Exercise is the action taken by the option buyer to utilize their right to buy or sell the underlying asset

While assignment is the obligation imposed on the option seller to fulfill their contractual obligation when the option is exercised.

Option owners are the only option traders who can exercise the right.

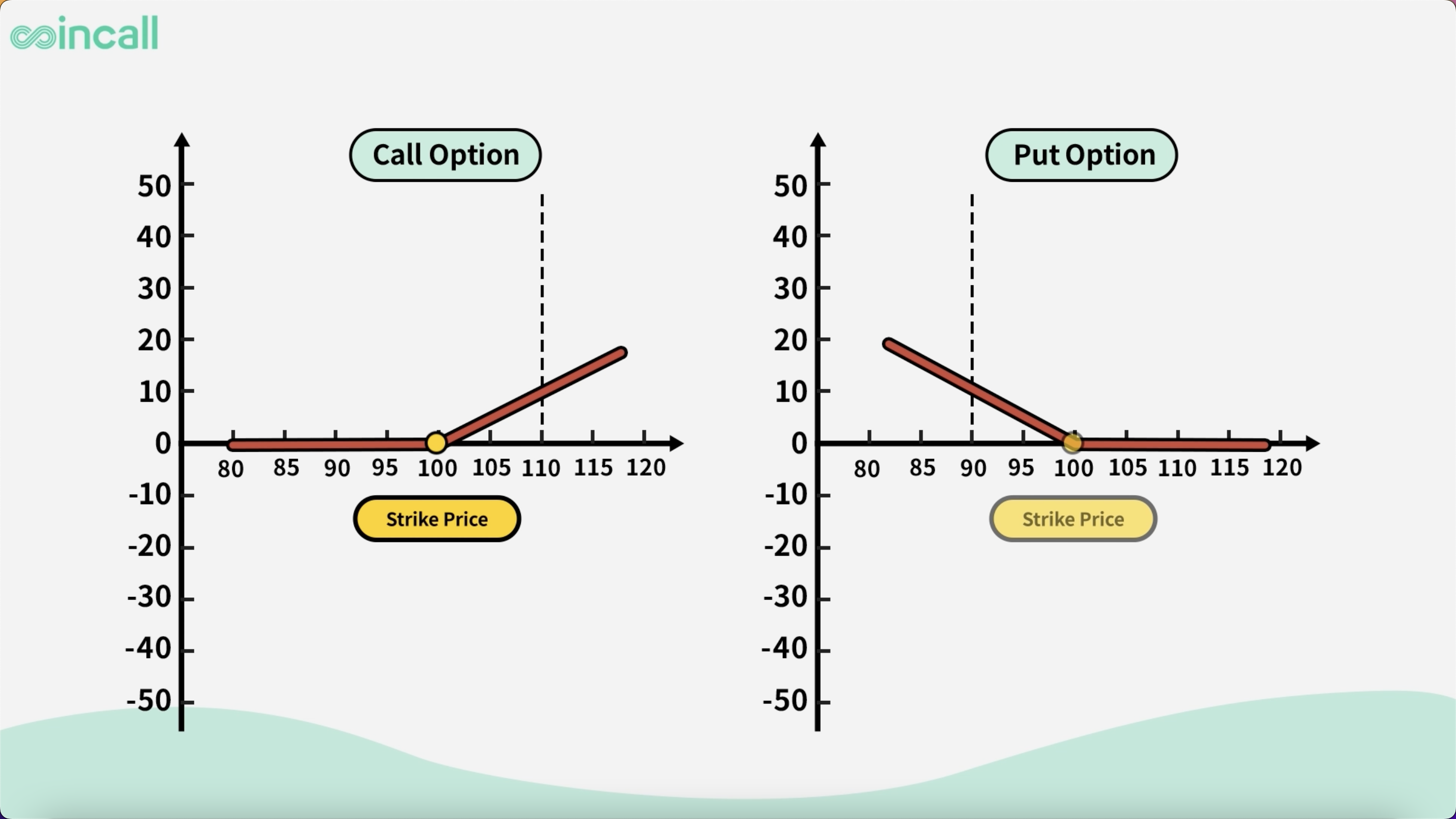

Those who are “ long the Call”, can exercise their right to buy the underlying at the strike price.

And put owners those who are “long the Put” can exercise of their right to sell the underlying at the strike price.

This means that the option buyers will have the right to buy the underlying at a price lower than the current market price or sell it at a price higher than the current market price.

But who would be willing to trade with them in such a way?

No one!

However, sellers of call options are obligated to sell the underlying to the buyer at a specific price.

Sellers of put options are obligated to buy that future at the specific price that is higher than the current market price.

Cuz they were paid a premium to take on the risk of having to sell or buy something at a lower or higher price than the current market.

When an option owner exercises the right embedded in the contract, “ someone” has to be assigned the duty of fulfilling the obligation.

The process of assigning options will be performed by Coincall using an algorithm to randomize the assignment of the option sellers.

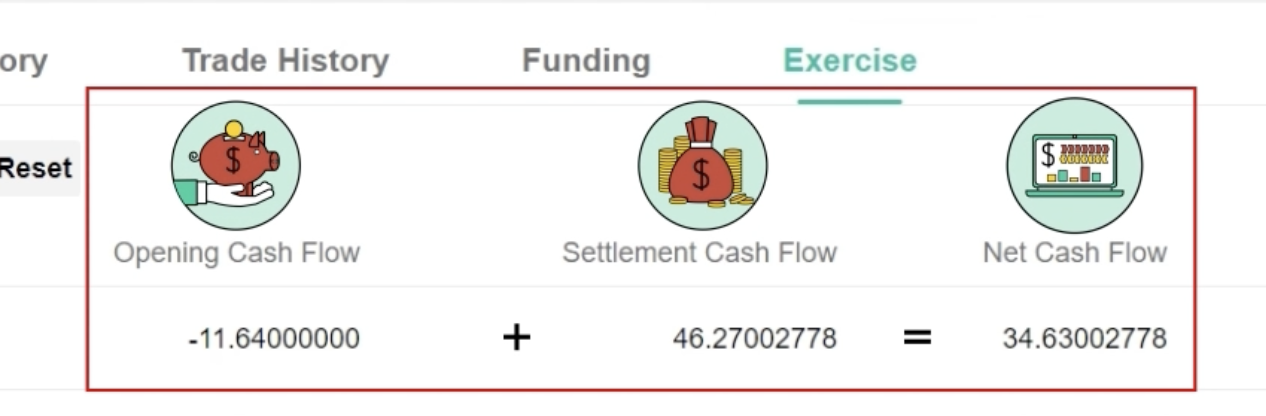

Coincall’s options automatically exercise at UTC 08:00 on the expiration date of the contract and the system calculates the profit and loss for both the buyer and seller based on the strike price and the underlying‘s price.

Users can check their profit and loss on “Position Overview”-“Exercise“ section.

Opening Cash Flow + Settlement Cash Flow = Net Cash Flow

The Exercise profit and loss will be settled in cash and show up in users’ balance.

There you have it!For more information regarding available options, visit Coincall’s product pages.

Comments