Market

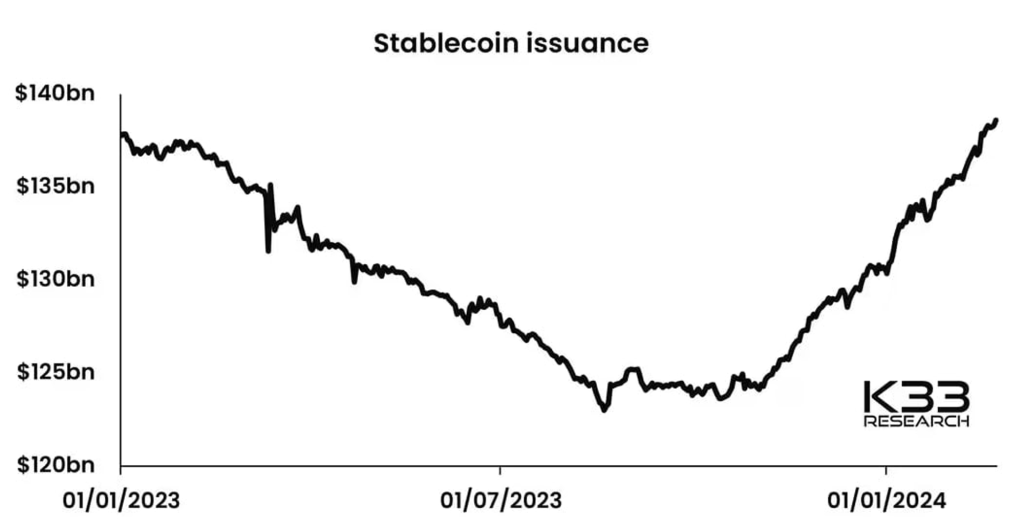

As in the previous analysis, as soon as BTC broke strongly above 53k, we immediately continued the trend. Stablecoin supply also shows a continuous upward trend. There was no reason not to be optimistic. I’m not sure if it’s a Local Top now, but I think BTC will go a little higher from here as well. Currently targeting levels 60-62k. I’m thinking that level could be a potential Local Top, but I’ll provide analysis accordingly once I’m a little more confident.

In fact, it is not a suitable level to buy from now on. I recommend starting to reduce your leverage positions little by little, and I think it’s a good idea to keep some cash on hand. Because we don’t know what will happen in the future. Beware of FOMO and manage your emotions.

If I were to recommend just one altcoin, I think SOL would be good. Currently, SOL is lagging behind ETH, which is contrary to last year, but I think that if market conditions continue to improve, SOL will take off.

(58k while writing this post 😊)

ETF Flow

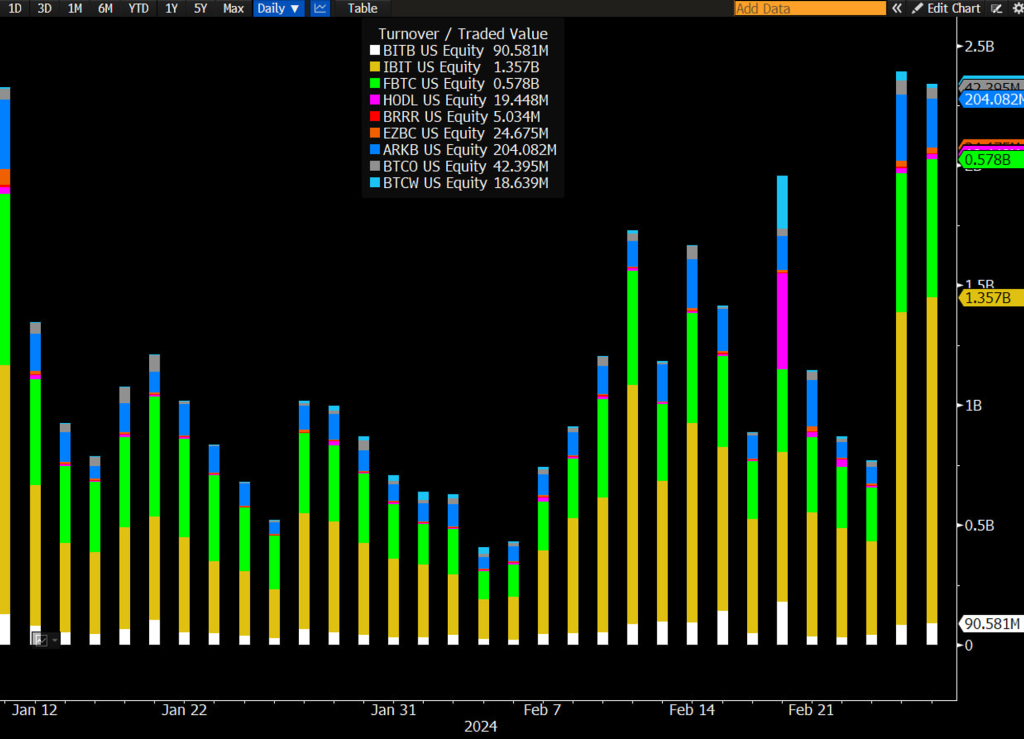

Yesterday, spot ETFs again showed high trading volume. It’s really amazing. I keep saying the same thing over and over again, but focus on the numbers and facts and look at the facts as they are. Demand continues to be very strong. BlackRock IBIT added $500M today and the spot ETF added over 100,000 BTC in February alone.

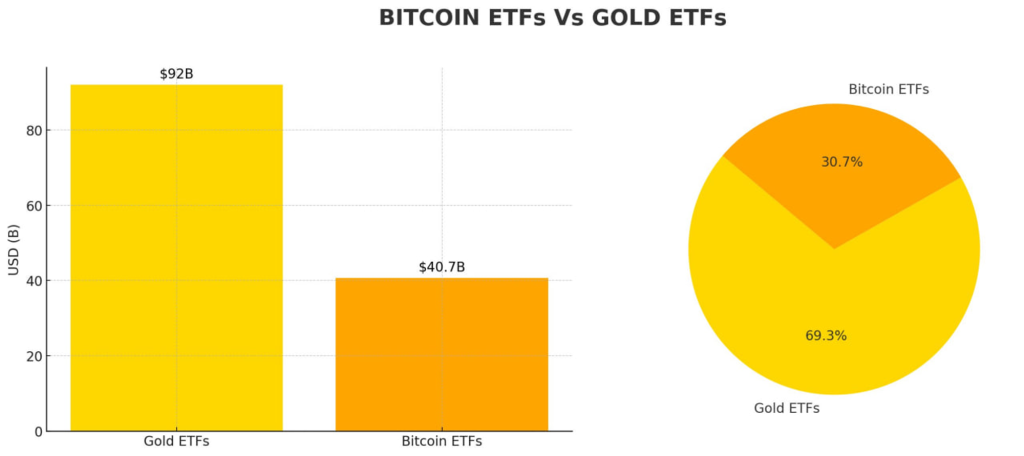

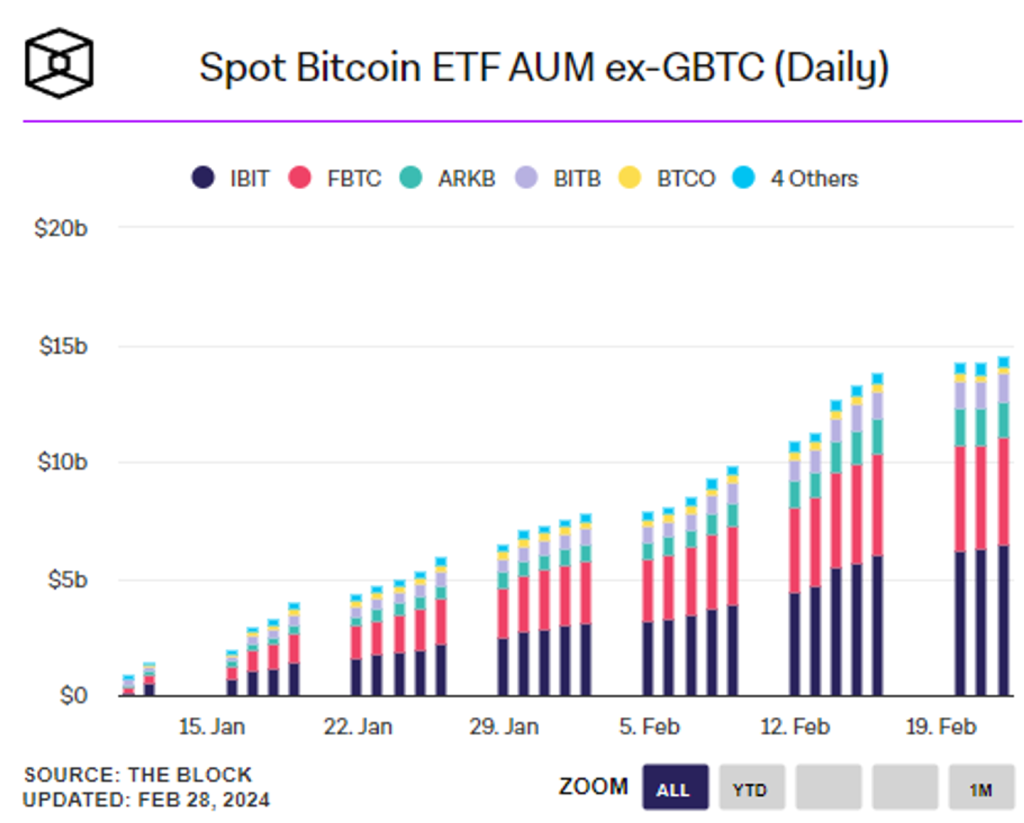

Currently, the BTC spot ETF has grown rapidly to half the size of the gold ETF. In just 31 trading days. It’s so amazing and fast. Even excluding GBTC AUM, it is $15B.

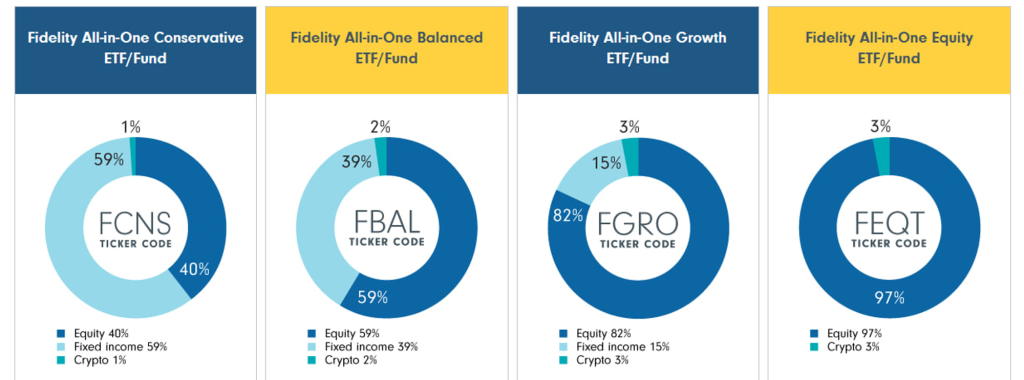

Fidelity recommends investing about 1% to 3% of your portfolio in Crypto. I’ve been saying these things will happen again and again. It’s starting now.

Options Market

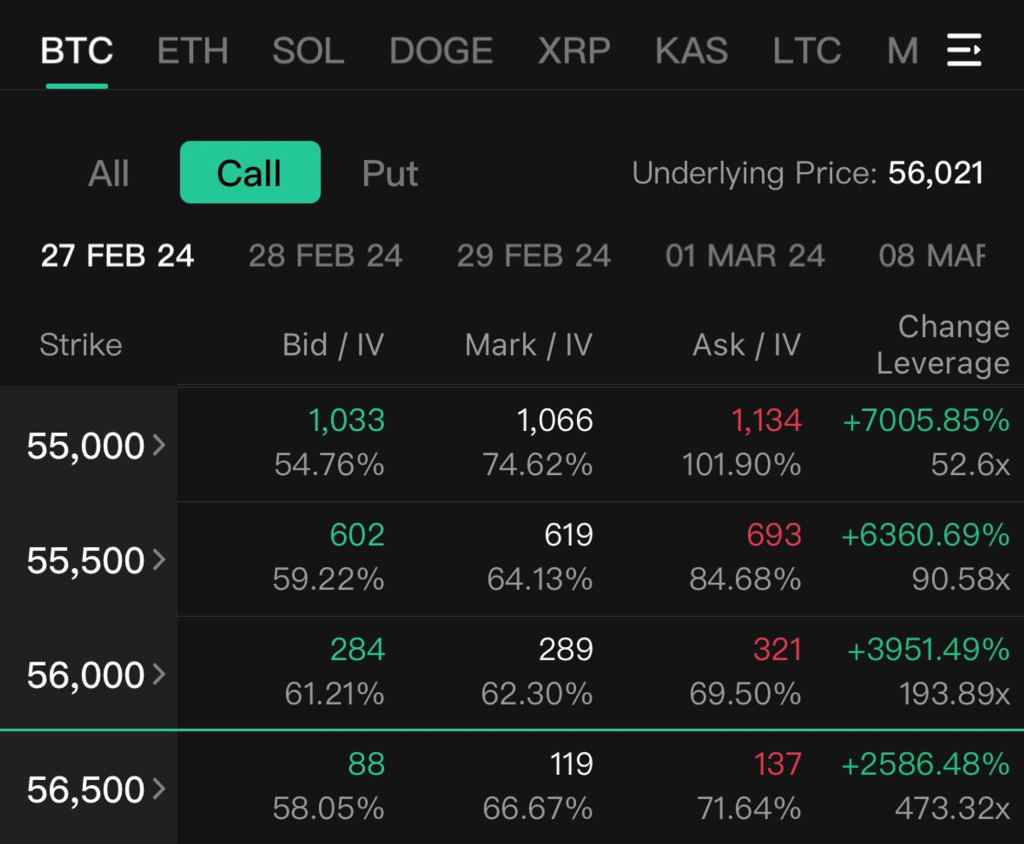

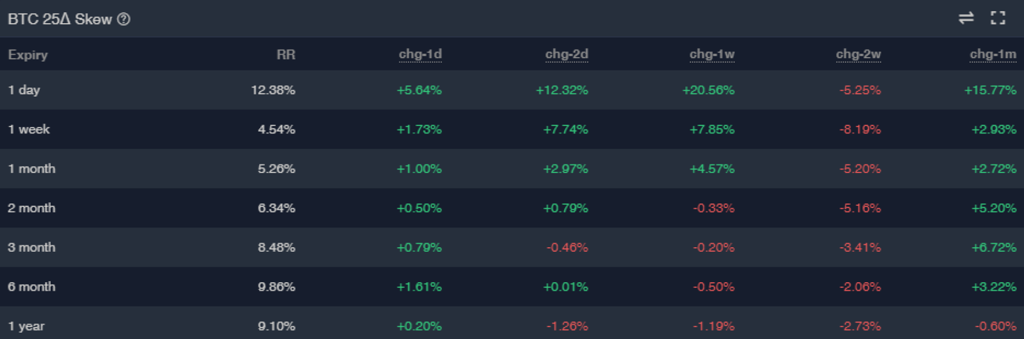

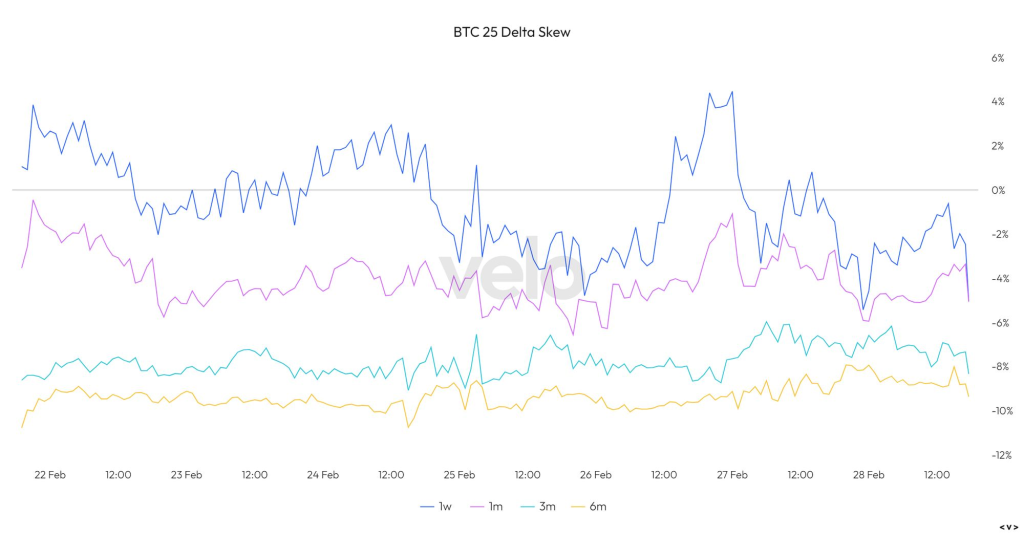

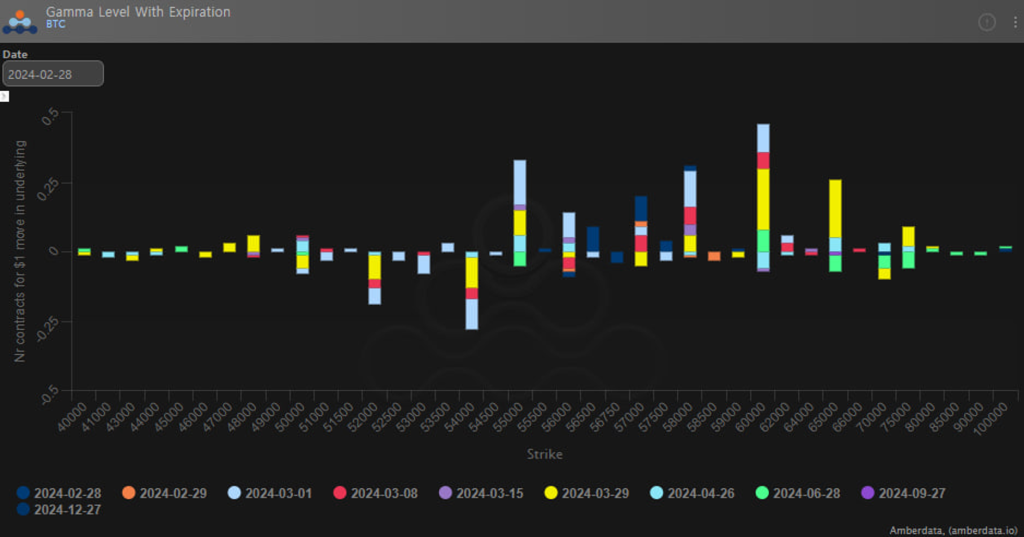

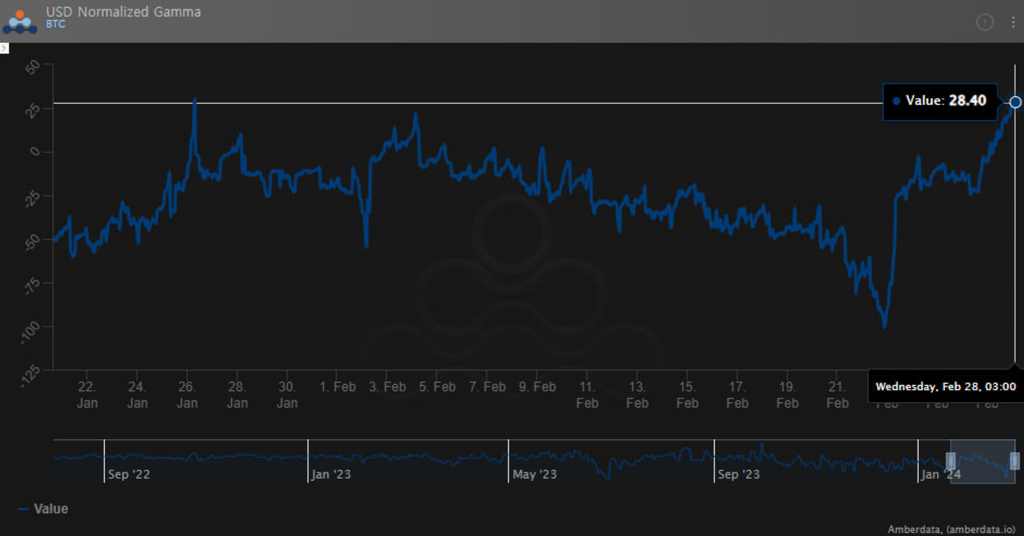

Thanks to BTC’s strong rise in the last week of February, vol also rose by about 10 points in a short period of time. Because the spot-vol correlation was positive, call option buyers were likely to have made good profits. Especially for short expiration options like 0DTE, it was a lottery hit.

To be honest, I didn’t think BTC would show a rapid rise at the end of February, but call option demand continues anyway. Even though the difference between realized and implied volatility is about 15%, it seems like people still want call options. There are more and more trades with high strike prices. Could it be FOMO?

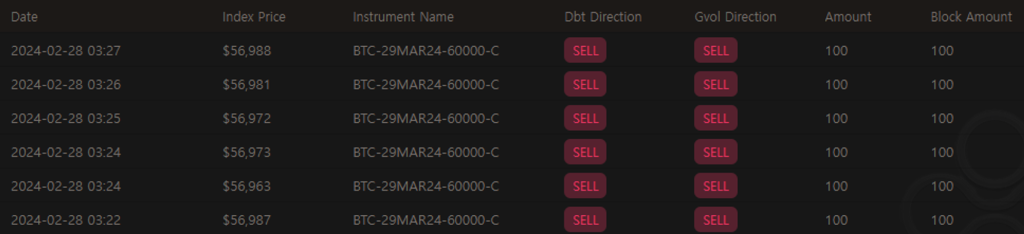

We are currently in long-gamma territory, but traders are selling BTC calls at high strike prices. If the price of BTC continues to rise rapidly, there is a possibility that they may become dangerous.

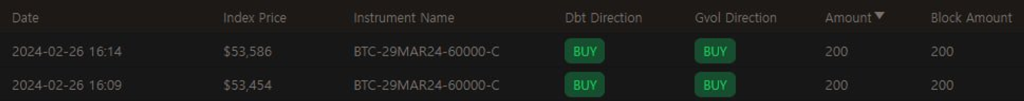

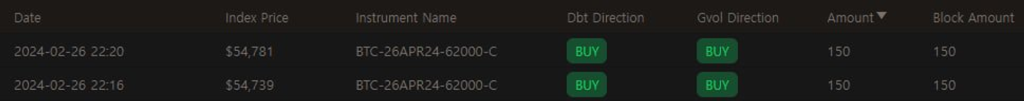

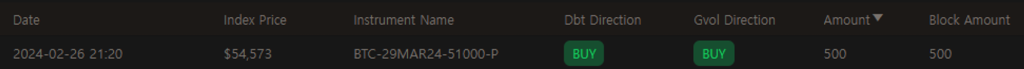

Block Trade

$670k

$1M

$1.9M

$800k

Have a great week everyone!

NFA DYOR 🙂

Comments