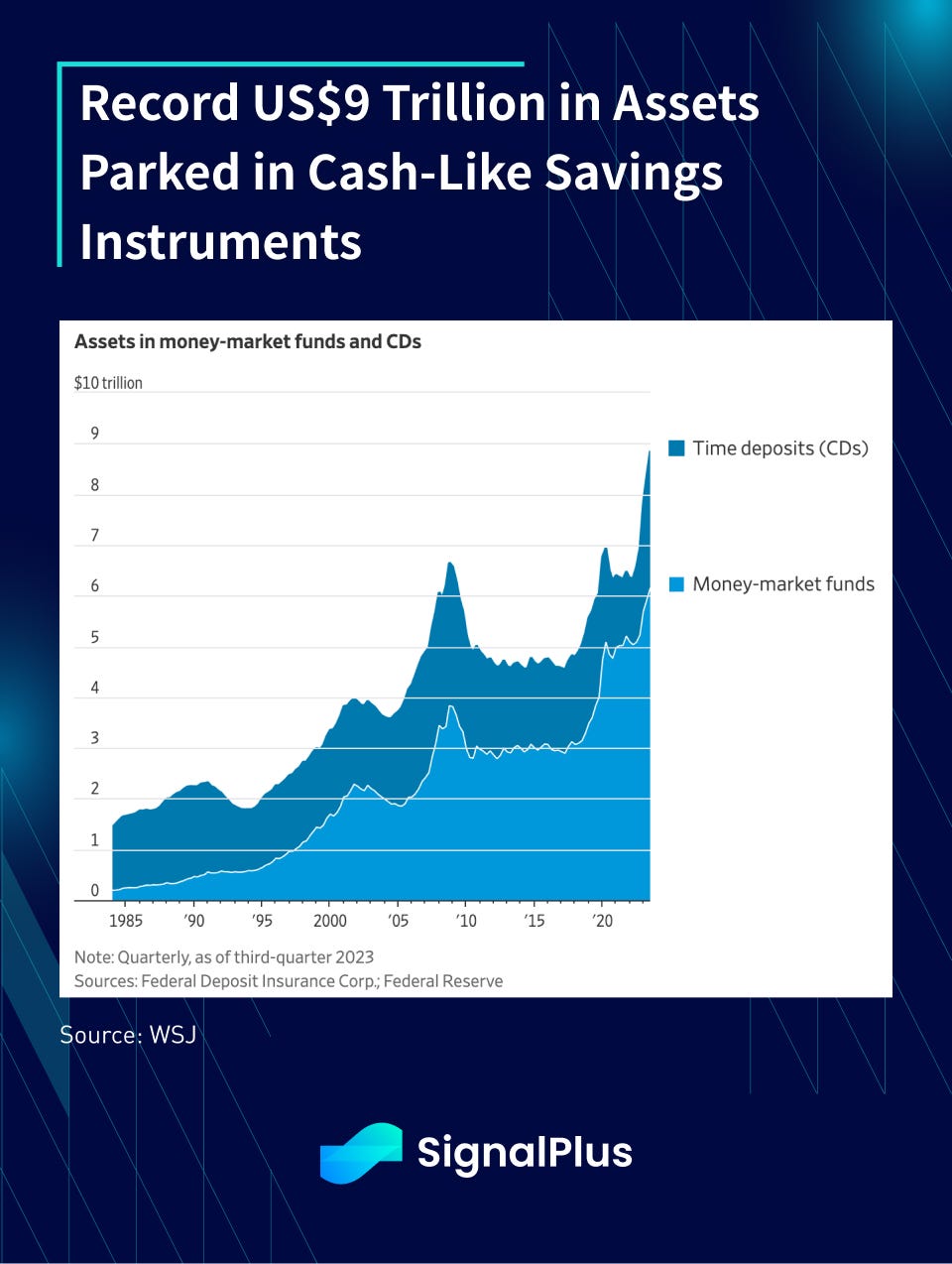

4. Follow the Money

Dry powder. Money on the sidelines. Whatever you want to call it, but a juicy ~5% deposit savings rate has attracted a record US$9 trillion of cash parked in money market funds and similar instruments over the past 2 years.

With the S&P 500 back to all time highs, bond yields falling heavily, crypto prices roaring back, and even IPO markets showing signs of thawing, will we see money-market investors FOMO back into risk-assets on the first rate cut by the Fed? Where will they reallocate the assets to? This will be one of the most important questions the market will seek an answer to in 2024.

5. The CRE Deep-Freeze

Unlike it’s only ‘up-only’ residential cousin, commercial real estate has been buried in the nadir as offices have been the single largest collateral damage from the Fed’s inflation-fighting campaign.

The perfect-storm combination of higher funding rates, lower financing quotas from balance-sheet impaired banks, sky-rocketing labour and input costs, and ratcheting office vacancies post the covid WFH era has fundamentally altered the allure of offices. Billionaire investor Barry Sternlicht, CEO of Starwood Capital Group ($115bln in AUM) has called the current situation a “Category 5 hurricane”, and distressed-debt firm Oaktree ($170bln in AUM) has said that commercial real estate is “the most acute area of risk right now” due to the incoming debt maturity wall.

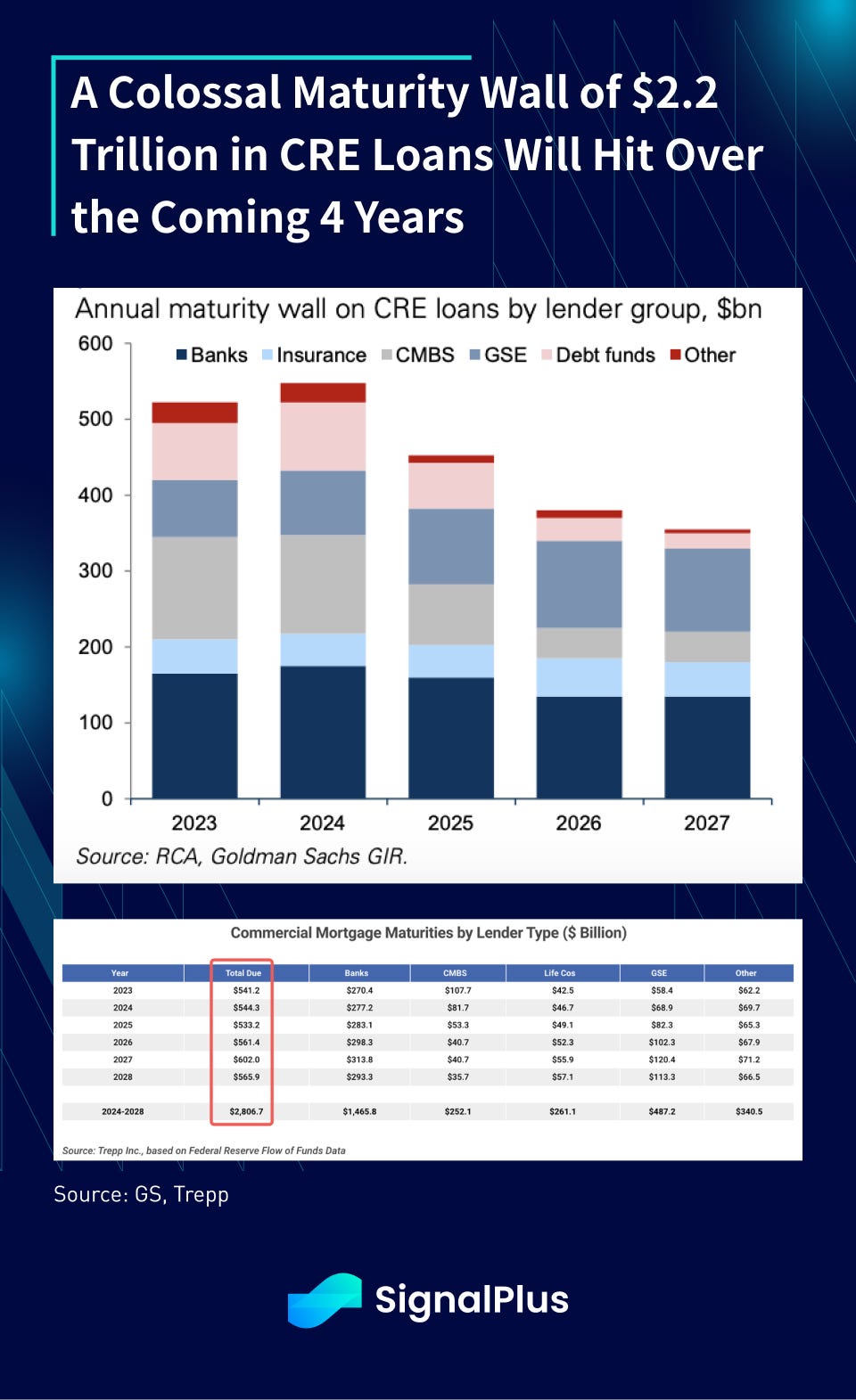

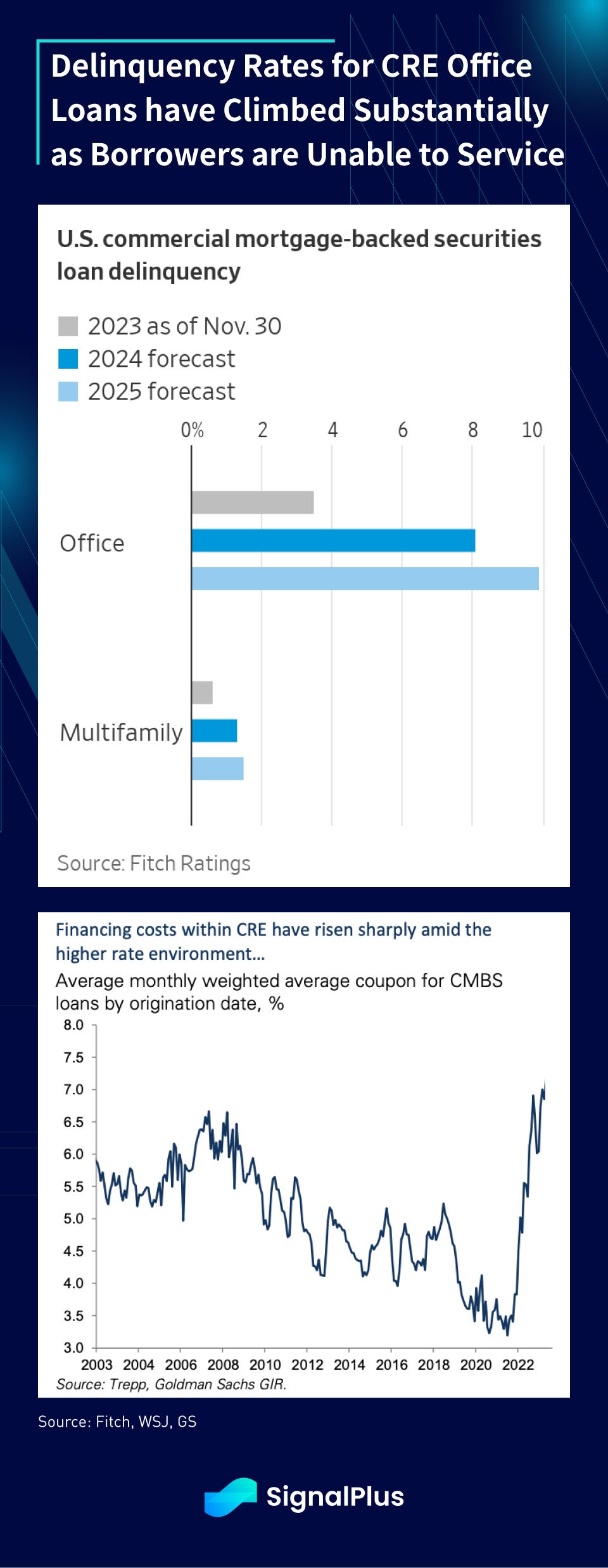

The troubled sector struggled with over $540bln of loans being due in 2023, the largest amount in a single calendar year according to data firm Trepp. To make things worse, there will be a tsunami-wall of $2.2 trillion in maturing debt coming due over the next 4 years, and loan delinquency rates have already started to climb as borrowers are unable to service or extend these loans in the current rate environment.

Data suggests that ~50% of CRE debt is held by banks, the same banks’ whose balance sheets have been hit with a wall of unrealized losses in their HTM (held to maturity) portfolios as we saw in 23Q1. Obviously, we shouldn’t expect the full impairment impact to be faced by the banks alone, as both private borrowers and lenders should be spending the next quarters formulating work-out deals to diversify the pain across the system. Interest cuts (should they happen) will also alleviate some of this pain, but this will be an important area to keep an eye on as a source of balance sheet risk.

6. Will China Finally Roar Back in the Year of the Dragon?

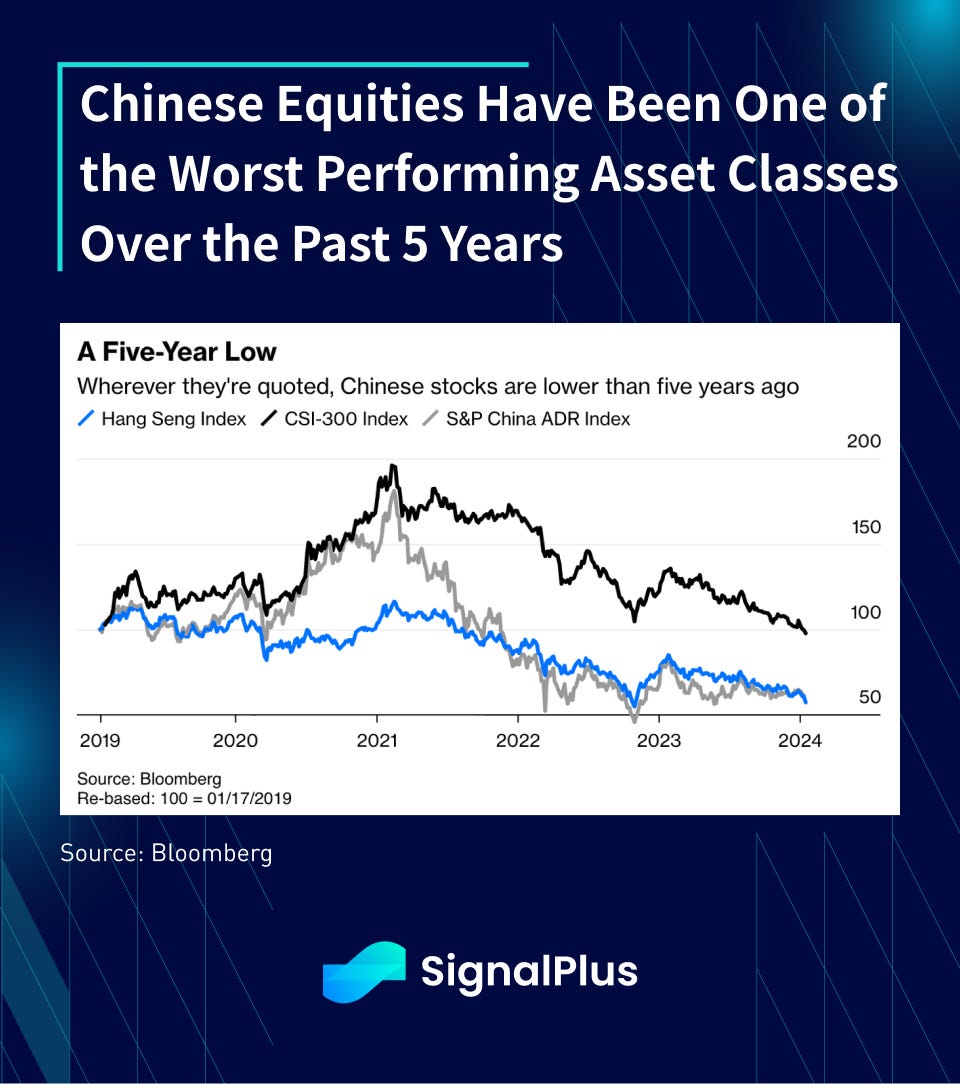

The one singular area where (offshore) macro strategists might have been the ‘most wrong’ on was arguably China.

The overwhelming consensus was for a strong redemption year following years of draconian pandemic lockdowns, followed by supportive macro policies to jump start a wounded economy.

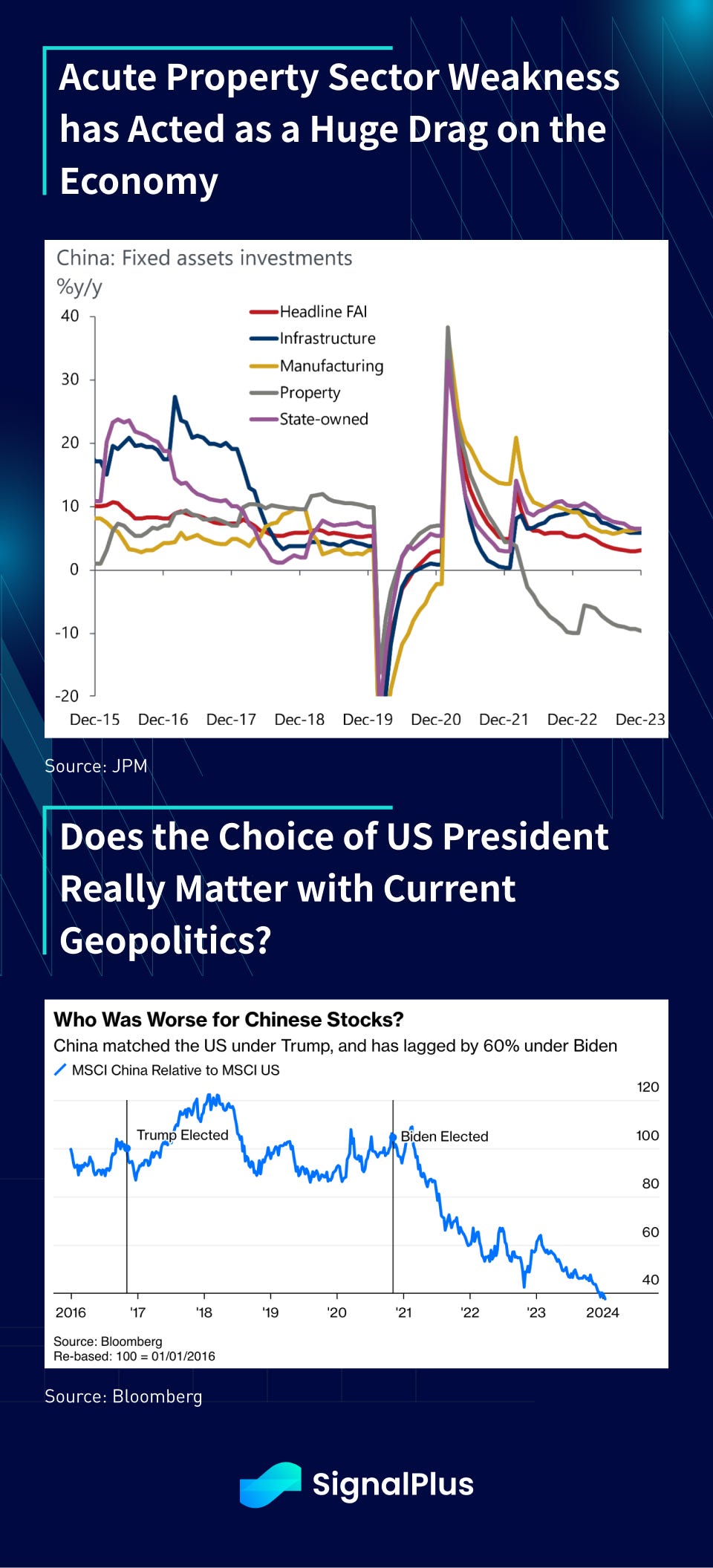

Instead, worsening developer defaults, challenging youth unemployment rates, weak consumer spending, foreign capital disinterest, ongoing geopolitical tensions, and tepid policy easing made China one of the worst performing markets in 2023.

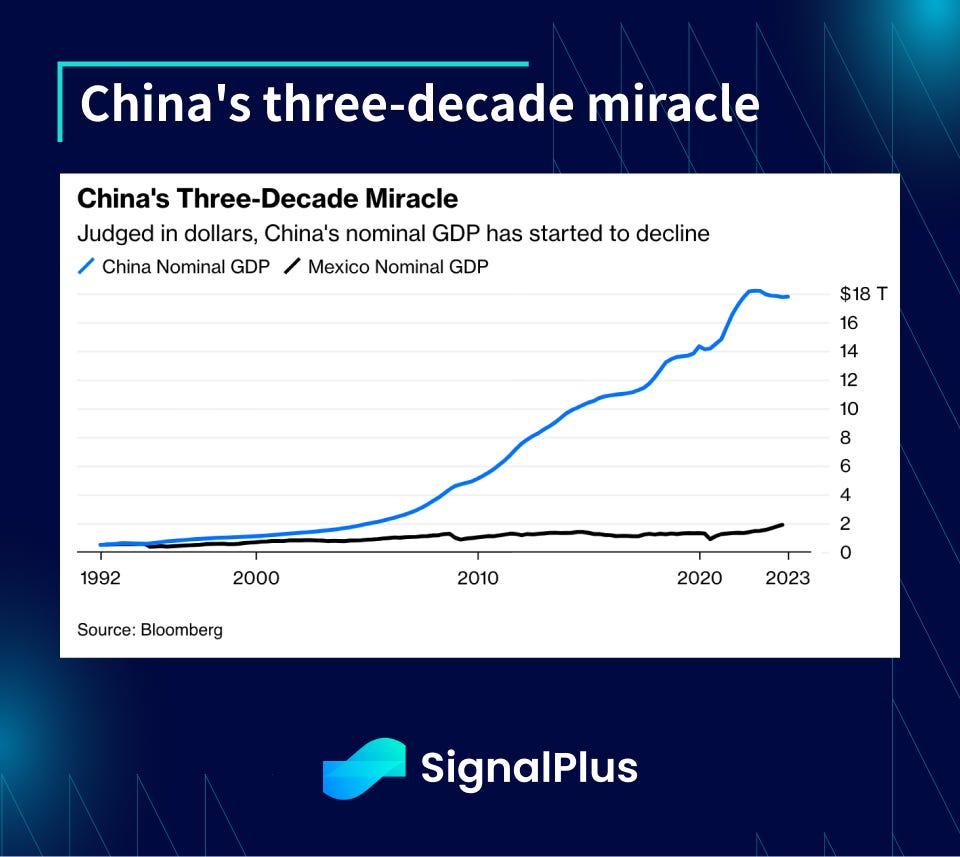

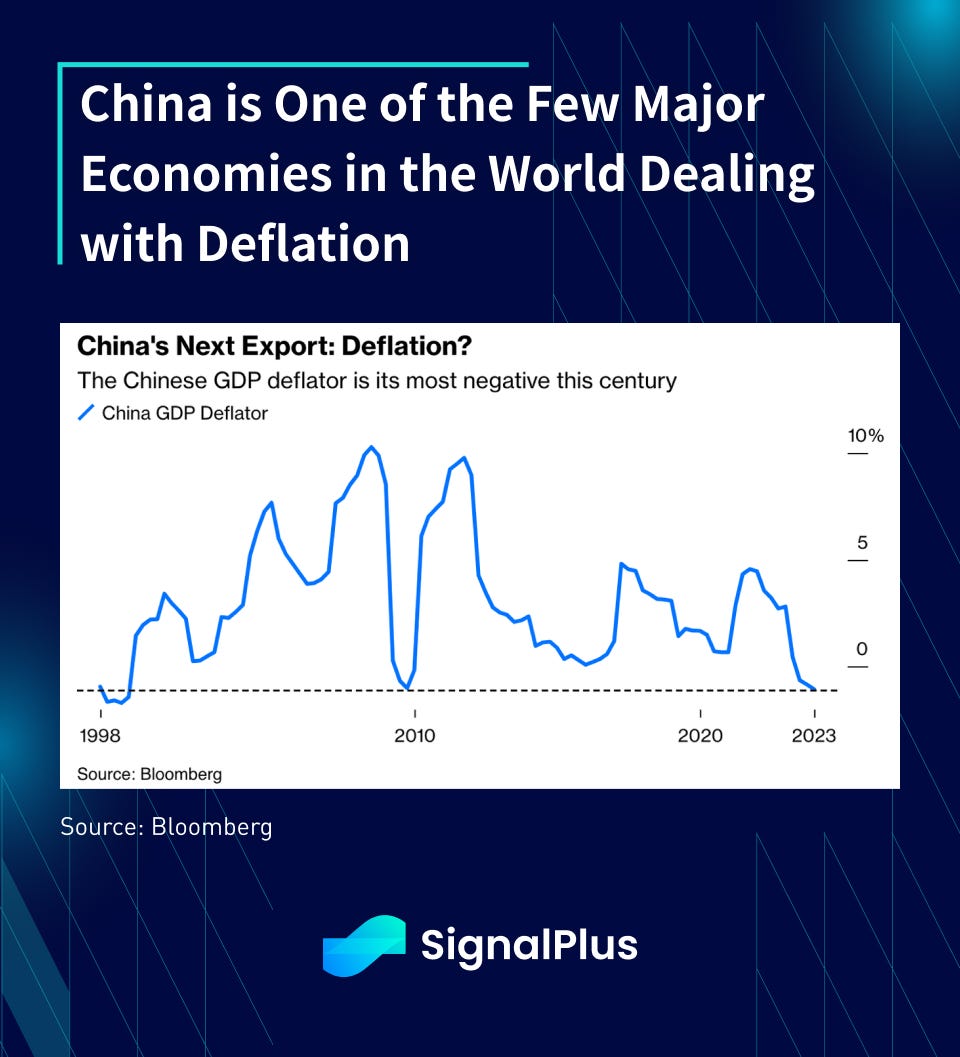

Furthermore, just as the world was worried about run-away inflation, China suffered its worst deflationary period in many decades, with nominal GDP (in dollars) also starting to plateau.

The vast majority of Wall Street is (once again) calling for a China rebound on monetary and fiscal easing, as well as new measures to stabilize the property sector. Is this the year where we finally get a turn in the fortunes of the world’s 2nd largest economy, or will it be more of the same? Only time can tell.

7. Investor Positioning and Immaculate Pricing

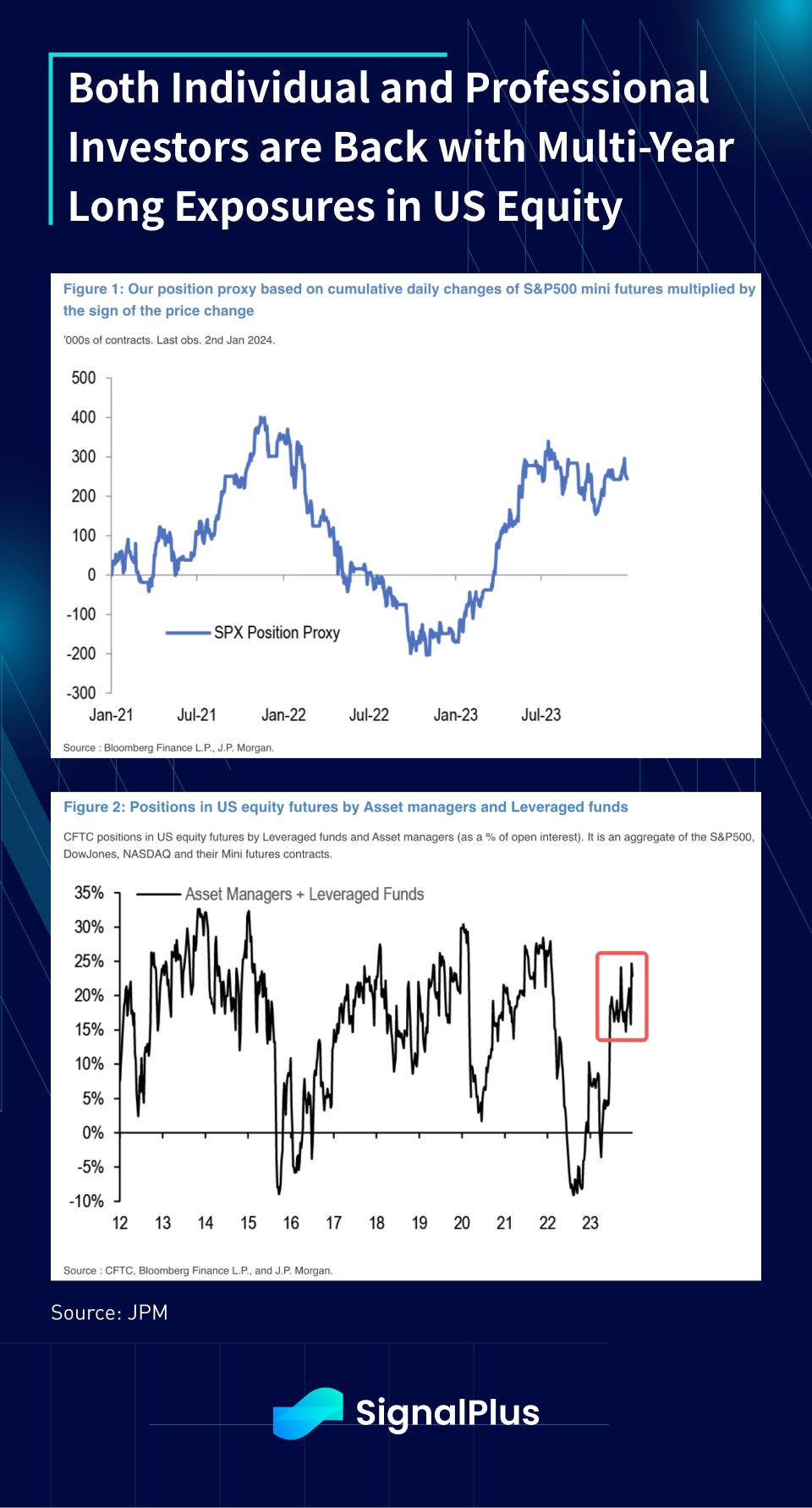

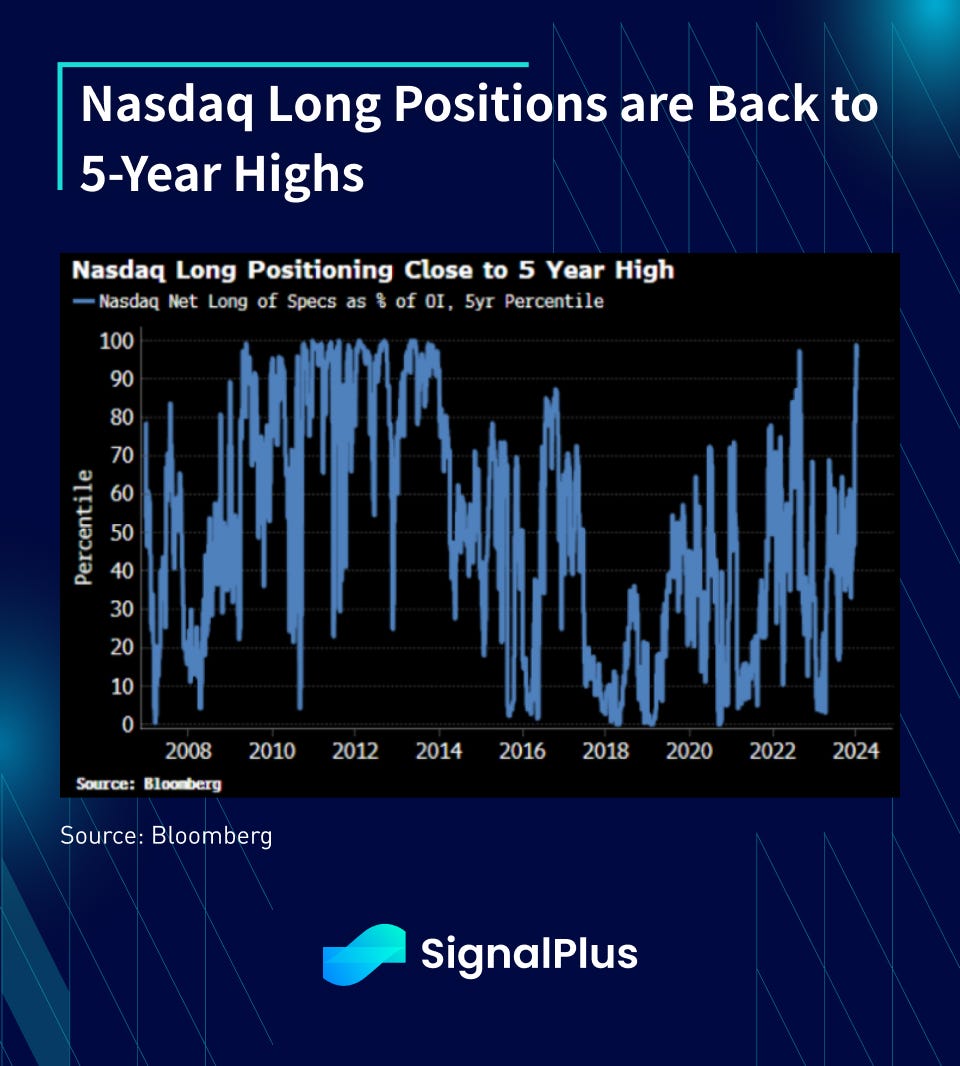

In complete contrast to how we began 2023, investors are starting 2024 with aggressively long exposures across nearly every risky asset class outside of commodities.

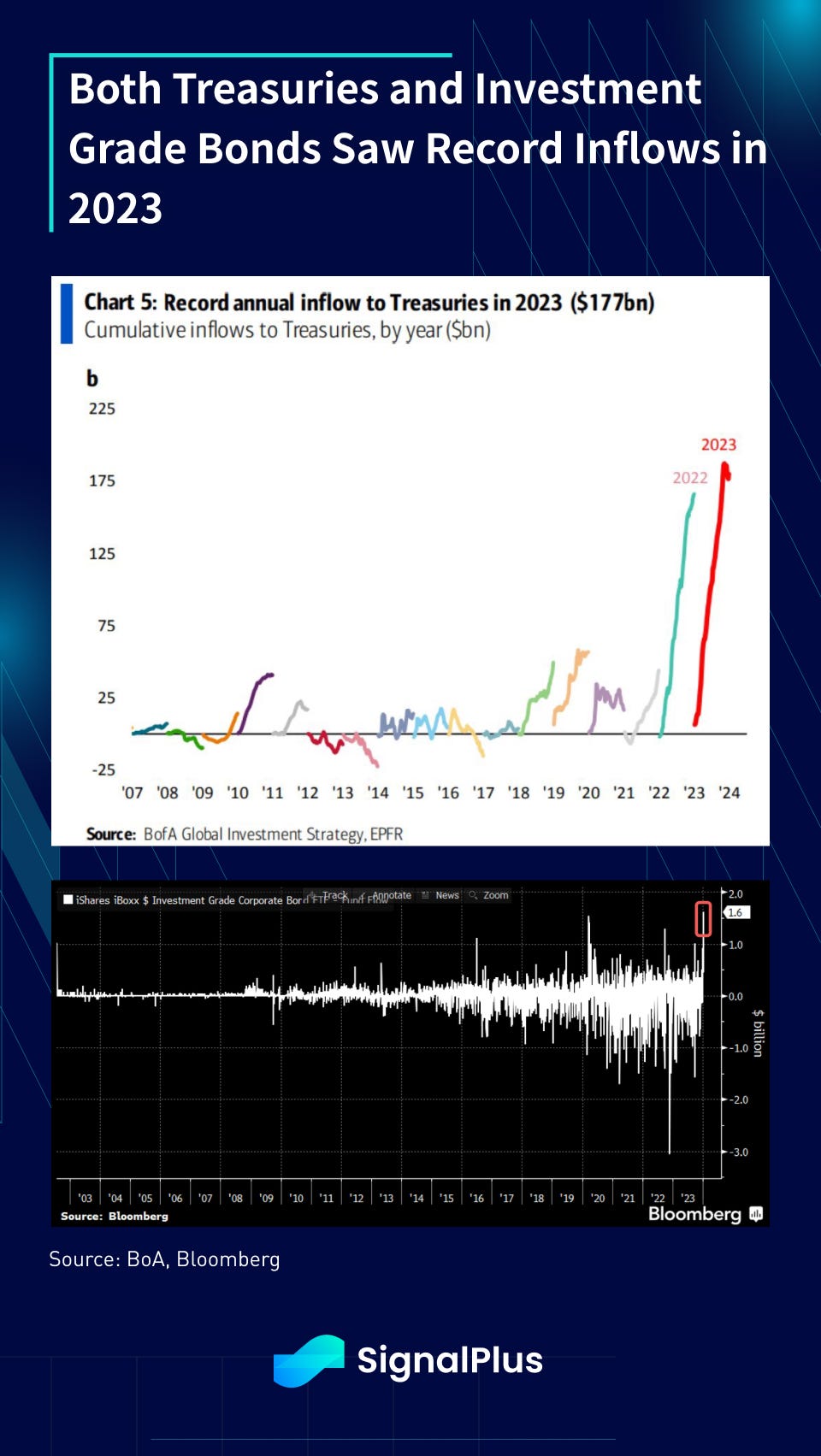

Investor optimism isn’t contained to just equities, with fixed income and corporate bonds seeing record inflows in 2023, as well as aggressive client long positioning into the new year.

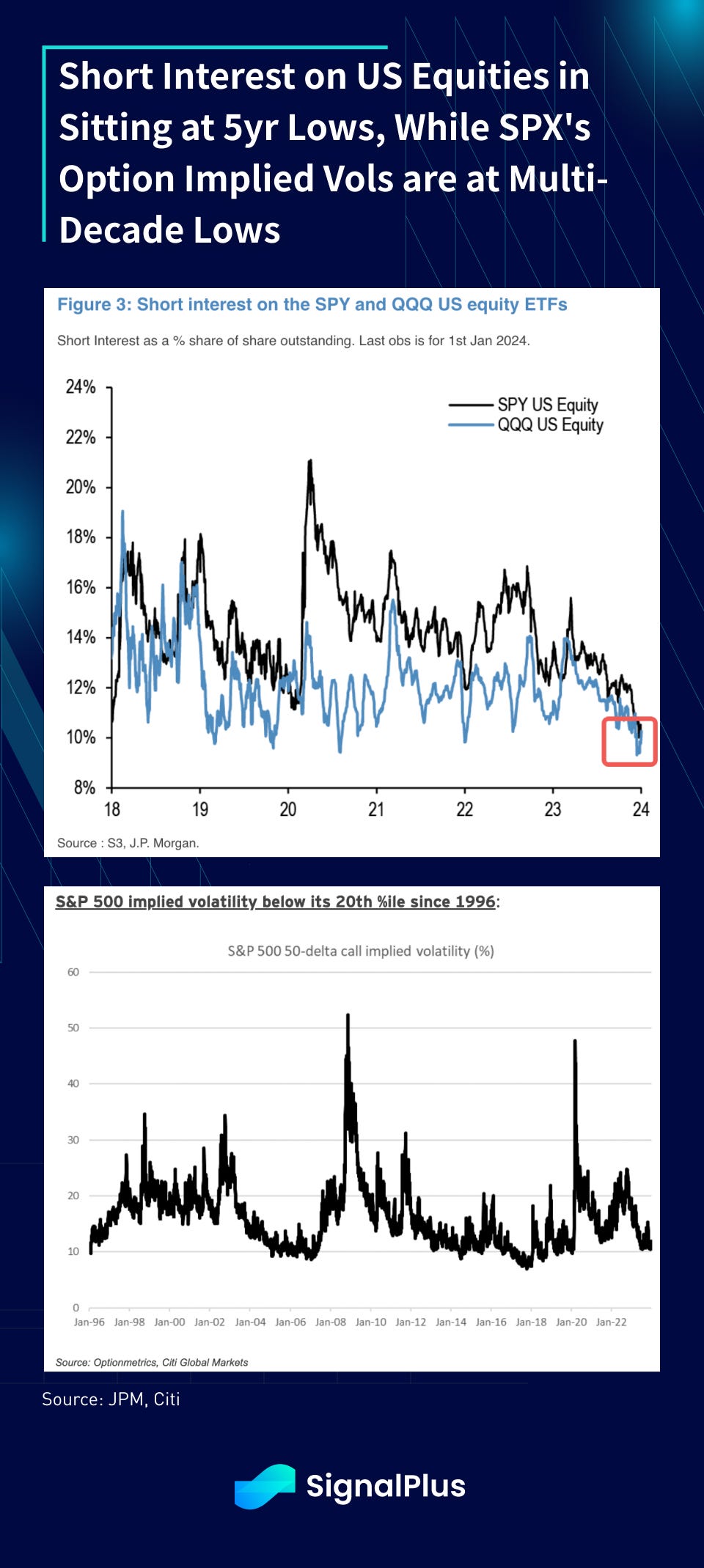

Furthermore, short interest on listed SPY and QQQ ETFs are sitting at some of the lowest levels over the past 5 years, and S&P 500’s option implied volatility has cracked underneath its 20%-percentile going back 30 years.

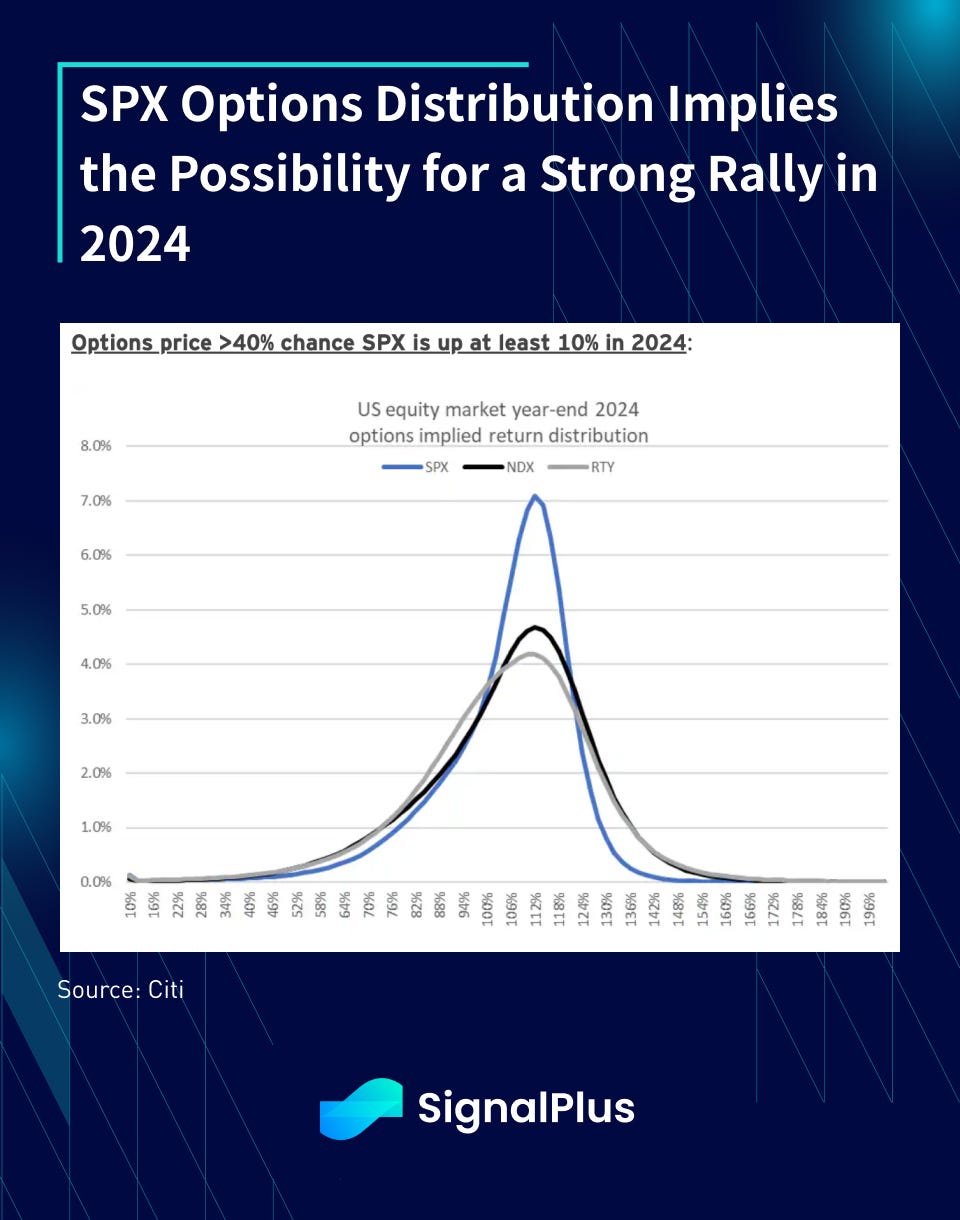

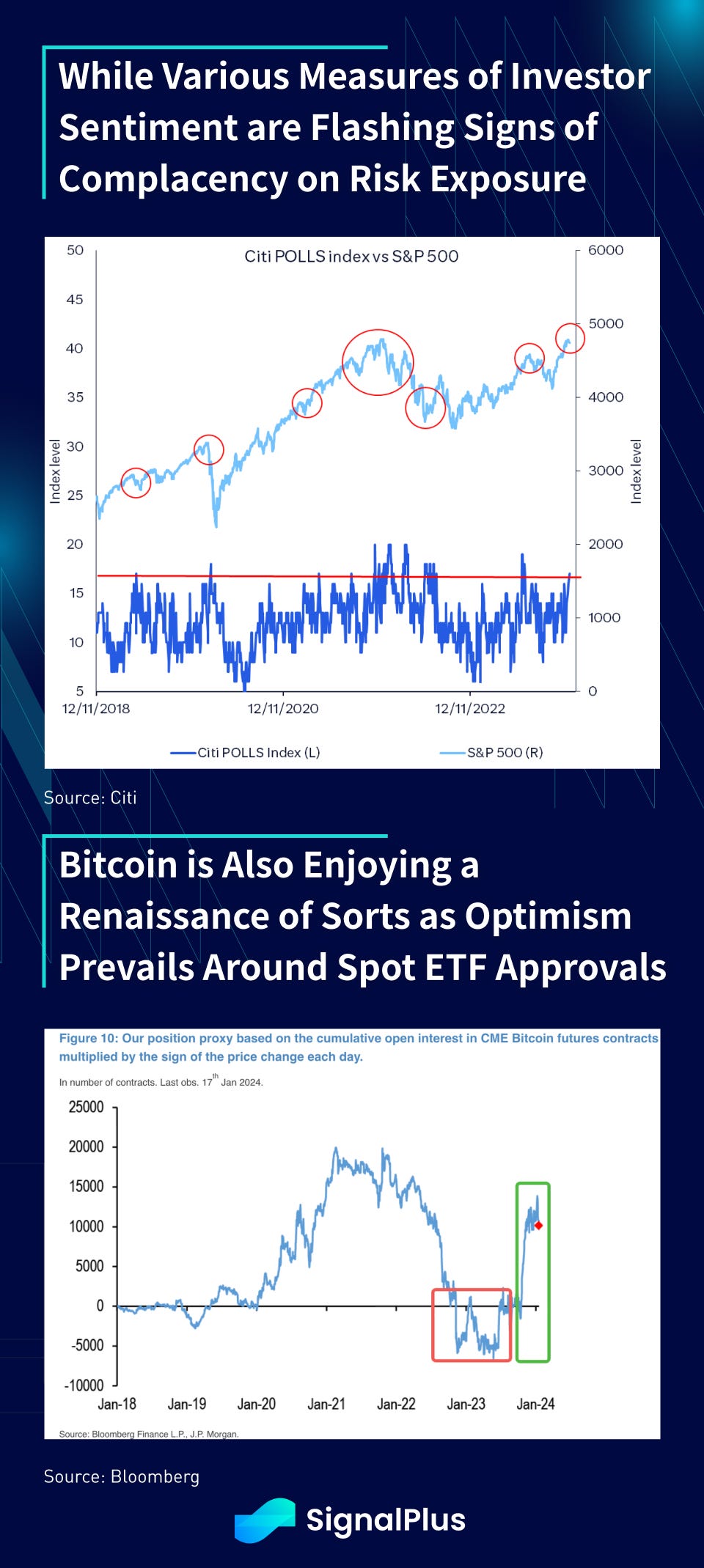

Option implied distribution implies a significant chance that the SPX will rally by more than 10% in 2024, while Citi’s ‘POLLS’ (Positioning, Optimism, Liquidity, Leverage, Stress) index is flashing signs of over-complacency consistent with previous interim highs.

As many wise investors have said, ‘price is what you pay, but value is what you get’, the significant rally in prices has raised the bar for expectations, and equities tend to be forward looking creatures with forward multiples often leading actual earnings growth. US equities will have to spend 2024 ‘growing into’ the multiple expansion that have been set in place, with the margin of error getting smaller just as investors are turning the most complacent as they have in over half a decade. Immaculate pricing indeed.

We are in agreement that the macro outlook appears more certain years past, spurred by a backdrop of policymakers ready to step in with rate cuts; however, we are also of the view that markets might be disappointed by the total magnitude of easing we’ll see, with central bankers showing more restraint with dispensing blanket liquidity post-pandemic.

We are also skeptical that inflationary pressures are fully behind us, and will be on the lookout for a resurgence in prices that could arise from a number of factors. The US economy could remain stronger than expected, asset markets could get ahead of themselves in anticipation of easing, escalating kinetic conflicts could reintroduce supply chain disruptions, and an unwelcome return of tit-for-tat trade campaigns heading into the US election are just some of the ‘knowable’ risks we see.

All in all, we’ve learned from experience to never be too bearish on markets, though we are more conscious of the risks heading into 2024. Patience might be our modus operandi in the next few months ahead.

8. What Happens After Rate Cuts?

There is an old trading idiom that claims markets generally move in the direction that exerts the most pain on the greater number of speculators, especially in the short-term. Markets have no feelings, and certainly don’t care about how you think it should react.

Markets are the ultimate expectations discounting mechanism, and they rarely move in the direction we most expect. That’s why capital markets are the world’s best casinos, and we speculators are happy to be gluttons for punishment.

So let’s say the Fed does end up cutting rates in 2024, what follows after? Do prices just moon indefinitely because the world’s problems are immediately solved by a 0.25% or even a 1.5% drop in our borrowing rates? Is that really all there is to it?

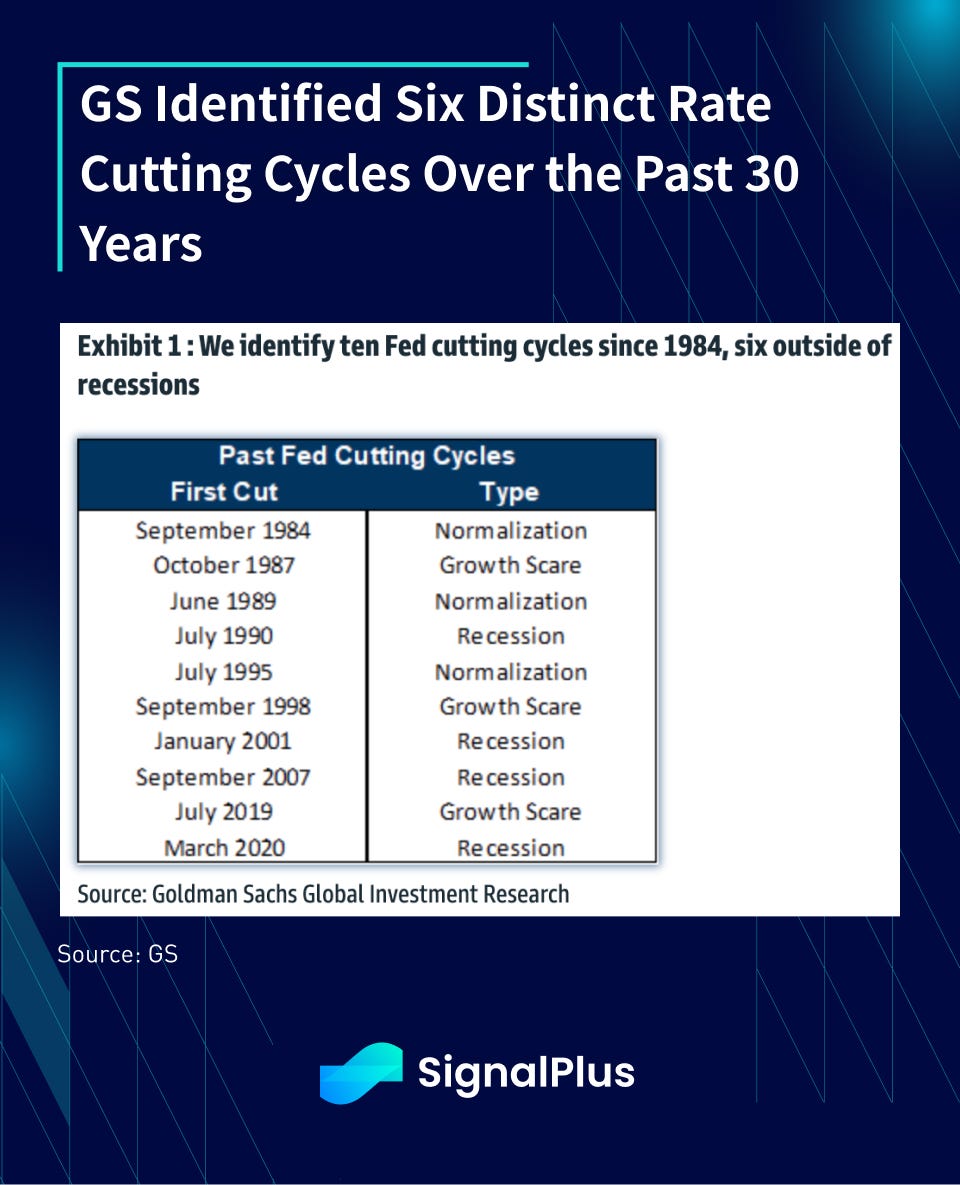

GS recently did a research piece looking at past ten cutting cycles, with a good cross section of scenarios and outcomes heading in and out of each period.

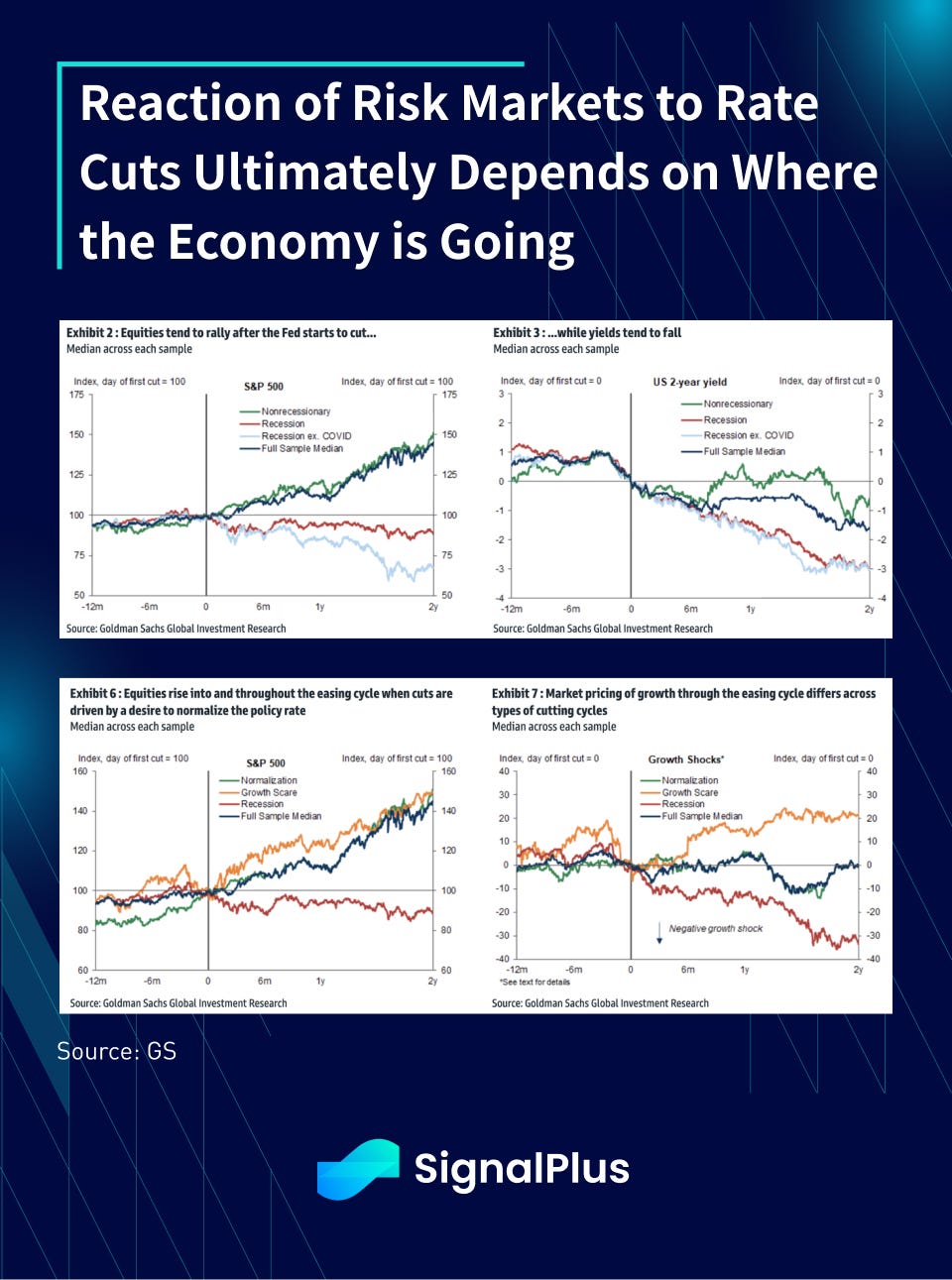

The TL;DR of the study was that, while rate cuts generally helped to rally equity prices and mostly certainly bonds, the longer-term outcome of asset prices really depends on the final path of the economy. If the Fed ends up easing policy support into a non-recessionary and growth period, asset prices perform very well as underlying economic output is catalyzed by lower discount rates.

On the other hand, should rate cuts occur because a recession is upon us, then equity prices are likely to sell-off as the economic downdrift would lead to earning drops and multiple-contraction.

As such, interest rates in and of themselves are not a panacea to the world’s problems, but rather as catalysts to our reaction functions, so their easing impact must be viewed within the context of the overall global output. I suppose it’s a good thing that macro analysis depends ultimately on… the economy, so hopefully we have added some value to our readers for reading our outlook piece up to this point!

That’s What It’s Really About, Isn’t It?

And on that, we want to thank all our readers and supporters for being with SignalPlus since the beginning of our journey. We are exceptionally excited about the positive developments to come for our company as well as for the digital asset space in 2024, and we can’t wait to share them with you in due time. As always, please get in touch with us via our official X accounts, TG channels, and WeChat groups to stay connected, and we look forward to hearing all your comments and feedback as we leap to new highs in the months ahead.

Wishing you a prosperous and profitable year of trading in 2024. LFG!

You can search SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto information. To receive timely updates and engage with a broader community, we cordially invite you to join and follow our official link for seamless communication and interaction with community members.

SignalPlus Official Links

Options Toolkits: https://t.signalplus.com

Twitter: https://twitter.com/SignalPlus_Web3

Discord: https://discord.gg/signalplus

Telegram: https://t.me/SignalPlus_Official

Medium: https://medium.com/@signalplus_web3

Website: https://www.signalplus.com/

Trading Ideas: https://t.me/SignalPlus_Playground

Comments